The United States stands as a prominent global hub for business expansion, investment opportunities, and efficient payment systems. For ambitious entrepreneurs based in Vietnam, establishing a Limited Liability Company (LLC) in the U.S. presents a multitude of significant advantages that can propel their ventures to new heights. Gaining access to global payment gateways is essential for international business. Platforms like Stripe and PayPal often necessitate a U.S. entity for full access, making incorporation a key enabler for Vietnamese businesses aiming to engage with a global customer base. Beyond payment processing, a U.S. company enhances credibility with international clients, investors, and potential partners. This boost in trust can lead to increased opportunities and stronger relationships. Furthermore, having a U.S. LLC streamlines operations when dealing with global customers, vendors, and various online platforms, simplifying international business transactions.

The stability of the U.S. financial system also provides a safety net against currency volatility and allows businesses to tap into stronger financial resources. This can be a crucial factor for Vietnamese entrepreneurs looking to protect their assets and expand into more stable economic environments. Consider exploring resources from the U.S. Small Business Administration (SBA) at https://www.sba.gov/ for additional insights on the advantages of operating a business in the U.S.

LLC Formation: The Fastest Route for Vietnamese Entrepreneurs

For most Vietnamese founders seeking a swift and efficient entry into the U.S. market, setting up an LLC in states like Wyoming or Delaware is often the ideal choice. The LLC structure offers several benefits that make it particularly appealing to international entrepreneurs. Firstly, the formation process is remarkably fast, allowing incorporation within days, without the need for travel. This speed is crucial for entrepreneurs eager to launch their businesses quickly and capitalize on emerging opportunities. Maintaining an LLC is also simple, with minimal paperwork requirements and relatively low annual fees compared to other business structures. This ease of maintenance reduces administrative burdens and allows entrepreneurs to focus on core business activities.

Full foreign ownership is permitted, meaning that Vietnamese entrepreneurs can retain complete control over their U.S. LLC without needing U.S. partners or shareholders. This autonomy is a significant advantage for founders who wish to maintain decision-making authority. Moreover, an LLC formed in Wyoming or Delaware typically qualifies for easy onboarding to key payment processors like Stripe and PayPal, which is essential for conducting online transactions and receiving payments from international customers. The U.S. government provides many resources for foreign entrepreneurs; you can learn more from https://www.usa.gov/.

Can I Open a Stripe Account From Vietnam?

Accessing Stripe or PayPal from Vietnam without a U.S. entity can be a significant challenge, often hindering the ability to effectively conduct international business and receive payments from global customers. However, by incorporating an LLC in the U.S., Vietnamese entrepreneurs can readily meet the eligibility criteria required by these platforms and unlock seamless access to global payment processing. Through services like Clemta, Vietnamese entrepreneurs can register their LLC online, obtain an EIN (Employer Identification Number), and open a U.S. business bank account if desired. This streamlined process empowers them to apply for Stripe, PayPal, and other global platforms, significantly expanding their business capabilities.

This fast path to monetizing services internationally and growing an online business is a game-changer for Vietnamese entrepreneurs seeking to tap into the global market. Securing a U.S. business bank account provides added financial stability and credibility when dealing with international clients and partners. Remember that you can learn more about US regulations on https://www.reginfo.gov/.

