File Federal Taxes with a Few Clicks

Why Choose Clemta for Federal Tax Filing?

Although the IRS offers online resources, the process can still be confusing and time-consuming. Our team comprises of a wide range of tax professionals who are always ready to assist you.

Easy Filing

Trusted Partner

Guided Support

Get personalized assistance for a successful tax filing for non-US residents.

Ensuring Compliance

Filing taxes promptly ensures accurate records and avoids penalties.

Federal Tax Filing Made Easy

The Process Explained

With a team of committed experts, we ensure that tax filing will be a stress-free experience. We handle all the complicated paperwork, while you focus on your business.

Review your information

Clemta’s team assesses your business to determine applicable deadlines, tax forms, and procedures.

Prepare forms

Our tax professionals help you prepare the required documentation and information for your tax return.

File tax return

Clemta assists you in filing your tax return with the IRS before the deadline and applying for an extension when needed.

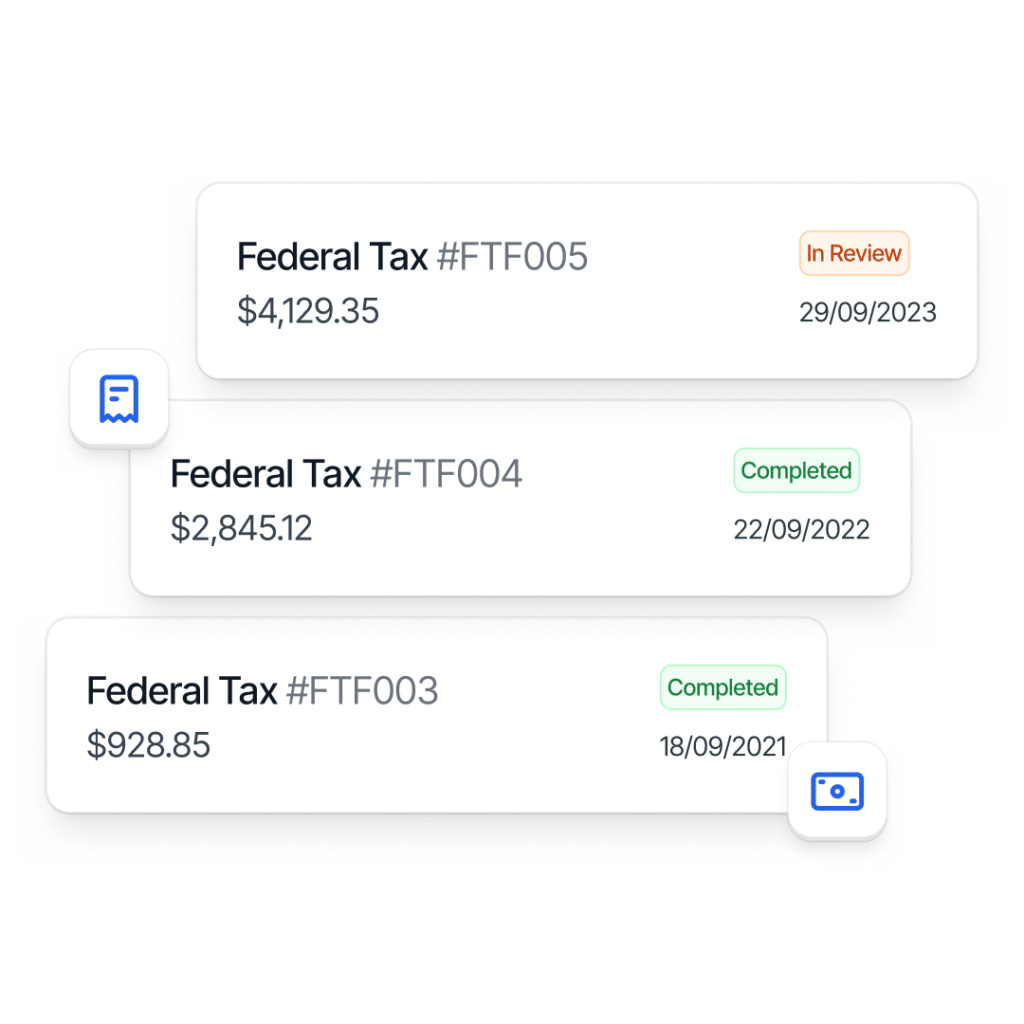

Get confirmation

We’ll keep you informed of the filing status and share the confirmation letter after the IRS accepts the submission.

Learn All the Essentials

What is the federal income tax?

What is a federal tax return and why is it important for my US company?

A federal tax return is a document filed annually with the IRS that reports your company’s income, expenses, and other pertinent tax information. It is crucial for legal compliance, ensuring your business pays the correct amount of taxes.

It also helps maintain good financial records and can be important for securing business loans or investments.

What are the deadlines for filing federal tax returns for businesses?

Deadlines vary depending on the business structure. Generally, corporations and individuals must file by April 15, while partnerships and S-corporations are required to submit their tax returns by March 15. However, if these dates fall on a weekend or holiday, the deadline is the next business day.

Extensions are available but must be requested before the original due date.

What are the consequences of failing to comply with federal tax filing deadlines?

Are there any special tax considerations for international entrepreneurs operating in the U.S.?

Yes, international entrepreneurs may be eligible for certain tax treaties, exemptions, or credits based on bilateral agreements between the U.S. and their home country.

Additionally, issues like double taxation, transfer pricing, and reporting of foreign assets are important and should be considered case-by-case.