Please note that the answers provided below are only for information purpose and has no intent to provide legal advice. Each taxpayer’s situation before the Internal Revenue Service (IRS) must be considered individually, and ideally with the assistance of a certified public accountant (CPA) for Federal income tax.

What is the federal income tax?

The federal tax is one of the main tax categories in the United States, which is directly levied by the IRS over the annual taxable income of individuals and legal entities. It also constitutes the largest revenue source of the US government.

For further information, you may visit our Federal Taxation Ultimate Guide from the following link: https://clemta.com/blog/federal-taxation-ultimate-guide.

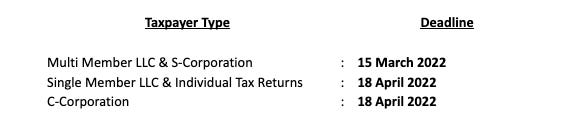

What are the deadlines of the federal income tax return for 2022?

What is the difference between Form 1040 and Form 1040NR?

Form 1040 is the one that you will file before the IRS if you are a US citizen or Green Card holder, or if you pass the substantial presence test. In this scenario, you will be taxed in the US for your all worldwide earnings.

On the other hand, if you do not meet the foregoing criteria, you will be considered as “non-resident alien” before the IRS and taxed only for your US sourced income (when it is not already withheld) or if you are engaged in US trade and business and have US source effectively connected income arising from such trade or business.

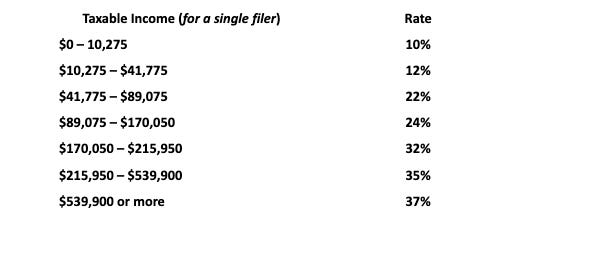

Please note that federal personal income tax has seven tax rates ranging from 10% to 37%. This tax is progressive, as taxable income increases, so does the tax rate. The tax rates also vary depending on marital status of the relevant individual while filing the tax return.

You may find below a general table showing tax brackets for a single individual in 2022:

How the companies non-residents can incorporate in the US (LLCs or C-Corporations) are taxed on federal level?

Taxation of LLC and C-Corp differs in many aspects; therefore, we will evaluate each individually as follows:

Limited Liability Company

Since limited liability companies are not separate tax entities like corporations, IRS treats them as “pass-through entities” or “disregarded entities”. As a result of this, single-member LLCs are considered as “sole proprietorship”, while multi-member LLCs are deemed as “partnership” in terms of filing tax returns.

All income and loss of the LLCs directly pass to the members of the company and the members are required to report such income/loss in their individual tax return, as explained under Question 3. In other words, LLC itself is not obligated to pay the federal tax, thus the double taxation is surpassed inherently.

IRS assumes that each LLC member receives its entire distributive share (as set out in the company’s operating agreement) every year, files, and pays relevant federal taxes. However, in reality, members can leave profits within the company for operational reasons. Even this is the case, the members are to pay their taxes over the whole sum of their distributive shares, regardless of the company actually distributes those amounts.

Important Point: Even a multi-member LLC is not required to pay income tax over the business earnings, the company is still obligated to;

1- Provide the Schedule K-1, indicating each member’s share on LLC’s profit or income, on which the member will depend while filing the federal tax return, and

2- File an informatory return through Form 1065, which will help IRS to understand whether such LLC members report their incomes accurately.

C-Corporation

Unlike LLCs, corporations are required to file federal income tax over their corporate earnings through Form 1120. If your entity does not gather any source of income in the United States, you will only have to declare your taxes. On the other hand, having an operationally active C-Corp will require you to pay the federal corporate tax, which is currently a flat rate of 21%.

If your company is a C-Corp, first you will have to pay 21% corporate tax, then follow the abovementioned process under Question 3 to spend your earnings as personal income. There is no doubt that this will lead to double taxation.

For more information on this topic, you may also visit https://clemta.com/blog/clemta-tax-manual#_Sales_Tax:

What is taxable income and what can you deduct from your gross income?

Your tax liability is determined through applying the appropriate tax bracket (based on your income level and filing status) on the taxable income. In a nutshell, the taxable income is calculated as follows:

Gross income – Expenses/Deductions = Taxable Income

Therefore, taxpayers are encouraged to show their all business-related expenses to lower the taxable income as much as possible. However, you can only deduct your legitimate business expenses from the gross income.

So, what can be deducted? Even the answer changes depending on the relevant taxpayer’s business, deductible expenses usually include advertisement costs, employee compensations, certain taxes, meal and travel allowances (up to a certain level), equipment costs, and so on! IRS also provides a list of legitimate business expenses that are certainly related to running the business and considered as deductible expenses: https://www.irs.gov/publications/p535

Taxable Income

Before filing the tax returns, you should also check whether there is any non-taxable item included in your taxable income. In principle, any item in your income is taxable, unless otherwise is provided in the relevant legislation. On the other hand, there are also non-taxable items that are still required to be listed in the tax return, but do not create any tax liability. Here, you may also find a list prepared by IRS regarding taxable and non-taxable incomes: Publication 525, Taxable and Nontaxable Income.

We know it may be tricky for business owners to decide whether an income is non-taxable and/or an expense is deductible. Therefore, it is becoming more important to keep the transaction and expense records in a neat and systematic way.

At this point, Clemta assists you throughout your journey in the United States and handles all bookkeeping and tax filing processes required for you and your business, so that you may focus on your business, rather than struggling with the paperwork.

We record all financial transactions of your business on a day-to-day basis and when the tax season arrives, our CPAs review such records and prepare important financial documentation (e.g., tax documents and profit-and-loss statements) in line with the applicable law. If available, they also inform you regarding extensions and tax advantages applicable for you.

You may also visit the following page for more information on our bookkeeping and taxation services:

https://clemta.com/blog/federal-taxation-ultimate-guide

What is Form 5472?

As a business owner, it may be natural for you to transfer money from the company’s accounts to yourself or vice versa; however, you should be aware of the Form 5472 while filing your tax return.

As of 2017, the following company types are required to file 5472 informatory return before the IRS, when a reportable transaction is realized within the relevant tax year:

- All single-member LLCs entirely owned by foreigners; and

- All corporations with foreign owners, holding at least %25 of the company stocks.

So, what is a reportable transaction? According to Section V of form 5742, amounts paid or received in connection with the formation, dissolution, acquisition, and disposition of the company, including contributions to and distributions from the company are considered as a reportable transaction. Therefore, even company incorporation expenses paid by you will be regarded as reportable transactions, and thus create the obligation to file Form 5472 for the relevant tax year.

Please note that failure to file or filing Form 5472 late may lead to sky-high monetary fines reaching $25,000.

We hope our above explanations will be helpful for you throughout the federal tax season. As failure to file or keep the records may lead to various penalties and fines, including criminal ones, we highly recommend you work with a professional both for bookkeeping and tax filing processes, since the stakes are considerably high.

Please reach us if you have any questions regarding federal tax returns via [email protected] or get a quote for your company from the following links:

Get a Quote for Federal Tax Filing for your LLC

Get a Quote for Federal Tax Filing for your C-Corp