As the global landscape shifts due to escalating tariffs and trade tensions, many entrepreneurs are finding unique opportunities to establish their businesses in the United States. The recent increase in average effective U.S. tariff rates has created significant changes in the market. However, for those ready to navigate this terrain, the U.S. remains a promising choice for company formation. It’s essential to analyze the current dynamics and strategically position your business to leverage the advantages offered by the American market. Furthermore, understanding the nuances of international trade and adapting your strategies accordingly can lead to sustained growth and success in this evolving economic environment. A proactive approach that emphasizes innovation and resilience will be key to thriving amidst these changes.

Understanding the Current Tariff Landscape

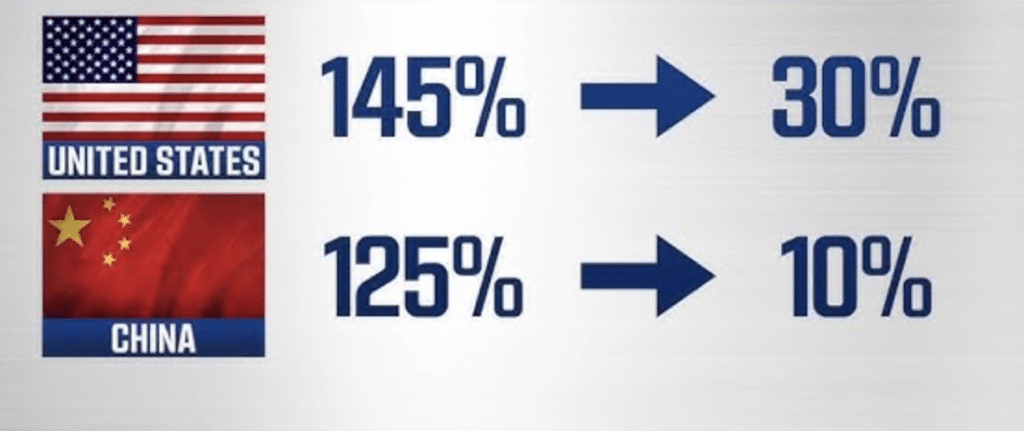

With the Trump administration’s implementation of steep tariffs, including a staggering 145% on Chinese imports and 25% on steel and aluminum, many have feared the potential repercussions on the U.S. economy. While these protective measures are designed to bolster domestic manufacturing and address trade deficits, they have also encouraged a reconsideration of where and how businesses operate. These tariffs aim to protect domestic industries and stimulate economic growth within the U.S., but they also create challenges for businesses that rely on international supply chains. It’s crucial for entrepreneurs to carefully evaluate the potential impact of these tariffs on their operations and develop strategies to mitigate any negative effects. For more information on trade policies and regulations, you can visit the Office of the United States Trade Representative’s website: https://ustr.gov/. The Office of the United States Trade Representative (USTR) is responsible for developing and coordinating U.S. international trade, commodity, and direct investment policy, and overseeing negotiations with other countries.

Despite fears of a recession, the U.S. economy is demonstrating resilience. The average effective tariff rate currently sits at 17.8%, and businesses are adapting rapidly to this new norm. As companies reassess their supply chains and sourcing strategies, the U.S. presents a viable option for those looking to establish a local presence. This resilience indicates the adaptability of American businesses and their capacity to overcome challenges posed by changing trade policies. It is important to note that understanding the long-term implications of tariffs requires a comprehensive analysis of various economic indicators and market trends. Furthermore, exploring innovative solutions, such as leveraging advanced technologies and adopting sustainable practices, can contribute to the long-term success of businesses operating in the U.S. market.

Why the U.S. is Still a Great Place to Start a Business

- Access to a Large Consumer Market The U.S. boasts one of the largest consumer markets in the world, with a diverse population that drives demand for various goods and services. Even with the recent tariffs, the size and purchasing power of the market offer businesses substantial opportunities to thrive. This vast consumer base provides a fertile ground for businesses to introduce new products and services, expand their reach, and achieve economies of scale. Understanding the demographic trends, consumer preferences, and purchasing habits within the U.S. market is essential for tailoring your business strategies and maximizing your chances of success. The diversity of the population also allows for niche markets to flourish.

- Support for Domestic Manufacturing The government’s focus on domestic manufacturing as a response to tariffs means that there are various incentives for startups in this sector. Companies that prioritize local production may qualify for tax breaks or grants, making it an excellent time to invest in manufacturing operations within the country. These incentives are designed to encourage job creation, stimulate economic growth, and reduce the reliance on foreign suppliers. By investing in domestic manufacturing, businesses can also gain greater control over their supply chains, improve product quality, and enhance their reputation as responsible and sustainable enterprises. For information on incentives, check out https://www.eda.gov/. The Economic Development Administration (EDA) is an agency within the U.S. Department of Commerce that provides grants and technical assistance to support economic development in communities across the United States. The EDA works to promote innovation and competitiveness, prepare American regions for growth and success in the worldwide economy. It aims to foster collaboration and economic growth across the nation.

