Starting a business in the United States as a non-resident offers incredible opportunities, especially for those in the eCommerce and startup world. However, one of the first critical decisions you’ll need to make is selecting the appropriate business structure. The two most popular options are Limited Liability Companies (LLCs) and C-Corporations (C-Corps). Each has its own advantages and disadvantages, and understanding the key considerations can help ensure you’re choosing the right structure to support your business’s growth.

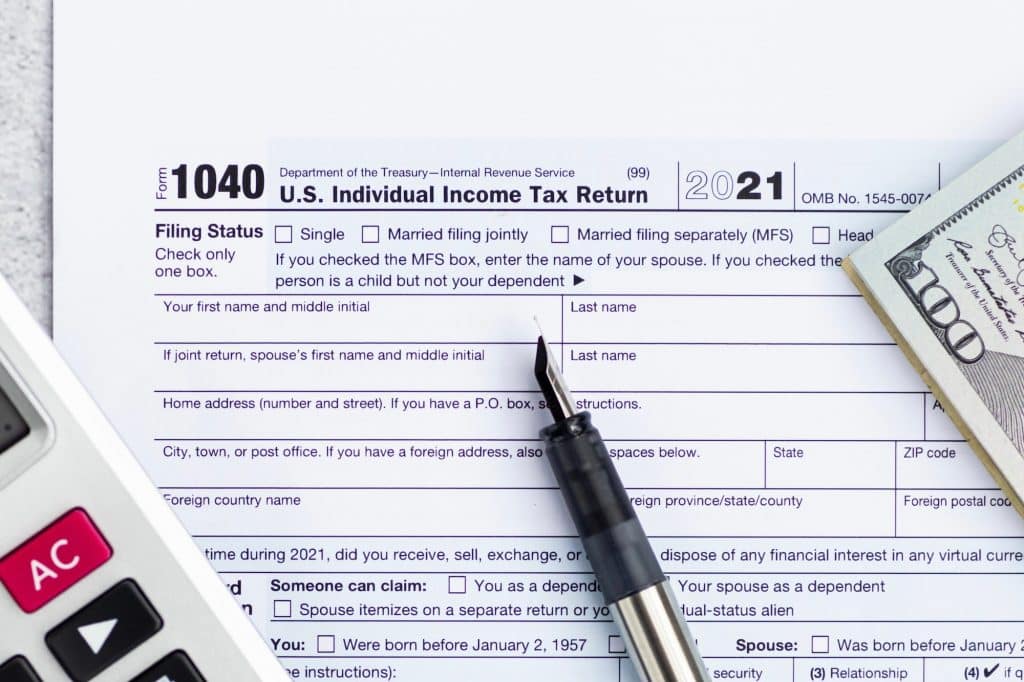

1. Taxation: Double Taxation vs. Pass-Through Taxation

One of the most significant distinctions between an LLC and a C-Corp lies in how they are taxed.

LLC Taxation

- LLCs are considered “pass-through entities,” meaning the profits and losses of the business are reported directly on the owner’s personal income tax return. The LLC itself doesn’t pay federal income taxes.

- This is advantageous for non-residents focused on keeping taxes simple and avoiding taxation at the company level. However, the potential downside arises when your income grows significantly—you may land in a higher personal tax bracket.

C-Corp Taxation

- A C-Corp, on the other hand, is a separate legal entity. It pays corporate income tax on its profits. If these profits are distributed to shareholders as dividends, those dividends are taxed again at the personal level. This is referred to as “double taxation.”

- However, with the corporate tax rate currently at a relatively low 21% in the U.S., the structure could still be appealing depending on your objectives, especially if your business reinvests the majority of its profits rather than distributing them as dividends.

When to Choose What?

- Go for an LLC if you’re looking to avoid double taxation and prefer straightforward tax filings.

- Go for a C-Corp if you require a structure that’s better suited for reinvestment or large-scale operations, even with potential double taxation.

2. Ownership and Scalability

LLC Ownership Structure

- LLCs are highly flexible when it comes to ownership. Members (owners) can be individuals, foreign entities, or even other LLCs.

- LLCs are ideal for small teams, family businesses, or single-member ownership. However, as the business grows and you add more stakeholders, managing equity distribution and bringing on investors can become more complicated.

