Limited Liability Companies (LLCs) are a popular business structure in the United States, offering protection and flexibility for business owners. However, various circumstances can lead an LLC to fall out of its good standing status. Reactivating your LLC involves a few key steps, which may differ from state to state. This guide will focus on the process in Delaware and how you can efficiently manage LLC reactivation.

Understanding LLC Status Changes

Before diving into the reactivation process, it’s crucial to understand the different reasons an LLC might lose its good standing status.

- Non-Payment of Taxes

In Delaware, failing to pay your LLC taxes can lead to a status change to “void”. It is essential to stay on top of your tax obligations to maintain good standing. - Loss of a Registered Agent

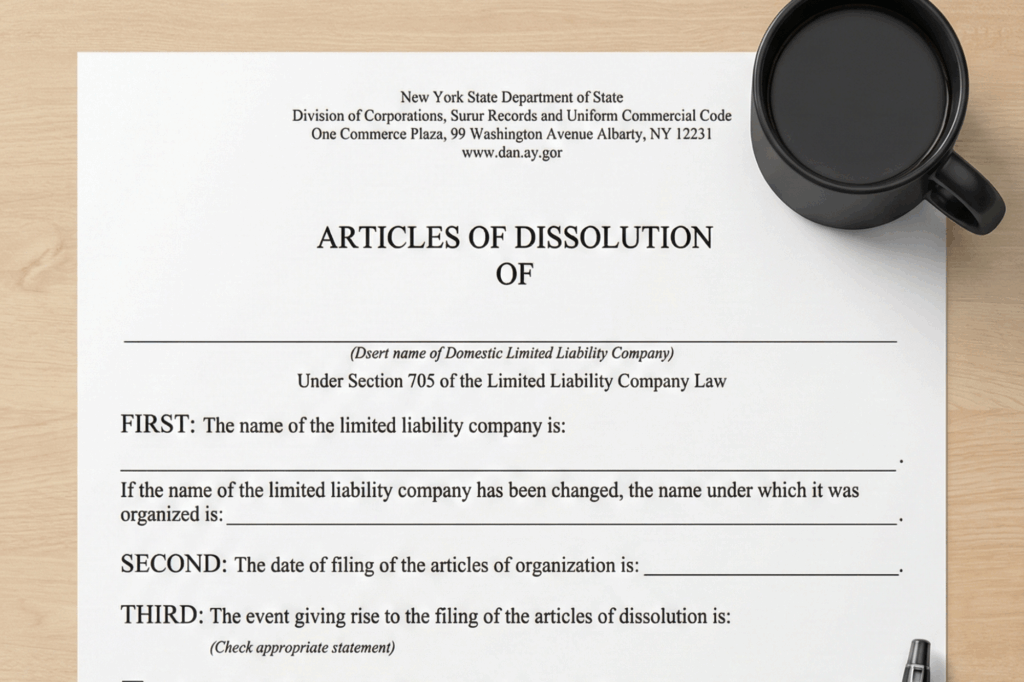

An LLC’s status can be shifted to “forfeited” if there is no Delaware Registered Agent maintained. It is mandatory for LLCs in Delaware to have a registered agent at all times. - Dissolution and Cancellation

If you dissolve your LLC, its status becomes “canceled”. While “dissolution” typically refers to corporations, “cancellation” is used for LLCs.

For detailed assistance with maintaining good standing or addressing these issues, visit clemta.com to explore professional services and guidance.

Steps to Revive Your LLC in Delaware

Once you understand the reasons behind a status change, you can proceed with the necessary steps to reinstate your LLC’s good standing.

- Pay Owed Taxes

Before filing for revival, ensure that all outstanding taxes are paid. This is a prerequisite for reactivation. - Maintain a Registered Agent

Make sure you have a registered agent in Delaware, as it is a strict requirement for all LLCs operating in the state. - File a Certificate of Revival

Prepare the Certificate of Revival for your Delaware LLC. This document requires your LLC’s name, the date of filing, and registered agent information. The submission can be done via mail, in-person, or electronically.- Fee for Filing

As of the latest update, the filing fee for the Certificate of Revival is $200. It’s advisable to check current fees on the Delaware Division of Corporations website.

- Fee for Filing

- Submit a Cover Letter

If filing by mail, include a cover letter. Use the Document Filing Sheet and follow the instructions provided by the Delaware Division of Corporations. Electronic submissions do not require a cover letter.

For more insights into the process and professional advice on smoothly handling your LLC matters, connect with experts at clemta.com.

Conclusion

Reactivating an LLC in Delaware requires awareness of the specific legal requirements and diligence in adhering to them. By following the outlined steps, you can restore your LLC to its good standing status efficiently. Remember, keeping a clear track of taxes and registered agent requirements will help prevent such issues from arising in the future. For comprehensive support, clemta.com offers resources and expert assistance tailored to your business needs.