2026 US Tax Season Survival Checklist & Top 5 Tax Mistakes Founders Make

The 2026 tax season is officially underway. For international founders, this is the most critical time to ensure compliance and avoid penalties. Join us as we cut through the complexity and focus on exactly what you need to handle between now and the filing deadlines.

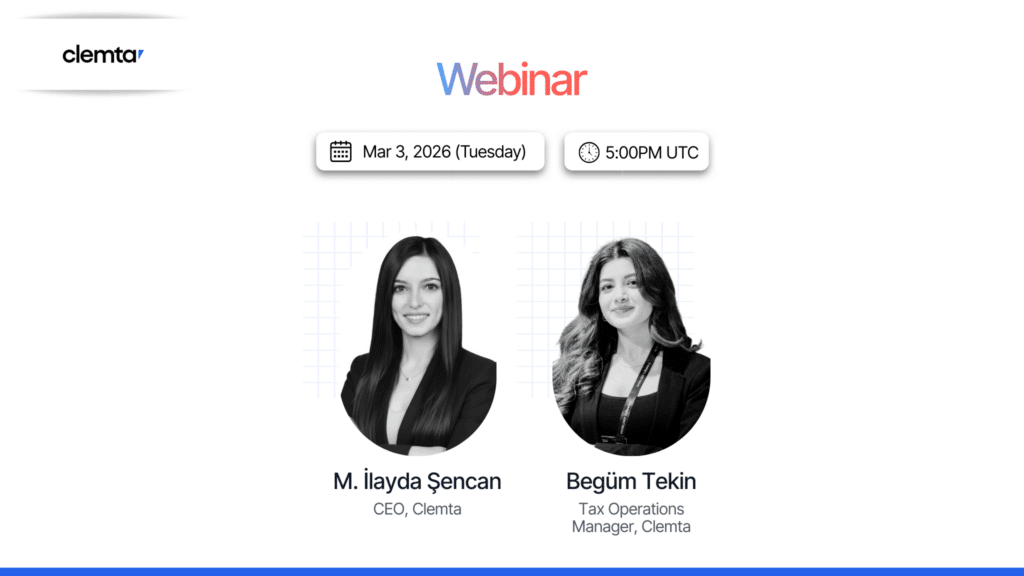

🎙️ M. İlayda Şencan, CEO | Clemta

🎙️ Begüm Tekin, Tax Operations Manager | Clemta

💻 Platform: Zoom

🗓️ Date: March 3, 2026

⏰ Time: 5:00 PM UTC

(12:00 PM New York · 5:00 PM London · 8:00 PM Istanbul · 9:00 PM Dubai)

What we will cover?

➔ Top 5 Tax Mistakes: From incorrect entity classification to missing disclosures that trigger penalties for foreign-owned companies.

➔ Decoding the Forms: Understanding Forms 1120, 5472, and 1065 for foreign-owned companies.

➔ State vs. Federal Requirements: Managing federal returns alongside state obligations like Franchise Tax.

➔ Extensions: How to file for an extension properly if your books aren’t ready?

➔ Live Q&A: Get direct answers to your specific questions from our CEO and Tax Expert.

Who Should Attend?

This session is for U.S. company owners filing their 2025 returns, first-time filers navigating their first tax season, and growth-stage founders who want a clearer understanding of tax compliance to work more effectively on their businesses.

Secure your spot by filling out the form.

You can unsubscribe at any time. For more information, please see our Privacy Policy.