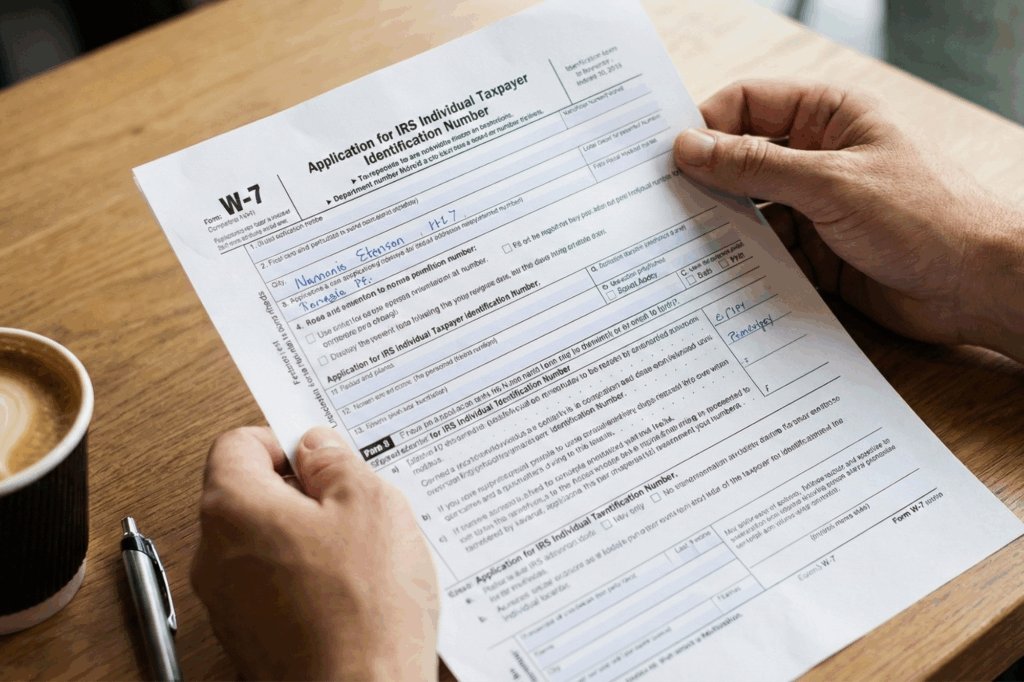

FAQ: How can an EIN help my business?

An Employer Identification Number (EIN), also known as a Tax ID, is a unique identifier assigned by the Internal Revenue Service (IRS) to business entities operating in the United States. It serves as a Social Security Number for your business, allowing it to conduct various financial and legal activities. Obtaining an EIN is essential for opening a U.S. business bank account, hiring employees, filing taxes, and applying for business licenses and permits. Without an EIN, your business may face difficulties in processing payments, establishing credit, and complying with legal requirements.

An EIN also enhances your business’s credibility and trustworthiness when dealing with customers, suppliers, and partners. It demonstrates that your business is legally registered and recognized by the U.S. government. The process of obtaining an EIN is typically straightforward and can be completed online through the IRS website or with the assistance of incorporation services like Clemta. Having an EIN is a fundamental step in establishing a U.S. presence and operating legally within the country’s business framework.

FAQ: What are the ongoing compliance requirements for a U.S. LLC?

Maintaining compliance with U.S. regulations is essential for ensuring the long-term success and legal standing of your LLC. Ongoing compliance requirements vary depending on the state where your LLC is registered and the nature of your business activities. Generally, you will need to file annual reports with the state, pay annual franchise taxes, and maintain accurate financial records. It’s also crucial to comply with federal tax obligations, including filing annual tax returns and paying estimated taxes on time.

Additionally, you may need to obtain and renew business licenses and permits at the local, state, and federal levels, depending on your industry and business operations. Regular monitoring of regulatory updates and changes is also vital to ensure your LLC remains in compliance with the latest laws and regulations. Failure to comply with these requirements can result in penalties, fines, and even the dissolution of your LLC. Seeking guidance from legal and accounting professionals can help you navigate the complexities of U.S. compliance and avoid potential pitfalls.

FAQ: What states are most popular for LLC formation?

Several states are popular choices for forming an LLC due to their favorable business environments, streamlined regulations, and attractive tax structures. Delaware and Wyoming are often cited as top destinations for LLC formation, particularly for entrepreneurs seeking privacy, flexibility, and asset protection. Delaware offers a well-established legal framework, a business-friendly court system, and low franchise taxes. Wyoming provides similar benefits, including low annual fees, no state income tax, and strong privacy protections.

Nevada is another popular option, offering no state income tax, minimal reporting requirements, and a favorable business climate. Each state has unique advantages and disadvantages, so it’s essential to carefully consider your specific business needs and objectives when choosing a state to form your LLC. Consulting with legal and tax professionals can help you make an informed decision that aligns with your long-term business goals.

Why Choose Clemta for Your U.S. Incorporation?

At Clemta, we specialize in helping global entrepreneurs navigate the complexities of starting a U.S. company, offering a fully online and streamlined process tailored to the unique needs of founders in Vietnam. Our services are designed to provide a fast and easy setup experience, ensuring a smooth and efficient journey towards establishing your U.S. presence. We are committed to transparent pricing with no hidden fees, allowing you to budget effectively and avoid unexpected costs.

Our team of experts provides guidance every step of the way, from initial consultation to ongoing compliance management after incorporation. We handle all the necessary paperwork, ensure your LLC is properly registered, and provide support with obtaining an EIN, opening a U.S. business bank account, and applying for Stripe and PayPal. We’re not just an agent — we’re your long-term partner in building your business in the United States.

Ready to Incorporate Your U.S. Company?

If you’re a Vietnamese entrepreneur looking to form a U.S. LLC and unlock Stripe, PayPal, and global business opportunities, Clemta makes it simple.

✅ Set up your U.S. company online in a few days

✅ Access global payments and international markets

✅ Build the foundation for your global brand

? Start your U.S. company today with app.clemta.com.