Protect Your Business with Insurance

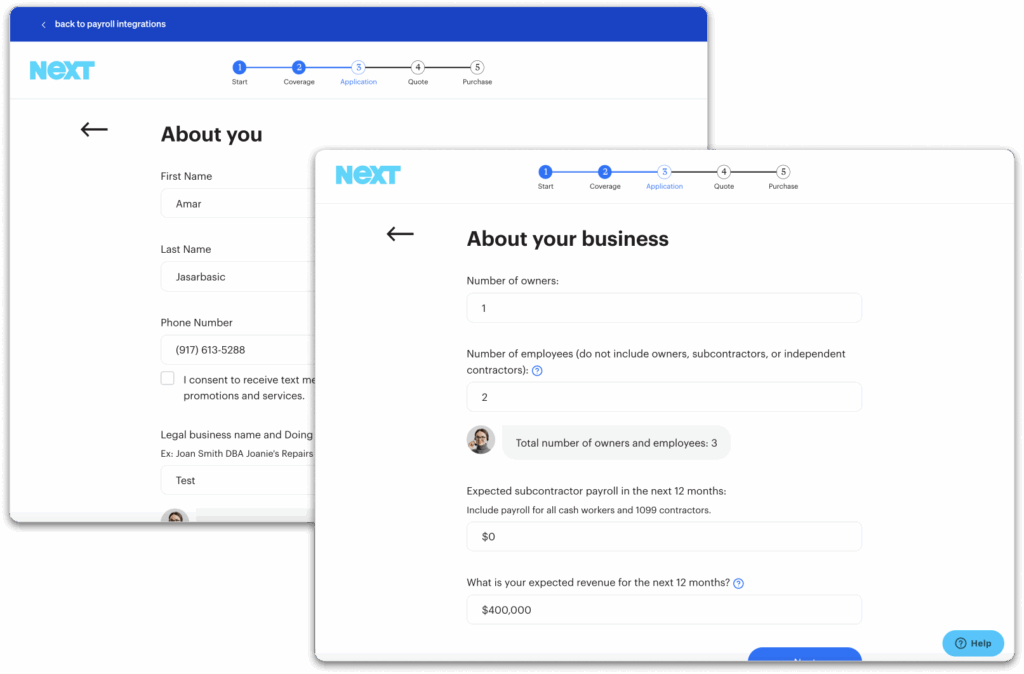

Our partner NEXT makes it easy to get the coverage you need to protect your business and stay compliant with state requirements.

Get Tailored Business Insurance

Protecting your business is simple with NEXT.

NEXT specializes in simple, digital, and affordable business insurance—100% dedicated to small businesses. Trusted by over 600,000 businesses, NEXT simplifies coverage with fast quotes, instant policies, and a fully digital experience.

Why Choose NEXT?

- Hassle-free Online Insurance

Get a free quote and purchase coverage online in minutes! Plus, manage your policy 24/7 with DIY access. - Affordably Priced

Save up to *25% in discounts. Pay for your insurance monthly or annually, and cancel anytime. - Built for Small Businesses

NEXT is committed to small businesses, offering tailored insurance packages for over 1,300 professions. - Trusted Insurance Partner

Harness the confidence that comes from partnering with a company rated “A- Excellent” by AM Best.

Why is Business Insurance Important?

Commercial insurance is crucial for protecting your business from financial losses. Without it, an accident or professional mistake could threaten the survival of your business.

Having the right insurance allows you to focus on your work without worrying about unforeseen circumstances. Additionally, many clients and vendors require proof of insurance before agreeing to work with you.

NEXT makes it easy to get the protection you need:

- Save with affordable policies tailored for small businesses.

- Get a free quote and purchase your policy online in minutes.

- Download your certificate of insurance (proof of insurance) when you buy your coverage.

- Use the NEXT mobile app to manage your coverage anywhere, anytime.

Available Coverages

Consider these essential coverages offered by NEXT:

- General Liability: Covers costs for property damage or injuries.

- Commercial Property: Protects physical items from damage or theft.

- Professional Liability: Protects against professional mistakes.

- Workers’ Compensation: Covers workplace injuries; required in many states.

- Cyber Liability: Covers costs from cyber incidents.

- Commercial Auto: Covers vehicle-related damages while working.

- Tools and Equipment: Covers repair or replacement of work gear.

Frequently Asked Questions

Why do small businesses need business insurance?

Business insurance protects against financial losses due to various risks, allowing you to focus on your work without the worry of “what if” scenarios.

What policies should small businesses consider?

Common coverages include:

- General Liability

- Professional Liability

- Workers’ Compensation

How much does business insurance cost?

You can save up to 25% with NEXT! Rates depend on factors like the type of work, location, and number of employees.

*To the extent permitted by law, applicants are individually underwritten, not all applicants may qualify.

Individual rates and savings vary and are subject to change. Discounts and savings are available where

state laws and regulations allow, and may vary by state. Certain discounts apply to specific coverages only.