What is a Domestic LLC?

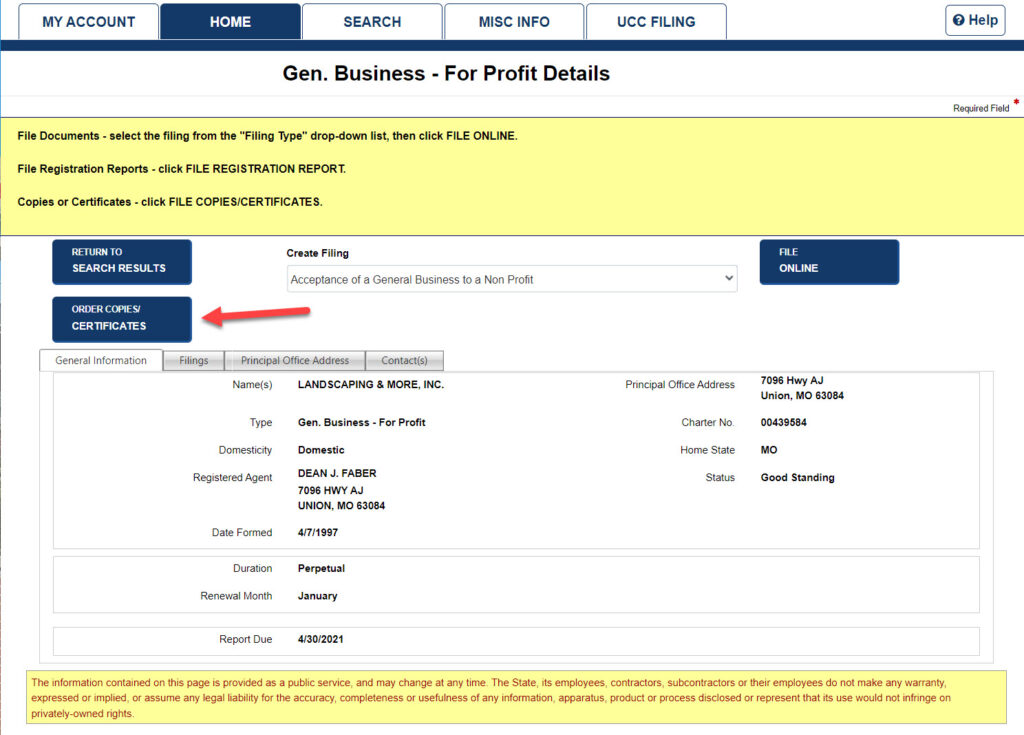

A Domestic LLC (Domestic Limited Liability Company) is a type of business entity established and operating within the same state where it was originally registered. The term “domestic” indicates that the LLC conducts its business in the same state in which it was formed, distinguishing it from a foreign LLC that operates in a state different from its state of formation.

Domestic LLCs are one of the most popular business structures in the United States because they offer flexibility, personal liability protection for owners, and fewer compliance requirements compared to corporations. This makes them particularly appealing for entrepreneurs and small business owners.

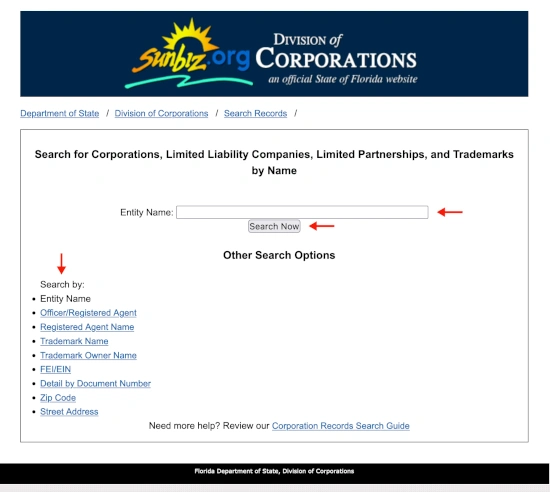

For more information about state-specific LLC requirements, visit an official government website such as www.sos.state.tx.gov.

