LLC Structure & Registered Agent: What You Need to Know

Starting or running a business in the United States as a non-resident founder or eCommerce startup can seem overwhelming. Choosing the right LLC structure (Limited Liability Company) and the right registered agent is crucial to ensuring legal compliance and operational success.

An LLC offers flexibility in management, tax benefits, and liability protection for business owners, making it a preferred choice for startups and international founders alike. Additionally, it provides a simple and scalable structure, which is particularly beneficial for businesses that anticipate growth or diversification.

A registered agent, on the other hand, is a designated individual or entity responsible for receiving legal and official documents (like tax notices or lawsuits) on your company’s behalf. With Clemta, this process is streamlined—we provide expert guidance, so you don’t have to worry about compliance challenges. For more information on state-specific requirements, you can visit www.sos.state.texas.gov.

Parent Subsidiary LLC Structure: What Is It and Why It Matters

If you manage multiple ventures or branches of your business, structuring them under a parent-subsidiary LLC structure can maximize operational efficiency. This structure is particularly useful for businesses looking to separate different lines of operations or mitigate risks across various ventures.

A parent LLC oversees subsidiaries (child LLCs), which are independent business entities owned by the parent company. This structure ensures better liability protection and allows you to separate business operations or focus on different markets. For example, an eCommerce founder with distinct product niches can create separate subsidiaries for each via a parent-subsidiary LLC structure, consolidating ownership while minimizing risk.

Our team at Clemta can guide you step-by-step in structuring your business this way for tax efficiency and legal clarity. Additionally, you can review state-specific guidelines for forming LLCs at www.sos.state.california.gov.

Registered Agent vs Virtual Address: What’s the Difference?

Many founders confuse a registered agent with a virtual address. While both play a role in maintaining your business’s legitimacy, they serve different purposes and are often required for different reasons. Understanding the distinction is essential to avoid compliance issues.

A registered agent is required by law in each state where you operate. Their role is to handle official documents (e.g., lawsuits, certificates, or legal notices). A virtual address, however, functions as a mailing address for your business, which can make your company appear more professional or establish a presence in a specific state.

At Clemta, we provide both registered agent services and assistance with setting up reliable virtual addresses, allowing non-residents to establish U.S. companies with ease. To ensure compliance with your state’s regulations, you can also visit www.sos.state.florida.gov.

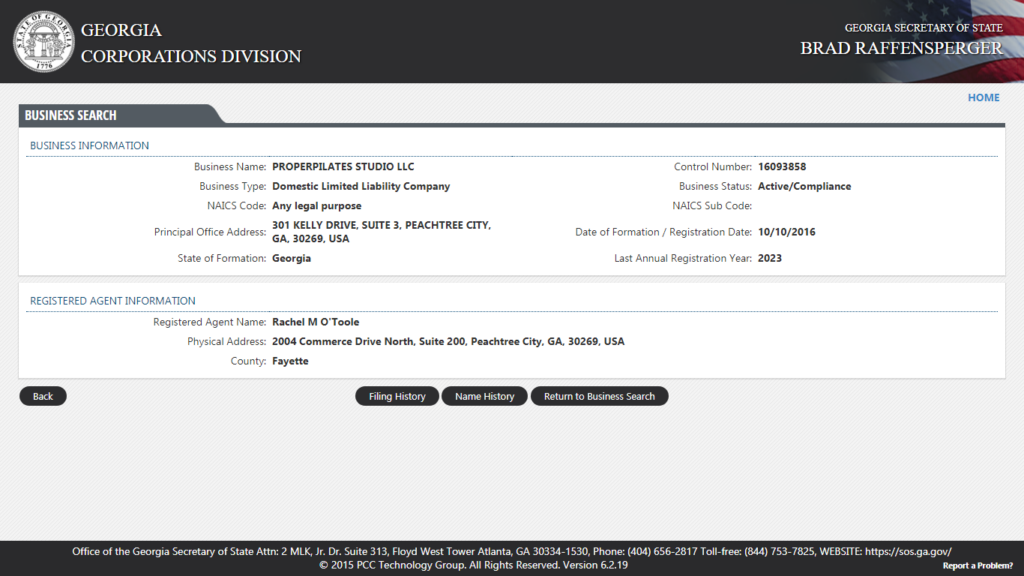

How to Create a Subsidiary LLC

Creating a subsidiary LLC under your existing LLC can seem daunting without the right guidance. However, with the right steps and assistance, the process can be straightforward and efficient. You’ll need to:

- Ensure your current LLC (the parent) is in good standing.

- File the appropriate documents with the Secretary of State where the subsidiary will operate.

- Obtain an EIN (Employer Identification Number) for the subsidiary.

For most non-residents or startups, this process is simplified when working with a service provider like Clemta, who can handle your EIN application, post-incorporation filing, and certificate of good standing. For more details, check out your state’s filing requirements at www.sos.state.newyork.gov.

How to Create a Subsidiary Under My LLC

If you already own an LLC and want to scale your operations or diversify your services, creating a subsidiary under your LLC is an excellent move. This strategy allows you to separate liabilities, enhance risk management, and organize your operations efficiently.

This involves:

- Drafting an Operating Agreement outlining the parent-subsidiary relationship.

- Filing an Amendment to Articles of Organization if needed.

- Submitting necessary state and federal filings for compliance.

Whether you’re expanding into a new market or separating business functions, Clemta simplifies the process by handling the technical details while you focus on growth. For further guidance, you can also reference your state’s LLC guidelines at www.sos.state.georgia.gov.

FAQ Section

Q: What is the main purpose of an LLC structure?

A: The LLC structure provides flexibility in business operations, tax benefits, and liability protection for founders and business owners. It is particularly popular among startups and non-resident founders due to its ease of management and scalability.

Q: What are the benefits of creating a parent-subsidiary LLC structure?

A: It separates liabilities, improves risk management, and allows operational independence for each subsidiary while maintaining ownership under one parent LLC. This structure is ideal for businesses with multiple ventures or product lines.

Q: What is the difference between a registered agent and a virtual address?

A: A registered agent handles legal documents and official correspondence for your business, while a virtual address assists with establishing a business presence. Both are essential for maintaining compliance and professionalism.

Q: Can I create a subsidiary under my existing LLC as a non-resident?

A: Yes, non-residents can create a subsidiary LLC with proper legal filings. Clemta specializes in assisting non-residents with this process, ensuring compliance with state and federal regulations.

Q: How does Clemta assist with creating an LLC in the U.S.?

A: Clemta provides end-to-end services, including company formation, EIN applications, tax filings, and assistance with registered agents to simplify the process for eCommerce startups and international founders.

Q: Why should I file for a certificate of good standing?

A: A certificate of good standing confirms that your LLC complies with state regulations, which is often required for bank accounts, contracts, or expanding your business. It is a critical document for maintaining credibility and operational legitimacy.

For more information, visit app.clemta.com.