Why Filing Your Annual Report Matters: A Comprehensive Guide for International Entrepreneurs

Filing your annual report is not just a bureaucratic formality—it’s a critical requirement for maintaining your business’s legal standing in the U.S. This document updates state authorities on essential details like your registered agent’s information, business address, and leadership structure. For international entrepreneurs, compliance demonstrates professionalism and commitment to U.S. regulations, which builds trust with investors, banks, and partners. Failure to file can jeopardize liability protections, hinder access to loans, and even lead to administrative dissolution. Staying proactive with annual filings ensures smooth operations and safeguards your business’s reputation. To learn more about state-specific requirements, visit the Alabama Secretary of State.

The Role of Annual Reports in Business Credibility

Annual reports serve as a public record of your company’s active status, which is vital for securing partnerships and funding. Banks often require proof of good standing before approving loans, and investors use this information to assess reliability. For international businesses, consistent compliance reinforces legitimacy in a foreign market. Additionally, maintaining updated records helps avoid legal disputes over outdated information. Explore filing guidelines on the Indiana Secretary of State website.

The Importance of Good Standing: Protecting Your Business

Good standing acts as your business’s legal and financial health certificate. It confirms that your company adheres to state regulations, pays required fees, and maintains transparency. This status is indispensable for accessing growth opportunities and avoiding penalties.

Maintaining Legal Protections

Limited liability protection shields personal assets from business debts—but only if your company remains compliant. Annual report filings validate this status, ensuring courts uphold your corporate veil. Neglecting filings risks exposing owners to lawsuits or creditors.

Accessing Funding and Expansion Opportunities

Banks and investors prioritize businesses in good standing, as it reflects financial responsibility. Compliance is also mandatory for expanding into new states via foreign qualification. Check the Georgia Secretary of State portal for multi-state registration rules.

Key Information You’ll Need: Preparing for a Smooth Filing Process

Gathering accurate data upfront prevents delays and errors. Below are the essentials for a seamless filing experience.

Registered Agent Details

Your registered agent’s name and physical address must be current to receive legal notices. Changes must be reported promptly to avoid missed communications. Many states impose fines for outdated agent information.

Leadership and Business Address Information

Corporations must list officers and directors, while LLCs provide member details. Ensure titles and addresses match official records. The principal business address should reflect your operational headquarters. For industry codes, refer to the U.S. Census Bureau.

Steps to Filing Your Annual Report: A General Guide

While processes vary by state, these steps provide a universal framework.

1. Research State Requirements

Visit your Secretary of State’s website, like the Washington Secretary of State, to download forms and review deadlines. Some states require online submissions, while others accept mail.

2. Submit Accurate Information and Fees

Complete forms carefully, double-checking names, addresses, and NAICS codes. Payment methods vary—credit cards are common for online filings. Save confirmation receipts for audits.

State-Specific Considerations & Useful Links

Each state has unique rules. For example:

- Delaware requires franchise tax payments alongside reports. Visit the Delaware Division of Corporations.

- California mandates a Statement of Information for LLCs. File via the California Secretary of State.

Navigating Multi-State Compliance

Businesses operating across states must file foreign qualification documents. The Wyoming Secretary of State offers streamlined processes for out-of-state entities.

Common Mistakes to Avoid: Ensuring Accurate and Timely Filing

Errors in annual reports can lead to penalties or loss of good standing.

Missing Deadlines

Late filings incur fees and may trigger compliance audits. Set calendar reminders and consider automated services. The Mississippi Secretary of State outlines grace periods.

Incorrect Registered Agent Details

Agents must have a physical address in the state. Virtual offices or PO boxes often violate rules. Update changes immediately through portals like the Nevada Secretary of State.

