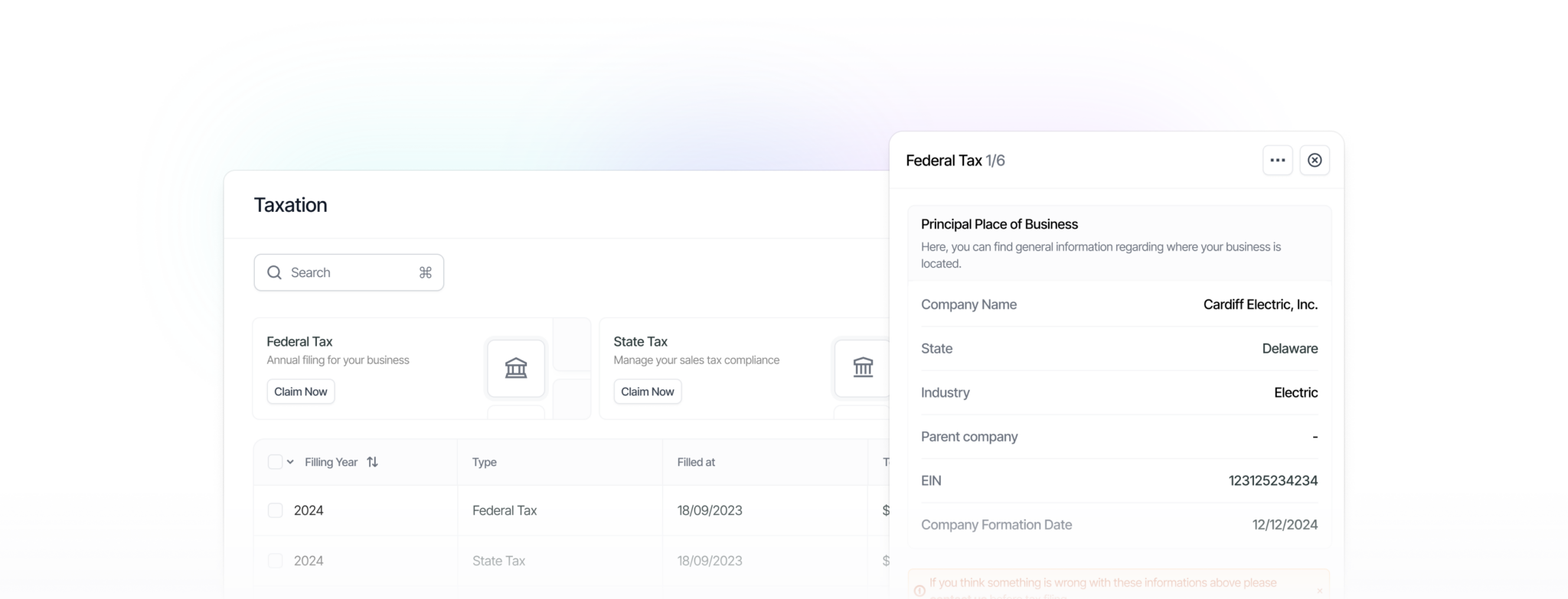

• Taxation

Tax Filing Without the Stress

Simplify tax filing with intuitive tools that guide you through every step, ensuring accuracy and compliance.

Complete Tax Filing Solution

From federal to state taxes, streamline your filings and avoid costly errors with expert-backed tools

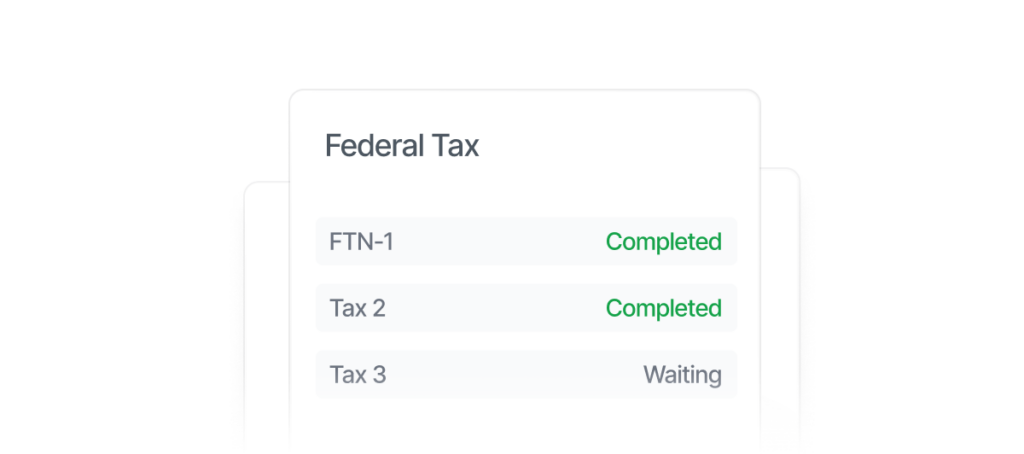

Comprehensive Federal Tax Filing

File your federal taxes with confidence and ease using guided workflows.

