Dissolving a Texas LLC involves several important steps to ensure compliance with state laws and regulations. Whether you’re closing your business due to changing circumstances or transitioning to a new venture, following the correct procedures is critical to avoid future legal or financial complications. This guide will walk you through the process, making it manageable and straightforward.

Step 1: Hold a Board Meeting and Vote

The first step in dissolving your Texas LLC is to hold a board meeting with all members or managers. During this meeting, you will discuss the decision to dissolve the company and take a formal vote.

Document the Decision

Record the results of the vote in your meeting minutes. This documentation serves as an official record of the decision to dissolve the LLC.

Review the Operating Agreement

Check your LLC’s operating agreement for specific dissolution requirements. Some agreements may require unanimous consent, a majority vote, or other conditions to proceed.

This step ensures that all members are in agreement and that you have a formal record of the decision to dissolve. For more information on LLC operating agreements, you can visit an official state resource, such as www.texas.gov.

Step 2: File a Certificate of Termination

Once the decision to dissolve has been made, the next step is filing a Certificate of Termination with the Texas Secretary of State. This document serves as the official notification of your LLC’s dissolution.

How to File

You can file the Certificate of Termination online through the Texas Secretary of State’s website or by mail. Be sure to complete all required sections of the form accurately.

Filing Fee

Be prepared to pay a filing fee, which is required to process the termination. The exact fee can vary, so check the Texas Secretary of State’s official website for up-to-date information.

This step legally ends your LLC’s existence in the state of Texas. To ensure compliance, you can refer to www.sos.state.tx.gov for additional details.

Step 3: Clear Outstanding Debts and Obligations

Before finalizing the dissolution, it’s crucial to settle any outstanding debts or obligations. This ensures that your LLC has no unresolved liabilities.

Pay Creditors

Ensure that all creditors are paid in full or that payment arrangements are made. This prevents future claims against your dissolved LLC.

Resolve Legal Issues

Address any pending legal disputes or lawsuits involving the LLC. These must be resolved before the dissolution process is complete.

Distribute Assets

After settling debts, distribute any remaining assets among LLC members according to the terms outlined in your operating agreement.

Maintaining detailed records of these actions is essential for compliance and future reference. For more guidance on financial obligations, consult resources such as www.irs.gov.

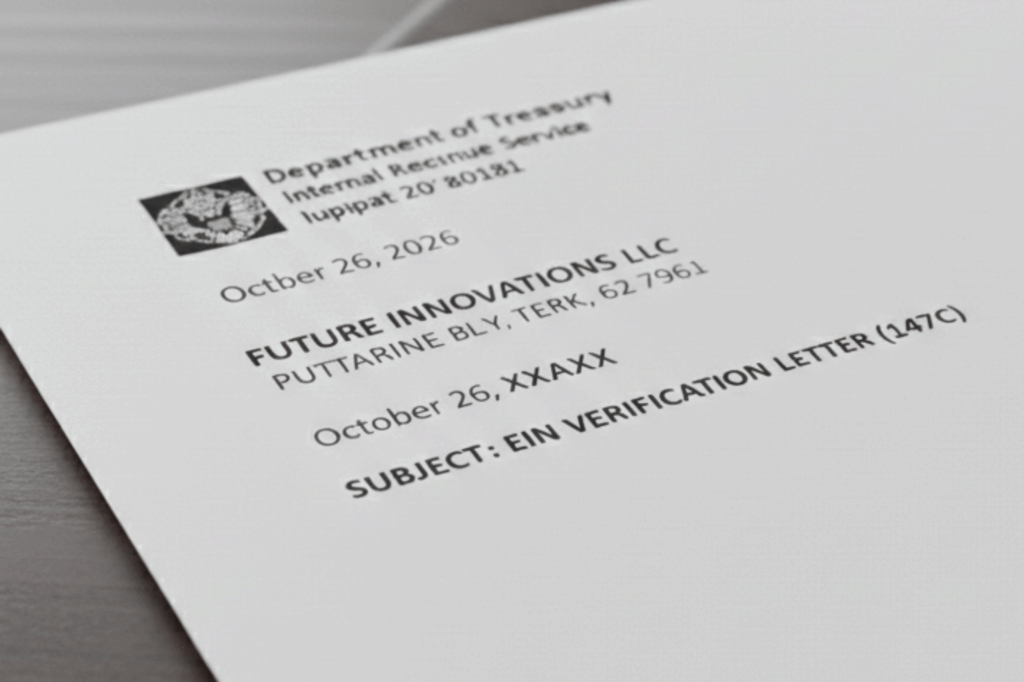

Step 4: File Final Tax Returns

After clearing all debts, you must file your final tax returns with both the IRS and the Texas Comptroller of Public Accounts. This step is critical for ensuring your LLC is in good standing with tax authorities.

Federal and State Taxes

Ensure all taxes are paid, including sales tax, franchise tax, and federal income tax. Failure to do so can result in penalties or legal action.

Certificate of Account Status

Obtain a Certificate of Account Status from the Texas Comptroller to confirm that all taxes have been settled. This document is required to finalize the dissolution process.

Filing your final tax returns ensures that your LLC is compliant with tax regulations. For more information, visit www.comptroller.texas.gov.

Step 5: Notify Relevant Parties

Communication is key when dissolving your LLC. Notify all relevant parties about the closure of your business to ensure a smooth transition.

Employees

Provide adequate notice to employees and address any final payroll obligations. This helps maintain professionalism and avoids potential disputes.

Suppliers and Vendors

Inform suppliers and vendors about outstanding invoices or contracts. This ensures that all business relationships are properly concluded.

Customers

Send notifications to customers, especially if they have ongoing subscriptions or services. This prevents confusion and maintains your reputation.

This step minimizes misunderstandings and ensures that all stakeholders are informed. For additional tips on business closures, you can consult www.business.texas.gov.

Step 6: Cancel Business Licenses and Permits

Your LLC may hold various licenses and permits that need to be canceled to prevent future liabilities. Overlooking this step can lead to unnecessary fees or obligations.

Contact Issuing Agencies

Reach out to the agencies that issued your business licenses and permits to cancel them. This includes local, state, and federal licenses, if applicable.

Avoid Future Obligations

Canceling these ensures that you won’t be held responsible for fees or obligations tied to an active license. It’s a critical step in fully closing your business.

For more information on licensing requirements, visit www.license.state.tx.us.

Step 7: Maintain Your Records

Even after dissolving your LLC, it’s important to retain your business records for at least seven years. Proper record-keeping can protect you from potential legal or financial issues in the future.

Why Keep Records?

These records may be needed for tax audits, legal disputes, or other issues that could arise after dissolution. Having organized records ensures that you are prepared for any situation.

What to Keep

Retain documents such as tax filings, financial statements, meeting minutes, and the Certificate of Termination. These records serve as proof of compliance and can be valuable references.

Proper record-keeping is an essential part of the dissolution process. For additional guidance, consult resources like www.archives.gov.

Conclusion

Dissolving a Texas LLC may seem overwhelming, but by following these steps, you can ensure that the process is legal and smooth. From holding a board meeting to filing final tax returns and canceling licenses, each step is essential to avoid future complications.

If you need assistance with tax filings, legal compliance, or any aspect of dissolving your LLC, Clemta offers professional services to help you navigate the process with ease. Contact us today to get started!

Learn more: Legally dissolve a company. ?

Contact us: Feel free to ask your questions ?