Welcome to Clemta’s Comprehensive Guide on LLC Ownership

Welcome to Clemta’s comprehensive guide on LLC ownership and related topics. Whether you’re an entrepreneur looking to understand how to sell your LLC to someone, add members to your LLC, or learn about the benefits of forming an anonymous LLC, we’ve got you covered. Clemta’s services ensure that non-resident founders, eCommerce businesses, and startups have all the tools they need for seamless company formation in the USA. Dive into this guide and empower your business decisions.

Can You Sell an LLC to Someone?

Yes, you can sell an LLC to someone! Transferring the ownership of an LLC can be part of your long-term business strategy or exit plan. This process, however, requires taking proper legal steps and ensuring all necessary documentation is in place to comply with state and federal regulations. The general steps involve providing a formal Purchase Agreement, updating your state LLC records, and transferring any necessary licenses or permits. Make sure to check your specific state’s guidelines by visiting resources like California Secretary of State. Clemta can assist you every step of the way, ensuring all paperwork is completed seamlessly.

Transferring LLC Ownership: A Step-by-Step Process

Transferring LLC ownership isn’t as intimidating as it may sound. Whether it’s selling the business or passing ownership to another member, the process becomes manageable when following the correct steps. These steps typically include:

- Reviewing the Operating Agreement – Check specific clauses outlining ownership transfer procedures.

- Drafting a Transfer Agreement – Document the ownership transfer formally, requiring all members’ consent.

- Updating State LLC Records – File an amendment to the Articles of Organization to reflect the new ownership structure.

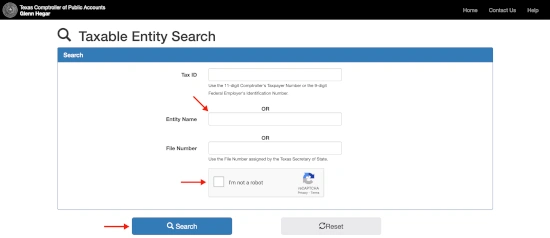

While every state might have slight variations in requirements, Clemta specializes in Post-Incorporation services, such as amending organizational articles or issuing a new Certificate of Good Standing after the ownership transfer. This ensures the process is smooth and compliant. For additional resources, you can visit Texas Secretary of State.

How Do You Transfer Ownership of an LLC?

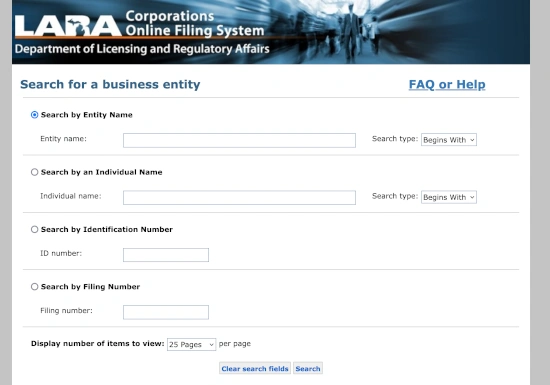

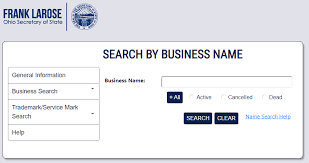

To transfer ownership of an LLC, proper documentation and adherence to state filing requirements are crucial. After drafting the ownership transfer agreement, business owners must notify the respective state agency, typically the Secretary of State. Certain states may require additional forms, such as Resignation of a Member or Articles of Amendment. For more specific requirements, consult resources like Ohio Secretary of State. Clemta enables businesses to process amendments, EIN updates, and Beneficial Ownership Information forms easily to ensure full compliance during the ownership transfer process.

Adding Members to Your LLC

Adding new members to your LLC indicates growth and brings additional expertise or resources to your business. The process generally involves filing updated Articles of Organization and an amendment specifying the new ownership structure. Additionally, consider revising the operating agreement to indicate the roles and responsibilities of the new member(s).

Some states may require official forms like “Statement of Change” or similar filings to reflect the addition. States such as Florida Secretary of State may also demand registration fee payments during these updates. Rest assured, Clemta assists businesses in navigating each technical requirement, ensuring all forms and filings are submitted accurately and on time.

Anonymous Limited Liability Company (Anonymous LLC)

An Anonymous LLC is a specialized LLC structure designed to protect the owner’s privacy. It ensures that personal or sensitive information does not become part of the public record, a significant advantage for individuals or businesses seeking confidentiality. This is achieved by using a registered agent’s name instead of the owner’s in state records.

Such LLCs are especially beneficial for high-profile individuals, entrepreneurs, and investors prioritizing privacy. If you’re looking for more detailed state-specific guidance, visit resources such as Wyoming Secretary of State. With Clemta’s expertise, forming an anonymous LLC becomes hassle-free, with all the paperwork and compliance fully managed for you.

What Is a Blind LLC?

A blind LLC operates similarly to an Anonymous LLC. It serves as a private business entity where the ownership details are excluded from public records, allowing confidentiality without compromising the business benefits of an LLC.

Blind LLCs are often used by investors, startups, or businesses that need to safeguard owners’ identities or financial stakes. Just like anonymous LLCs, blind LLCs ensure limited liability protection for owners and operators while addressing privacy concerns. Clemta’s services support the creation and compliance management of such LLCs, offering solutions tailored to business needs.

Best State for Anonymous LLC Registration

Anonymous LLCs offer remarkable privacy advantages, but selecting the right state plays a critical role. The three most popular states for anonymous LLC formation include Delaware, Wyoming, and New Mexico. These states are renowned for their privacy-friendly regulations and business-friendly infrastructure:

- Wyoming: No public disclosure of members/owners’ names.

- New Mexico: No annual reporting or ongoing fees for LLCs.

- Delaware: Internationally recognized for its robust, business-friendly legal environment.

If you’re confused about choosing the most suitable state, check resources like Delaware Secretary of State, or let Clemta guide you. We customize our recommendations based on your privacy and business goals, ensuring you maximize your LLC’s benefits without unnecessary hurdles.

Frequently Asked Questions (FAQs)

Can you sell an LLC to someone?

Yes, selling an LLC is possible. The process includes drafting a formal Purchase Agreement, acquiring member consent, and ensuring state registration records are updated appropriately.

How do you transfer ownership of an LLC?

Ownership transfers involve reviewing the operating agreement, drafting a transfer agreement, and filing notifications with the relevant state office after receiving members’ consent.

Can I add members to my LLC?

Yes, adding members requires an official amendment of the Articles of Organization. Alongside, a revised operating agreement should detail the roles and responsibilities of new members.

What is an Anonymous LLC?

An Anonymous LLC is a business entity that preserves the owner’s confidentiality by protecting their personal information from public records.

What is a Blind LLC?

A Blind LLC similarly upholds confidentiality, ensuring the ownership details remain private while retaining all the legal and operational benefits provided to LLCs.

Which state is best for Anonymous LLCs?

The best states for anonymous LLCs are Delaware, Wyoming, and New Mexico due to their privacy-centric regulations, straightforward filing processes, and minimal ongoing compliance requirements.

If you aim for seamless LLC ownership transfer or wish to establish an anonymous LLC, partner with Clemta’s experts. Let us guide every step of your journey with ease and efficiency through our trusted platform, app.clemta.com.