- Innovation and Technology The U.S. continues to be a leader in innovation and technology, with vast resources dedicated to research and development. Entrepreneurs in the tech sector will find a supportive ecosystem, access to venture capital, and networking opportunities that can help their businesses flourish. This ecosystem includes world-class universities, research institutions, and a vibrant startup community that fosters creativity and collaboration. Access to venture capital and angel investors provides entrepreneurs with the necessary funding to develop and scale their innovative ideas. Furthermore, the U.S. government supports innovation through various programs and initiatives aimed at promoting research and development.

- Regulatory Environment for Startups The regulatory framework in the U.S. is generally conducive to entrepreneurship. With various resources available for small businesses and startups, including the Small Business Administration (SBA) and numerous local programs, the process of launching a company has become more streamlined. These resources provide entrepreneurs with access to funding, mentorship, training, and technical assistance. The SBA also offers loan programs that can help small businesses access the capital they need to start and grow. Additionally, various state and local government agencies provide support for startups through tax incentives, grants, and other programs. The U.S. maintains a regulatory environment that attempts to encourage innovation while simultaneously protecting consumers.

- Talent Pool The U.S. is home to a highly skilled workforce with a strong emphasis on education and vocational training. Companies can benefit from a diverse talent pool, making it easier to find the right employees who can innovate and drive growth. This talent pool includes graduates from top universities, experienced professionals, and skilled tradespeople. The U.S. education system produces a steady stream of qualified candidates in various fields, including science, technology, engineering, and mathematics (STEM). Furthermore, the U.S. attracts talent from around the world, creating a diverse and dynamic workforce.

Navigating Tariffs: Strategies for Success

Starting a business now means understanding how to effectively navigate the tariff landscape. Here are some strategies for success:

- Local Sourcing: Consider sourcing materials and components domestically to avoid high tariffs on imports. This approach not only mitigates costs but also supports local economies. By establishing relationships with local suppliers, businesses can reduce their exposure to international trade risks and contribute to the growth of their local communities. This strategy also enhances supply chain resilience, ensuring a more stable and reliable source of materials.

- Diversifying Supply Chains: If importing from countries with high tariffs, businesses should explore diversifying their supply chains. Utilizing suppliers from countries with lower tariffs can improve profitability. This diversification reduces the risk of relying on a single source and provides businesses with greater flexibility in responding to changing trade policies. Thoroughly researching and vetting potential suppliers from different countries is essential for ensuring quality and reliability.

- Market Research: Conduct thorough market research to understand how tariffs influence consumer behavior. This can help refine your product offerings and marketing strategies. Understanding how tariffs affect consumer prices, purchasing decisions, and brand loyalty is crucial for adapting your business strategies accordingly. Market research can also reveal new opportunities and identify untapped market segments.

- Long-Term Planning: While the current tariff environment presents challenges, it can also lead to long-term benefits. Develop a business model that accounts for ongoing changes in trade policies, focusing on sustainability and growth. This involves anticipating future trends, investing in research and development, and building a resilient and adaptable organization. Sustainability should be considered on every level to promote long-term success.

Conclusion

Despite the complexities introduced by tariffs and trade wars, the landscape for starting a business in the U.S. is filled with potential. With access to a robust market, government support for manufacturing, and a pool of skilled talent, entrepreneurs are well-positioned to capitalize on these opportunities. Now is the time to take advantage of the favorable conditions for business formation in America. Discover resources and tools to help you succeed at app.clemta.com.

FAQ About Starting a Business in the U.S.

What are the main advantages of starting a business in the U.S. right now?

The U.S. offers access to a large consumer market, support for domestic manufacturing through government incentives, a leading position in innovation and technology, a favorable regulatory environment for startups, and a highly skilled workforce. Despite tariffs, these factors combine to make the U.S. an attractive location for new businesses. The country’s infrastructure and access to capital are also advantageous.

How can I navigate the tariff landscape when starting a business?

To navigate tariffs, consider local sourcing to avoid import costs, diversify your supply chains to include countries with lower tariffs, conduct thorough market research to understand consumer behavior, and develop a long-term business model that accounts for ongoing trade policy changes. This strategic approach will help mitigate risks and maximize profitability. You can also seek professional advice from trade consultants.

What government resources are available for startups in the U.S.?

The U.S. Small Business Administration (SBA) offers various resources, including funding, mentorship, training, and technical assistance. Additionally, numerous local programs and state-level initiatives provide support for startups. Take advantage of these resources to streamline the process of launching and growing your business.