ITIN - Get Your Taxpayer Identification Number

Why Choose Clemta for Your ITIN Application?

A Certified Acceptance Agent (CAA) is authorized by the IRS to facilitate the applications. Our expertise minimizes the chance of rejection and ensures your application is handled with care.

Easy Application

Expert Guidance

Receive customized assist to successfully apply for individual taxpayer identification number.

Maintain Compliance

Focus on Growth

While we handle all the paperwork, stay focused on growing your business.

Expert Guidance in Every Step

The Process Explained

Complete online form

Submit your application

Receive your ITIN

Learn All the Essentials

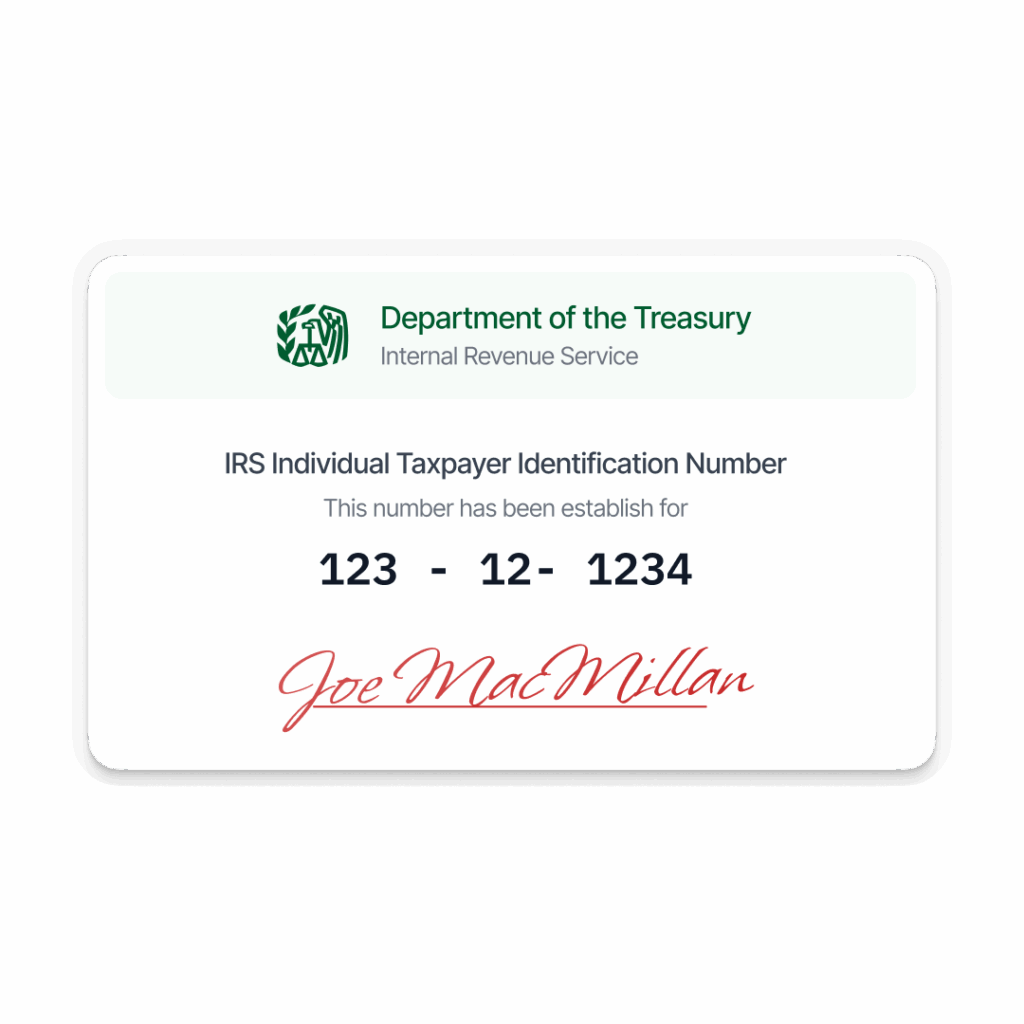

What is an ITIN?

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the Internal Revenue Service (IRS) in the United States.

The ITIN is issued to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security Number (SSN) from the Social Security Administration (SSA).

It’s important to note that ITINs are used for tax purposes only. They do not provide authorization to work in the U.S. or provide eligibility for social security benefits or the earned income tax credit. ITINs are intended to enable the IRS to ensure that individuals, regardless of their immigration status, are correctly taxed on income earned in the U.S., and to allow these individuals to comply with U.S. tax laws.

When an ITIN is necessary?

An ITIN is vital under several circumstances, primarily related to tax filing and reporting requirements. The ITIN is used by individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security Number (SSN).

Here are some examples of when an ITIN is necessary:

– Filing U.S. Tax Returns: Non-resident aliens, resident aliens, and certain individuals who are required to file a U.S. tax return but do not have an SSN must obtain an ITIN.

– Claiming Tax Benefits: Individuals who need to claim tax benefits or refunds and are not eligible for an SSN require an ITIN for tax purposes.

– Opening a PayPal or U.S. Bank Account or Applying for Loans: Some banks and financial institutions may require an ITIN from individuals who do not have an SSN for account opening or loan processing.

The ITIN is crucial for ensuring compliance with U.S. tax laws and payments for individuals not eligible for SSNs.

What is the difference between an SSN, EIN, or ITIN?

The ITIN (Individual Taxpayer Identification Number), SSN (Social Security Number), and EIN (Employer Identification Number) are all identification numbers used in the United States for tax purposes, but they serve different functions and are issued to different types of entities or individuals.

– SSN is a unique nine-digit number issued by the Social Security Administration (SSA) to US citizens, permanent (green card holders), and temporary residents. The primary purpose of an SSN is to track individuals for social security purposes, but it has grown to serve as a primary identifier for individuals within the United States for various purposes.

– EIN is a unique nine-digit number the IRS assigns to identify US business entities for tax purposes.

– Finally, ITIN is a tax processing number issued by the IRS to individuals who are required to have a US taxpayer identification number but who do not have and are not eligible to obtain, an SSN from the SSA.

In summary, SSNs are for individual US citizens and residents, ITINs are for individuals who are not eligible for SSNs but need to file taxes in the US, and EINs are for business entities operating in the US.