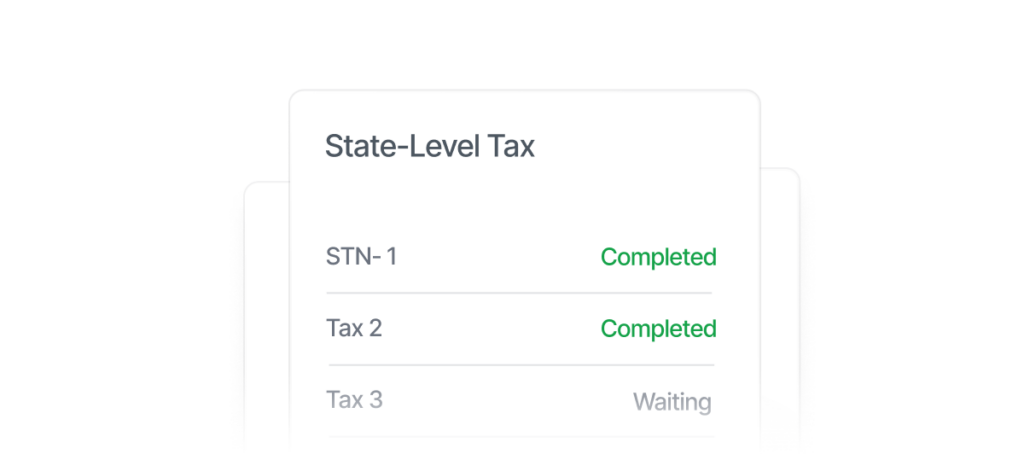

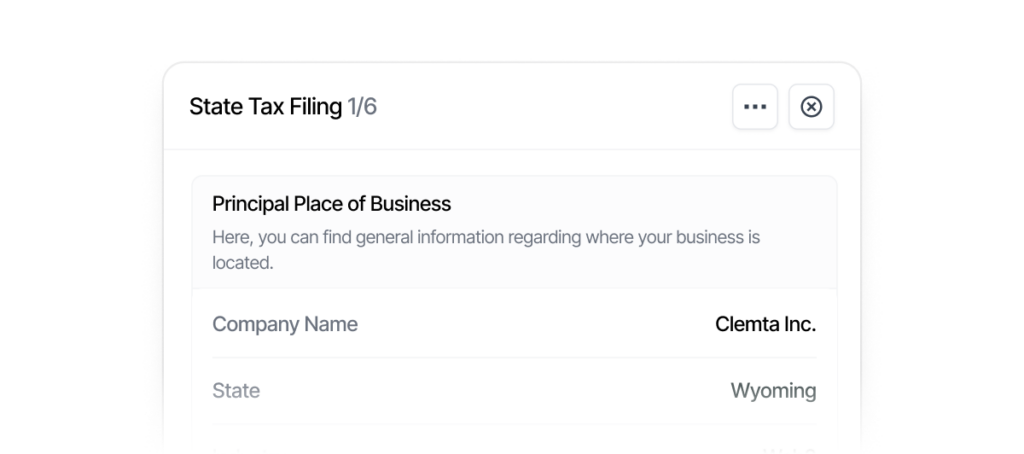

Effortless State Tax Compliance

Stay compliant with tailored solutions for state-specific tax filing requirements.