Domestic Limited Liability Company Definition

A Domestic Limited Liability Company is legally defined as a hybrid business structure that combines the benefits of a corporation (such as limited liability) with the operational simplicity and tax advantages of a sole proprietorship or partnership. To form a Domestic LLC, individuals or groups must file organizational documents, such as Articles of Organization, with the appropriate state agency, typically the Secretary of State.

Unlike corporations that require formalities like boards of directors or shareholders, Domestic LLCs offer a more flexible management structure. The owners, referred to as “members,” are protected from personal liability for the company’s debts or obligations. This makes it an attractive choice for small business owners who want legal protection without the complexity of running a corporation.

For detailed guidelines on forming a Domestic LLC in your state, check resources such as www.sos.state.ca.gov.

What Does Domestic LLC Mean?

The meaning of a Domestic LLC lies in its operational jurisdiction. Simply put, a Domestic LLC means the business is “home-based” in the state where it is officially registered. For example, if an LLC is formed in Florida and operates only in Florida, it is considered a Domestic LLC in that state.

This type of business structure is ideal for startups, small businesses, and eCommerce founders who want to begin operations in their home state while enjoying limited liability protection. It allows entrepreneurs to focus on growing their businesses while avoiding the complexities of operating across multiple states.

For state-specific information on LLCs, visit a government website like www.sos.state.fl.us.

Key Features of Domestic LLCs

- Liability Protection: Members are generally not personally liable for business debts or lawsuits, protecting personal assets.

- Flexible Management Structure: Members have the freedom to manage the business without adhering to strict formalities.

- Pass-Through Taxation Options: Profits and losses can be reported on personal tax returns, avoiding double taxation.

- State Specifications: Rules for forming and maintaining a Domestic LLC vary by state but typically involve filing Articles of Organization and paying state fees.

These features make Domestic LLCs a practical choice for entrepreneurs who want legal protection and operational flexibility. However, it’s essential to understand the specific requirements of your state. For example, you can visit www.sos.state.ny.gov for New York’s LLC guidelines.

Why Choose a Domestic LLC?

Choosing a Domestic LLC provides unique advantages for entrepreneurs and startups looking for a simpler structure with liability protection. This combination of ease and legal safeguards makes Domestic LLCs an excellent option for non-residents, eCommerce founders, and small businesses that plan to operate within one state.

Whether you’re launching an online store or opening a local shop, forming a Domestic LLC ensures that you can protect your personal finances while keeping your business operations straightforward. Additionally, Domestic LLCs are ideal for businesses that want to avoid the complexities of managing a corporation while still enjoying tax benefits and liability protection.

Keep in mind that a Domestic LLC only applies within the borders of the state where it is registered. If you plan to expand your business across state lines, you may need to register as a foreign LLC in those states. For more details, visit official resources like www.sos.state.il.gov.

FAQs About Domestic LLCs

Q1: What is a Domestic LLC company?

A: A Domestic LLC company is a business entity formed and operating within the same state where it was originally registered. It offers liability protection for its members and is simpler to manage than a corporation.

Q2: What does “domestic limited liability company” mean?

A: It refers to a business structure that operates within its state of registration, providing members with liability protection and pass-through taxation benefits.

Q3: How is a Domestic LLC different from a corporation?

A: While both offer liability protection, a Domestic LLC has a simpler management structure and avoids double taxation, unlike corporations that require more formalities and have stricter tax regulations.

Q4: Can a Domestic LLC have only one member?

A: Yes, a Domestic LLC can be a single-member LLC. This makes it an ideal choice for sole proprietors who want liability protection without the complexities of a corporation.

Q5: What documents are required to form a Domestic LLC?

A: Typically, you need to file Articles of Organization with your state’s Secretary of State and pay the required filing fees. Additional documents, such as an operating agreement, may also be necessary depending on your state.

At Clemta, we simplify the process of forming a Domestic LLC, helping non-residents, startups, and eCommerce founders achieve their business goals in the United States. From obtaining your EIN (Employer Identification Number) to filing state and federal taxes, we’re here to make your business journey stress-free.

Start your Domestic LLC formation today with Clemta!