C-Corp Ownership Structure

- C-Corps are designed for scalability. They issue shares of stock, making them the preferred structure for companies that expect to bring in outside investors, such as venture capitalists or angel investors.

- C-Corps have stricter ownership protocols. For example, directors and officers must be appointed, and shareholders must adhere to specific ownership rules. Non-residents can own shares in a U.S. C-Corp, which makes it attractive for international entrepreneurs.

When to Choose What?

- Choose an LLC if you’re starting small and want a more flexible ownership structure.

- Choose a C-Corp if you aim to scale quickly, raise capital through stock issuance, or plan an Initial Public Offering (IPO) in the future.

3. Legal Liability Protection

Both LLCs and C-Corps offer limited liability protection. This means the business owners’ personal assets are shielded from the debts and liabilities of the company. However, the structural differences may have implications depending on how you operate.

LLC Liability Protection

- An LLC’s liability protection is straightforward, with limited government oversight. However, it’s crucial to maintain running agreements and operational consistency to preserve the liability shield.

C-Corp Liability Protection

- C-Corps provide even greater protection, particularly for shareholders, since liabilities and lawsuits are tied exclusively to the corporation. Stakeholders’ exposure is limited strictly to the amount of their investment in the company.

When to Choose What?

Both structures offer substantial liability protection, but if you’re focused on stricter safeguards or have plans to attract many shareholders, the C-Corp might offer a slightly more robust option.

4. Administrative Complexity and Costs

Administrative complexity can be an important factor for non-residents, startups, and small business owners looking to save time and money.

LLC Simplicity

- LLCs are simpler to form and maintain. They require fewer formalities such as record-keeping, annual meetings, or resolutions.

- For non-residents forming or managing a U.S. LLC, this light administrative burden can be a significant advantage.

C-Corp Complexity

- C-Corps are administratively intensive. The requirements often include board meetings, detailed reporting, the issuance of stock certificates, and regularly filed corporation minutes.

- While these actions benefit larger businesses that need to ensure legal compliance and credibility with shareholders, they can be burdensome for smaller startups or non-residents unfamiliar with U.S. business regulations.

When to Choose What?

- An LLC is the better option if simplicity and ease of administration are priorities.

- If you’re working toward building a high-growth, shareholder-driven company, a C-Corp’s complexities may be necessary and worth the effort.

5. Attracting Investors and Raising Capital

If you have plans to bring in external funding, the choice between an LLC and a C-Corp becomes critically important.

LLC Challenges in Raising Capital

- While LLCs can support multiple members and even sophisticated ownership structures, they often face challenges when raising capital from venture capital firms or issuing equity.

- Investors may prefer C-Corps due to their standardized structures, clear shareholder agreements, and ability to issue multiple classes of stock.

C-Corp Advantage in Raising Capital

- C-Corps are designed to attract funding from investors. They can issue stock options, preferred shares, and more, making the fundraising process seamless.

When to Choose What?

- Choose an LLC if funding is not a concern or you’re self-funding your venture.

- Choose a C-Corp if attracting investors is a priority and extensive funding rounds may be required.

6. Residency and International Considerations for Non-Residents

LLCs for Non-Residents

- LLCs are an excellent option for non-residents because they are flexible with income reporting and do not require residency or permanent establishment. The lack of double taxation is also appealing.

C-Corps for Non-Residents

- C-Corps allow for easy ownership by foreign entrepreneurs and entities. If you plan to expand globally or participate in larger business ecosystems, a C-Corp is often the better choice.

When to Choose What?

- Non-residents who want a quick, straightforward setup without a complex tax structure may prefer LLCs.

- Non-residents with plans for a global presence or large-scale operations may lean toward C-Corps.

Conclusion: Making the Right Choice

Choosing between an LLC and a C-Corp depends on your business needs, growth plans, and financial goals. Here’s a summary to guide your decision:

- LLC: Best for small businesses, simpler operations, personal taxation, and non-residents looking for ease of management.

- C-Corp: Ideal for companies aiming to scale, attract investors, issue equity, and grow into an internationally recognized organization.

Still unsure? At Clemta, we specialize in guiding international entrepreneurs and eCommerce business owners through the process of U.S. business formation, ensuring that they make informed decisions about the right structure. Let us help you build the foundation for your success.

Ready to get started? Contact Us Now or explore our services to learn more about LLC and C-Corp formation tailored to your needs.