Mercury for Global Founders

Struggling to open a U.S. bank account for your international startup? Skip the confusion, avoid unnecessary rejections, and get back to building your business.

Join our exclusive live Q&A with Mercury to learn the exact requirements, compliance tips, and document checklist to open your US business account successfully and start transacting globally.

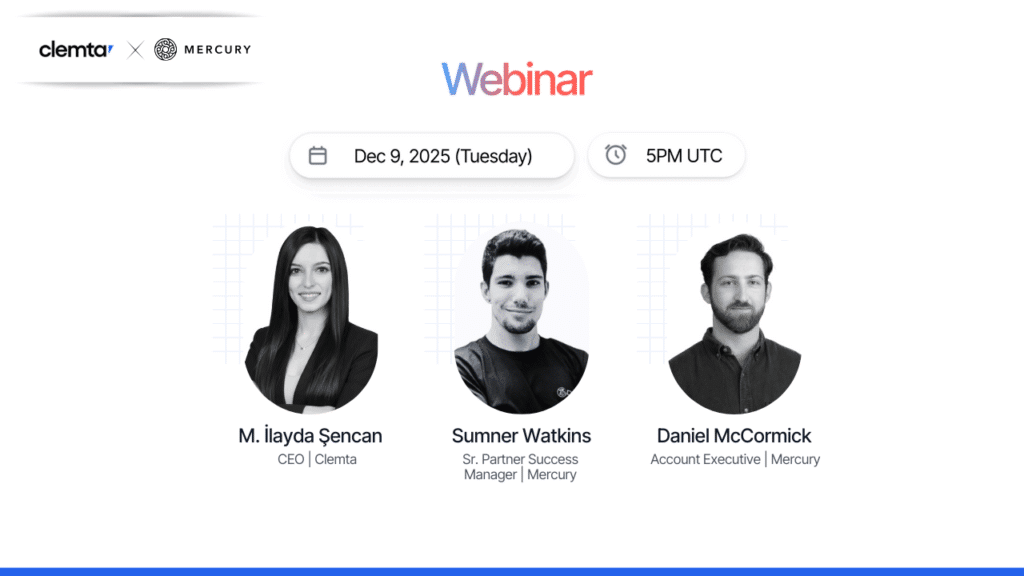

🗓️ Date: Dec 9, 2025 (Tuesday)

⏰ Time: 5PM UTC

💻 Platform: Zoom

🎙️ M. İlayda Şencan, CEO | Clemta

🎙️ Sumner Watkins, Sr. Partner Success Manager | Mercury

🎙️ Daniel McCormick, Account Executive | Mercury

Key Takeaways

This session is a pure Q&A. No generic slides, just direct, practical answers from the Mercury team.

➔ The Eligibility Checklist: Get the definitive list of must-have documents (EIN, Articles, ID) for a successful application and learn how to avoid common rejections.

➔ Compliance & Red Flags: Discover which countries and industries Mercury cannot support and learn the top reasons applications fail, so you can apply once and get approved.

➔ Unlock US Business Credit:

Understand the requirements for the Mercury credit card, how spending limits are set, and how the card helps you build credit in the U.S.

➔ Simplify Global Cash Flow:

Learn the best way to receive international transfers and efficiently manage payments to non-US suppliers.

Who Should Attend?

This event is essential for international founders with a U.S. company (LLC or C-Corp) seeking a modern, remote-friendly banking solution to handle their global finances.

Already have a Mercury account? You are also welcome to join us to get your specific questions answered directly by the team.

Be sure to fill out the form to secure your place at the webinar.

*Mercury is a fintech company, not an FDIC-insured bank. Banking services provided through Choice Financial Group and Column N.A., Members FDIC.

You can unsubscribe at any time. For more information, please see our Privacy Policy.