Florida, with its vibrant economy and appealing business climate, is a popular choice for entrepreneurs looking to establish a Limited Liability Company (LLC). Whether you’re a seasoned business owner or just starting out, understanding the steps involved in forming an LLC in Florida is crucial. This guide will walk you through the process, ensuring a smooth and compliant setup.

Why Choose Florida for Your LLC?

Florida offers several compelling advantages for businesses, making it an attractive destination for entrepreneurs:

- No State Income Tax: Similar to Texas, Florida boasts no state income tax, allowing you to retain more of your profits.

- Business-Friendly Environment: Florida’s government is generally supportive of small businesses, creating a favorable ecosystem for growth.

- Access to a Large Market: With a large and diverse population, Florida offers access to a significant consumer market.

- Tourism Benefits Florida’s robust tourism sector helps drive new business for new businesses.

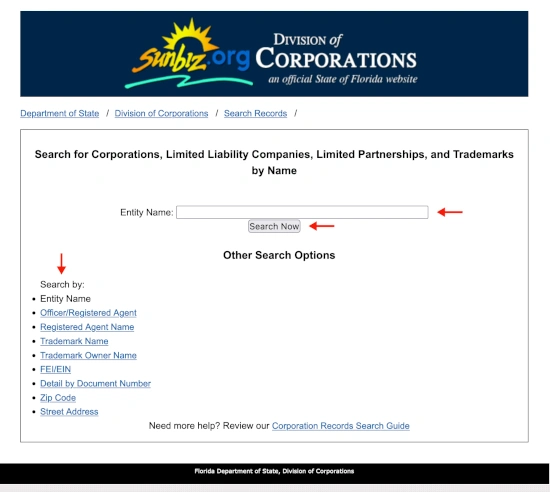

Step 1: Selecting a Business Name

Choosing the right name is crucial to starting an LLC.

Your name must adhere to these Florida rules:

- Naming Conventions: Your LLC name must end with “LLC,” “L.L.C.,” “Limited Liability Company,” or “Limited Company.”

- Uniqueness is key Your name can not be too similar to another business in Florida’s existing records.

- Search the Florida Division of Corporations database: Search for existing businesses, you can visit the Florida Division of Corporations’ website to ensure your desired name is available.

Step 2: Designate a Registered Agent

Your Florida LLC needs a registered agent, an individual or business that recieves legal docs on your behalf.

Requirements:

- Physical Location in Florida: A registered agent must have a physical street address in Florida (a P.O. Box is not sufficient).

- Availability During Business Hours: The registered agent must be available at the designated address during normal business hours.

Benefits of using a registered agent.

- Reliable service: The registered agent will ensure all important legal notices are delivered.

- Privacy: You can keep your private address off public records.

- Focus: Let a professional handle legal mail so you can concentrate on managing your business.

Step 3: File Articles of Organization

This is the legal document that formally establishes your LLC with the state of Florida.

What is included:

- LLC Name and Address

- Registered Agent Information

- Management details

- The filing fee: As of 2024, the filing fee is typically around $125, but it’s crucial to verify the current fee on the Florida Department of State’s website.

Step 4: Create an Operating Agreement

While not legally required in Florida, an operating agreement is highly recommended. This document outlines the ownership structure, member responsibilities, profit and loss allocation, and procedures for handling disputes.

Benefits

- Clarity: Prevents misunderstandings by clearly defining the roles of business partners.

- Credibility: Adds credibility with stakeholders, like banks and suppliers.

- Customization: Lets you tailor rules to fit your particular business needs.

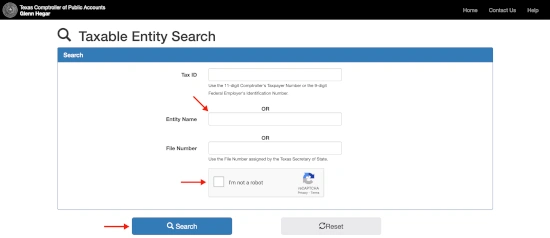

Step 5: Obtain an EIN (Employer Identification Number)

If your LLC has more than one member, or if you plan to hire employees, you’ll need an EIN from the IRS. This number is used for tax purposes.

To get an EIN:

- Apply Online: It’s free to apply for an EIN on the IRS website.

Step 6: Open a Business Bank Account

Opening a separate bank account for your LLC is essential for managing finances and maintaining liability protection.

Documents generally needed:

- EIN

- Articles of Organization

- Operating Agreement

- Valid Photo ID

Benefits of having a business bank account.

- Liability protection

- Tax prep

- Financial tracking

Step 7: Obtain Licenses and Permits

Depending on the nature of your business and its location, you may need specific licenses and permits to operate legally in Florida.

- Check State and Local Requirements: Consult the Florida Department of Business and Professional Regulation and your local county and city governments to determine which licenses and permits are required for your business.

Final Thoughts

Forming an LLC in Florida is a straightforward process that can provide significant benefits for your business. By following these steps carefully and consulting with legal and financial professionals when needed, you can set your Florida LLC up for success