Comprehensive blogs, one click away from you

Explore our blog to unlock the full potential of your business

We share powerful business strategies and insights for your company regularly. Join our newsletter to stay up to date!

-

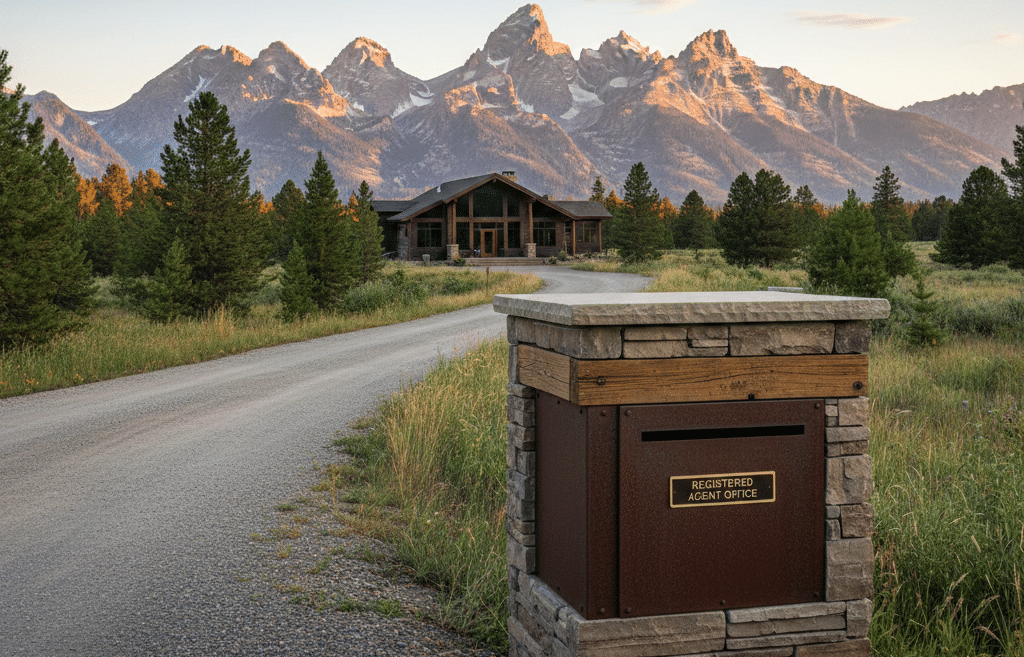

Öykü Çelik

Wyoming offers incredible privacy for business owners, but one wrong move on your Registered Agent form can make your personal address public. Here is why every Wyoming LLC needs a professional agent.

-

Leyla Magsud

If you are a non-US freelancer or business receiving payments from the US, the W-8 form is not optional. It's essential to avoid an automatic 30% tax withholding. This guide demystifies the complex IRS landscape and clarifies the critical differences between W-8BEN for individuals and W-8BEN-E for entities.

-

Leyla Magsud

April 15th is just one of four deadlines for business owners. Learn how to calculate your quarterly liability, understand the Safe Harbor rule, and determine if you meet the criteria for a total tax exemption.

-

Begüm Tekin

The IRS has shifted how businesses report non-employee compensation. From the critical differences between the 1099-NEC and 1099-MISC to the "Double Reporting" dangers of the 1099-K, here is everything you need to know to navigate tax season without penalties.

-

Özgür Kuşkonmaz

Discover how international entrepreneurs can instantly turn a new U.S. LLC into a revenue-generating business. This guide explores using Snapwear’s premium print on demand service to launch risk-free global brands without inventory, leveraging Kornit Digital technology and dual-continent fulfillment.

-

Özgür Kuşkonmaz

Launch a fully compliant U.S. product brand without inventory, warehouses, or upfront risk. With Clemta handling formation and compliance, and Supliful managing on-demand production and fulfillment, building a supplement or coffee brand has never been easier.