Comprehensive blogs, one click away from you

Explore our blog to unlock the full potential of your business

We share powerful business strategies and insights for your company regularly. Join our newsletter to stay up to date!

-

Özgür Kuşkonmaz

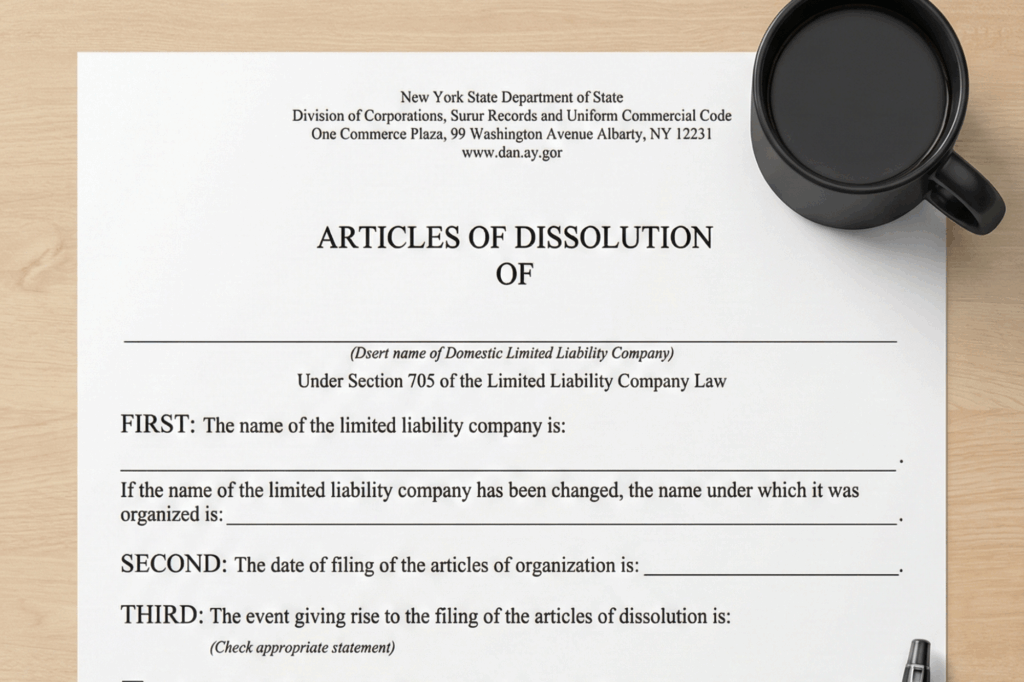

Simply stopping your business operations does not legally close your LLC. If you fail to file the correct dissolution forms, the state will continue to charge you fees. Here is your guide to exiting cleanly.

-

İlayda Şencan

İlayda Şencan

Michigan is one of the most affordable states for international entrepreneurs. Here is your step-by-step guide to navigating LARA, appointing a Registered Agent, and staying compliant from outside the US.

-

İlayda Şencan

İlayda Şencan

Applying for an ITIN is not a standalone process. You generally must file it alongside your annual tax return. Here is a helpful guide on how to get your number without getting rejected.

-

Begüm Tekin

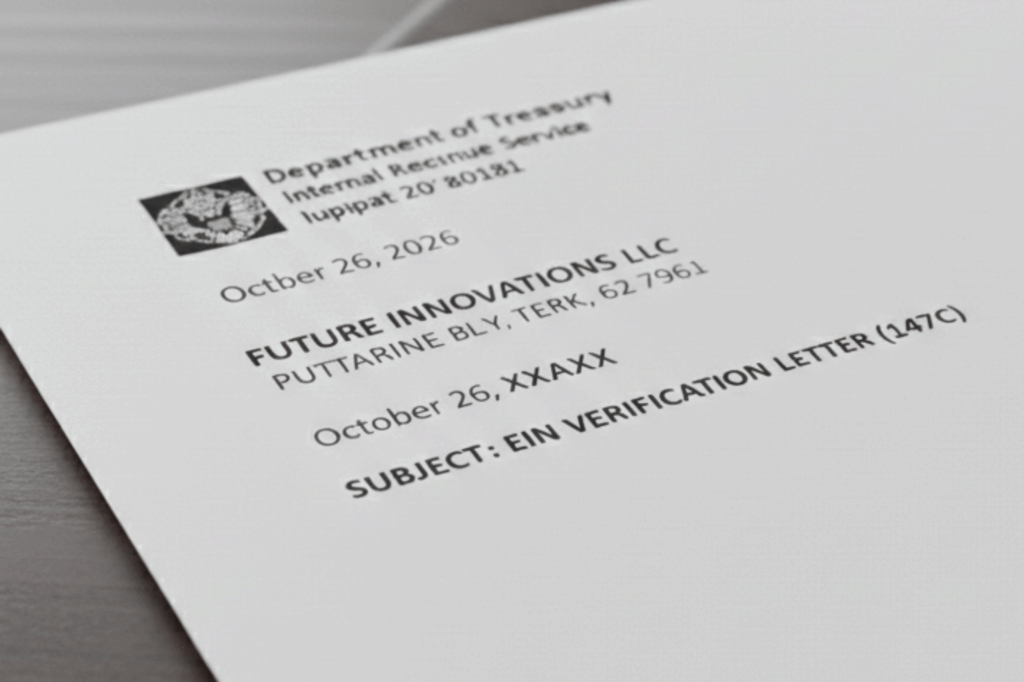

Banks and payment processors often reject old EIN documents. If you lost your original CP-575 form, the 147C Letter is the only way to prove your tax ID exists. Here is how to get it.

-

İlayda Şencan

İlayda Şencan

Not all LLC services are built for international founders. Some hide fees while others leave you stranded with IRS paperwork. Here is your checklist for choosing the right partner.

-

Begüm Tekin

Filing the standard IRS Form 1040 can be a costly mistake for non-resident business owners. It could accidentally subject your entire worldwide income to US taxes. Here is the correct way to handle your LLC taxes.