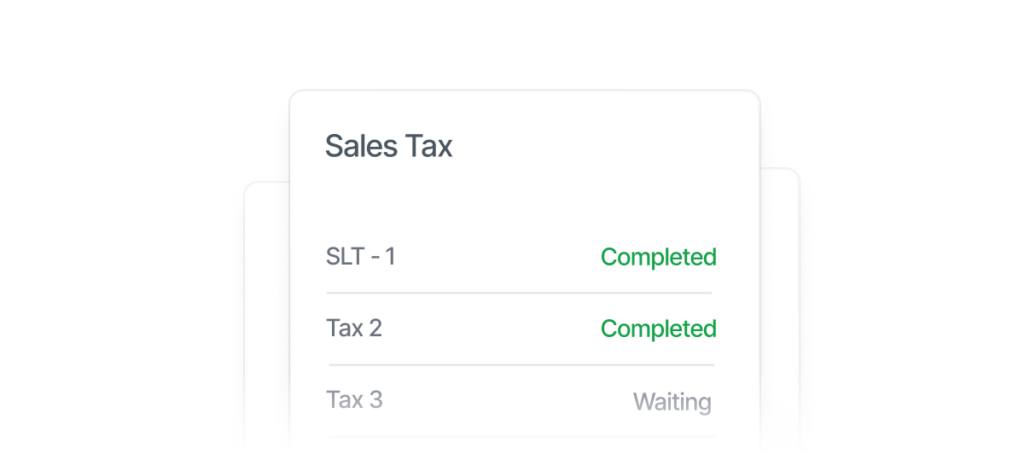

Sales Tax Automation

Calculate, track, and file sales taxes without breaking a sweat.

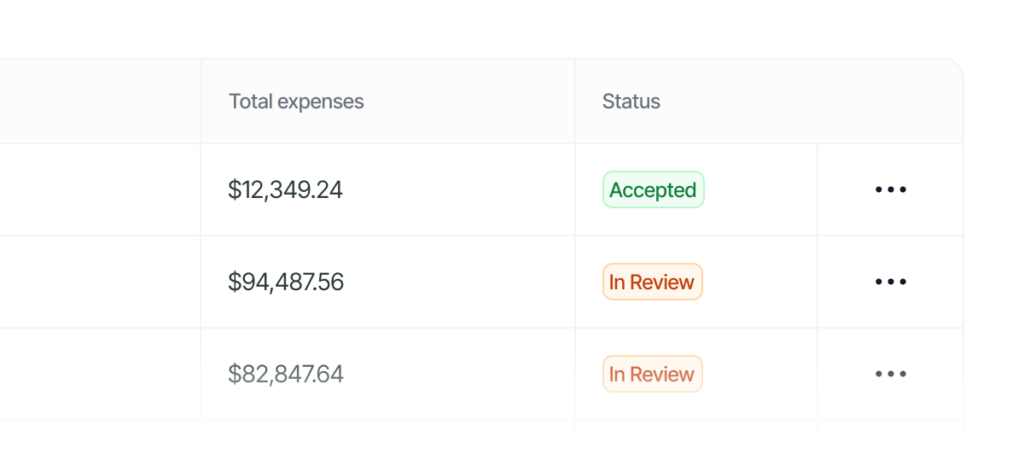

Organized Tax Records

Access your tax filing history anytime with secure storage and easy retrieval.

Quick & Simple Filing Process

Follow a straightforward, step-by-step process designed to minimize effort.

Expert Support When You Need It

Get guidance and answers to your tax questions from certified professionals.

FAQ

Learn All the Essentials

We gathered all commonly asked questions regarding tax filing processes below:

Is Clemta's taxation solution suitable for non-accountants?

Indeed, we’ve crafted our advanced tool to suit both novices and seasoned professionals, ensuring user-friendly navigation for all.

What types of businesses can use Clemta's taxation platform?

Clemta is scalable and user-friendly, suitable for both novices and professionals.

When my business' tax liabilities will be due?

State and federal-level deadlines vary based on factors like company type, state selection, and owner count. With Clemta’s advanced taxation tool, you can effortlessly track all relevant deadlines. For deeper insights, feel free to consult our expert team at [email protected].

What are the consequences of failing to comply with state and federal tax deadlines?

Failing to timely file tax returns & annual reports can lead to severe consequences, including IRS penalties surpassing $25,000 or even business dissolution. However, with Clemta’s advanced taxation and compliance tools, we ensure you remain compliant and avoid such pitfalls.

Can I import my taxation data from my existing accounting software?

Though Clemta doesn’t provide a direct import function, you can swiftly export tax data from your existing software and then input the pertinent details into Clemta’s platform seamlessly.

How secure is my taxation data on Clemta?

Clemta uses bank-level encryption and strict security measures to ensure your taxation data is protected and confidential.

Does Clemta provide tax support for businesses located outside the United States?

Currently, Clemta’s taxation features are designed to cater to businesses operating within the United States, offering support for federal, state, and sales tax filings.

Can I share my taxation data with my accountant?

Yes, you can easily share your taxation data and filings with your accountant by granting them access to your Clemta account or exporting the relevant data for their review.

Testimonials

Trusted Worldwide: Serving Across 154+ Countries

Real success stories from small business owners to enterprises! You can find our clients’ experiences below and discover how Clemta can help you turn your dream business into reality.

Ready to Simplify Your Tax Filing Process?

Get started with Clemta today and discover how our powerful taxation tool can help you save time and stay compliant.