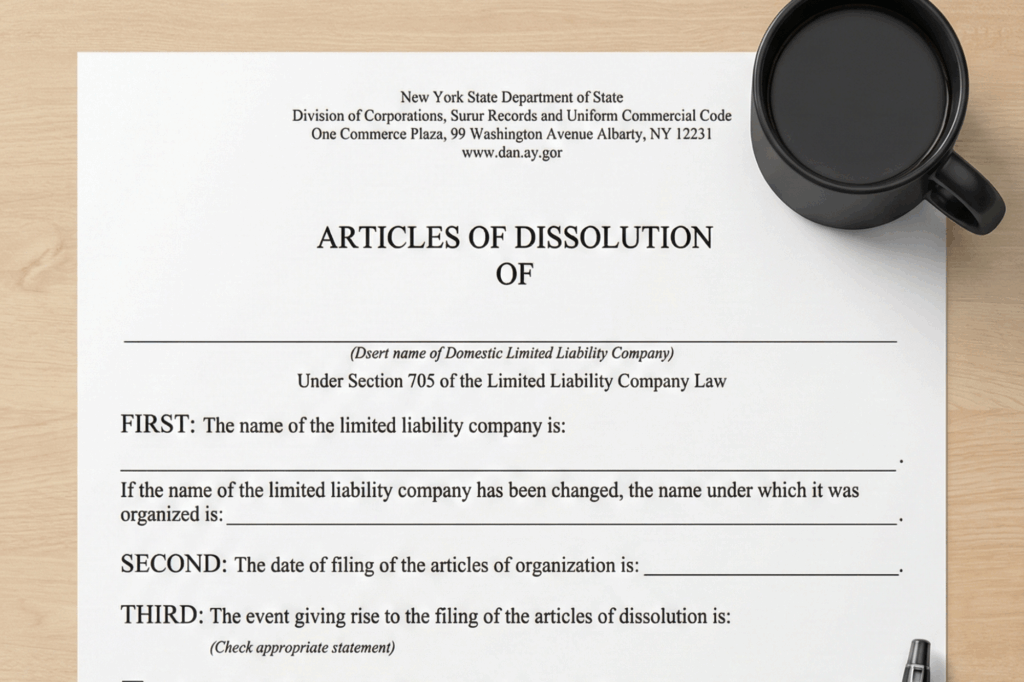

The Cost of Non-Compliance: Understanding the Risks

Ignoring annual reports risks fines, dissolution, and reputational damage. Late fees accumulate quickly, and dissolution complicates reinstatement. For compliance support, visit app.clemta.com to connect with experts.

Long-Term Financial and Legal Repercussions

Non-compliance can void contracts, invalidate licenses, and deter investors. Proactive filing preserves growth opportunities and operational stability.

For personalized assistance with filings, registered agent services, or multi-state compliance, explore app.clemta.com.

FAQs About Filing Your Annual Report for International Entrepreneurs

What kind of information do I need to prepare for filing my annual report?

You’ll typically need your registered agent’s details (name and address), information about your company’s leadership (officers, directors, or members), and your principal business address. Make sure all this information is up-to-date and accurate. Using outdated information or P.O. boxes (if not allowed) as a registered agent address are common mistakes that can lead to penalties.

How do I actually file my annual report? Is there a general process I can follow?

While the exact process varies by state, the general steps are: first, research the specific requirements of the state where your business is registered. This usually involves visiting the Secretary of State’s website for that state. Second, gather all the required information and complete the necessary forms (either online or on paper). Third, submit the forms and pay the required filing fees. Always save your confirmation receipt for your records.

What happens if I miss the deadline for filing my annual report?

Missing the deadline can result in late fees, compliance audits, and even administrative dissolution of your business. It’s critical to set calendar reminders and be proactive. Some states offer grace periods, but it’s best not to rely on those. Check with your specific state’s Secretary of State for details on their policies regarding late filings.

My business operates in multiple states. Do I need to file annual reports in each state?

Yes, if you are “foreign qualified” to do business in multiple states, you’ll likely need to file an annual report in each state where you are registered. This ensures you remain compliant in all the jurisdictions where you operate. Foreign qualification requires filing specific documents with each state.

How can I avoid common mistakes when filing my annual report?

To avoid mistakes, double-check all information for accuracy, especially names, addresses, and NAICS codes. Ensure your registered agent’s details are current and that they have a physical address (not a PO box, if not allowed). Set reminders for deadlines and consider using automated filing services or consulting with an expert to ensure compliance.