EIN and ITIN for E-commerce Businesses in 2025

Navigating the financial landscape in the U.S. as an e-commerce entrepreneur involves understanding crucial identifiers like the Employer Identification Number (EIN) and Individual Taxpayer Identification Number (ITIN). Both play significant roles in business operations and tax compliance.

The Importance of an EIN for Non-Resident Business Owners

An EIN, essential for non-residents operating a U.S. business, facilitates tax reporting, legal compliance, and enhances business credibility, enabling activities like opening bank accounts, hiring employees, and fostering growth and partnerships.

Understanding IRS Form 5471

Understanding IRS Form 5471 is crucial for U.S. persons with stakes in foreign corporations. This guide breaks down who needs to file, filing deadlines, and the critical information required to stay compliant. With potential penalties starting at $10,000 for non-compliance, it’s essential to grasp the specifics of this filing requirement to navigate the intricacies of international tax obligations effectively.

What is Form 1042-S?

Form 1042-S is a critical document for US tax reporting. It is used to report payments made to non-US entities by US-based organizations. The form documents US-source income distributed to non-US residents and is required by employers, educational institutions, and financial organizations to report payments and income withholdings.

Sales Tax Nexus Simplified: Your Essential Guide to Understanding Nexus Laws

Sales tax nexus is the connection between a business and a jurisdiction that requires the business to collect and remit sales tax. This connection can be established through physical presence or economic activities such as sales within the region.

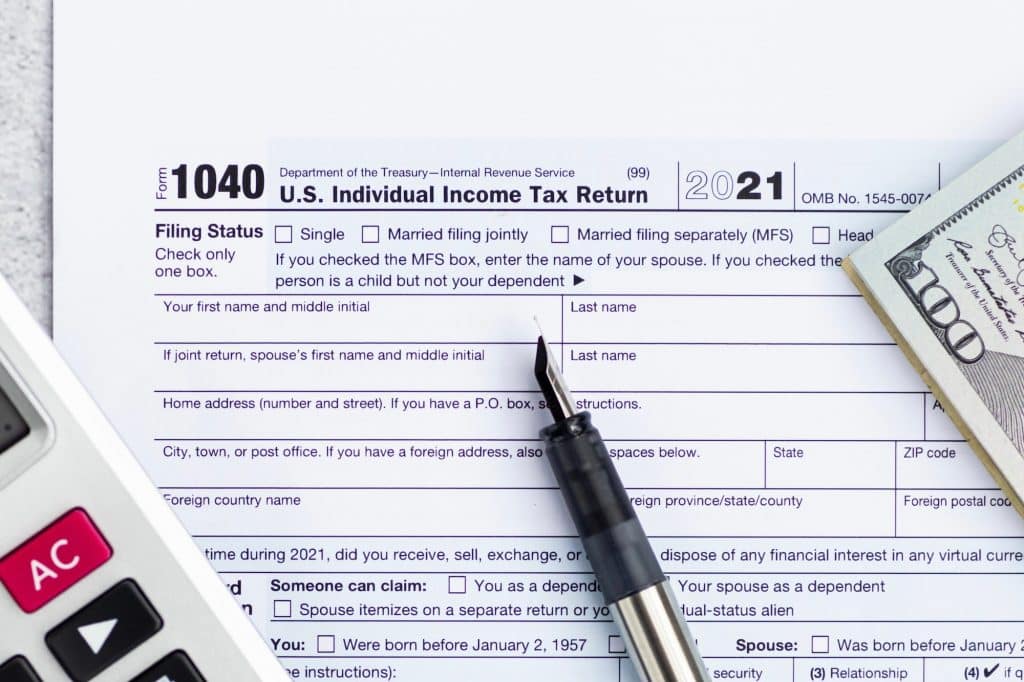

Understanding the New 1099-K Reporting Thresholds

Navigating the complexities of tax reporting for online sales is crucial with recent changes to Form 1099-K thresholds, as understanding your reporting obligations can help avoid penalties and ensure a smooth tax filing process.

State Tax | Annual Report

The annual report intends to provide necessary information for the filing offices, other government agencies, the public, and the investors. It includes your location and contact information through which such parties can communicate with you.

Postpone Tax Deadline: File an Extension

The United States federal tax deadline is very soon, the due date is April 15! Since there are only a couple of days left, you may consider filing an extension if you have not filed your taxes yet.

Essential Forms For Federal Tax Season

We are in the season when every company focuses on completing its federal tax obligations. While the deadline is coming, we want to clarify some essential forms required to be filled out for federal tax returns.

EIN Letter From IRS: Everything You Need to Know

Navigating the process of obtaining or retrieving your Employer Identification Number (EIN) from the IRS is crucial for business compliance with federal tax obligations. This article provides comprehensive guidance on how to apply for an EIN, steps to take if you’ve lost your EIN, and how Clemta can assist non-resident entrepreneurs in establishing their businesses in the United States.