Get Your Resale Certificate

Why Choose Clemta for Your Resale Certificate?

With Clemta, you can easily secure your seller’s permit, unlocking various tax benefits for your venture. We will save you time, money, and stress while you focus on growing your business.

Easy Application

Our expert team streamlines the seller’s permit application process.

Expert Guidance

Get step-by-step guidance throughout the process. Our team ensures your application is submitted correctly, with all the right documents, to avoid delays or rejections.

Sales Tax Exemption

Start buying wholesale without sales tax. Once your resale certificate is issued, you’re eligible for tax-free purchases intended for resale—boosting your profit margins.

Focus on What You Sell

We take care of the tax setup so you can focus on scaling your business.

Professional Guidance

Get tax exemptions for goods intended for resale with a reseller certificate or seller’s permit. Clemta professionals help with the application and guide you through tax benefits.

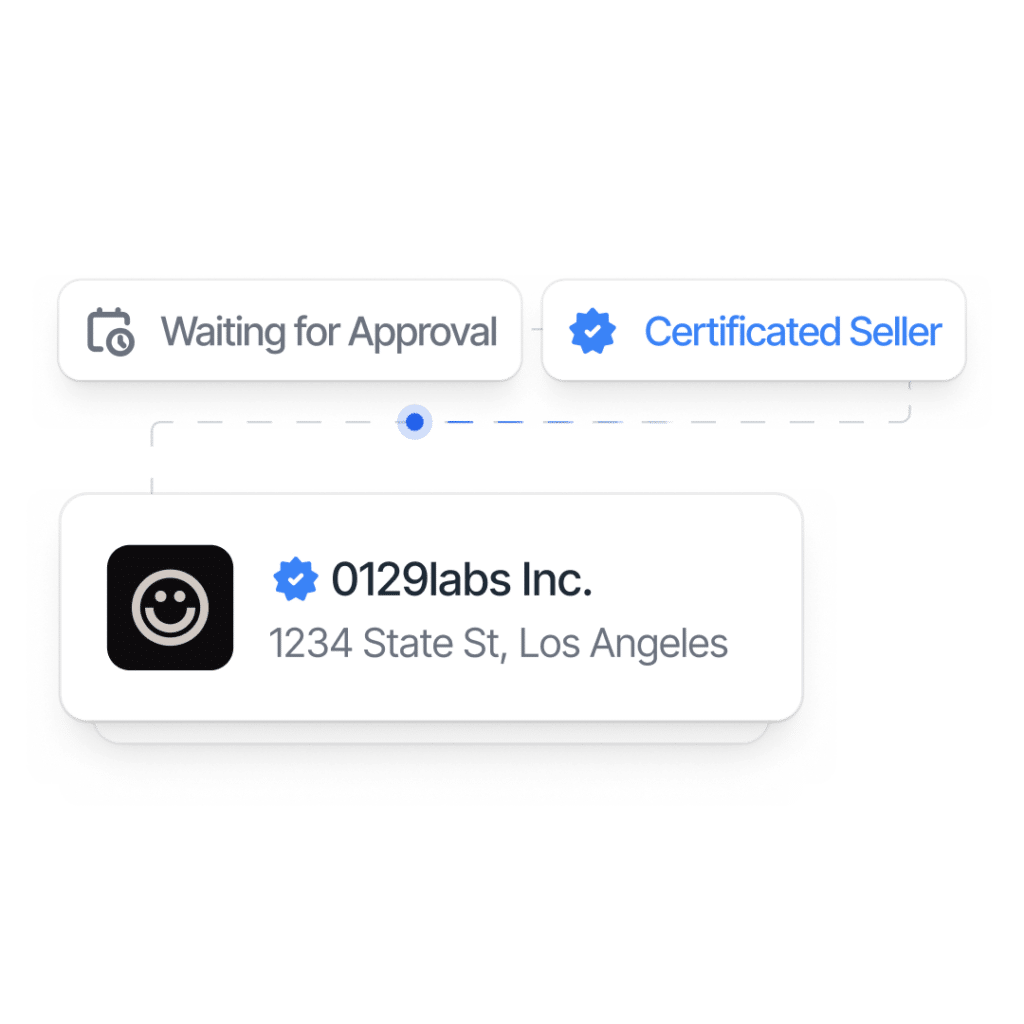

The Process Explained

We’ll ask you a few quick questions to get started, then handle the entire application process — from filing with the state to securing your Sales & Use Tax ID and resale certificate. It’s fast, simple, and handled by experts.

Provide Your Info

We collect basic info about your business to prepare your application.

Submit Your Application

Receive Your SST ID

Once approved, you’ll receive your Sales & Use Tax ID from the state.

Get Your Resale Certificate

With your SST ID, your resale certificate is issued — ready to use for tax-free purchases.

Learn All the Essentials

What is a resale certificate?

A resale certificate (also known as a seller’s permit or reseller ID) allows you to purchase goods without paying sales tax, as long as those goods are intended for resale.

What are the benefits of having a resale certificate?

The main benefit is sales tax exemption on wholesale purchases. This reduces your costs and helps improve profit margins if you’re reselling products to customers.

Do I need a resale certificate?

You’ll need one if you buy products for resale, either online or in-store. This applies to retailers, e-commerce sellers, dropshippers, and wholesalers.

Do I need a Sales/Use tax license to get a resale certificate?

Yes. To obtain a resale certificate, you must first register for a Sales & Use Tax License with the state where you’re doing business. This registration provides you with a Sales Tax ID (SST ID), which is required to issue a valid resale certificate.

For more details, check out our blog post on Streamlined Sales Tax and how the process works.

How long does it take to get a resale certificate?

Once your Sales & Use Tax License is approved, the resale certificate is typically issued within a few business days, depending on the state.

Will I need to file taxes if I get a resale certificate?

Yes. Once you’re registered with a state and receive your Sales & Use Tax License, you’re generally required to file sales tax returns — even if no taxable sales were made. But no need to worry — Clemta’s dedicated tax team will assist you with tracking deadlines, sending reminders, and filing your returns on your behalf to keep you fully compliant.

Are there any fees to get a resale certificate?

Yes. Most states charge a fee to register for a Sales & Use Tax License, which is required before you can receive a resale certificate. Clemta’s service fee also covers the preparation, submission, and guidance throughout the process.

See our pricing page for details.

Learn More About Resale Certificate

Curious about how resale certificates work and whether you need one? We’ve put together a blog post that breaks it all down—when to use it, how to get one, and common mistakes to avoid.

What Is a Resale Certificate? Understanding Sales Tax and the Streamlined Sales Tax Program

A resale certificate lets you buy inventory in the US without paying sales tax upfront—crucial for protecting ecommerce margins. In this guide, we unpack how resale certificates differ from sales-tax permits, how to apply in every state, and how the Streamlined Sales Tax Program can fast-track compliance for non-resident founders. Avoid penalties, simplify filings, and learn how Clemta automates the entire process.