Transferring an LLC: What You Need to Know

If you’re considering transferring an LLC, you might be facing questions related to ownership, location, or restructuring. Whether you’re exploring how to transfer an LLC to a family member, moving an LLC from one state to another, or simply wondering, “can you transfer an LLC to another state?”—this guide covers everything you need to know. Let’s break it down step by step.

How to Transfer an LLC to a Family Member

Transferring LLC ownership to a family member is a straightforward process but does require legal precision. In most cases, this involves executing an LLC Transfer of Ownership Form, which ensures the rights and responsibilities are properly transferred. Before proceeding:

- Check your Operating Agreement to ensure ownership transfers are allowed.

- Consult with a legal advisor to handle state and federal documentation smoothly.

- Notify the appropriate state authorities to update ownership records.

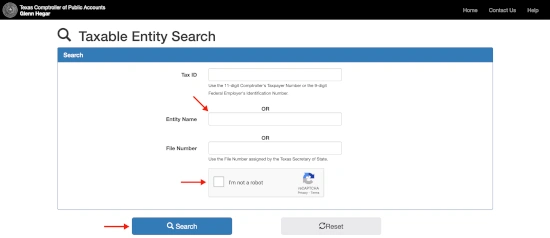

This type of transfer is especially common in family-run businesses, but it applies across LLCs of all sizes. It’s important to ensure all legal steps are followed to avoid future disputes. For more guidance, visit your state’s business resources at www.sos.state.tx.gov.

Can You Transfer an LLC to Another State?

Yes, you can transfer your LLC to another state, but the process requires careful handling. Have you been asking:

- “How to transfer LLC from one state to another?”

- “Can I change my LLC to another state?”

These are valid concerns for business owners expanding or relocating to new territories. You have two primary options:

- Domestication: This involves formally moving your LLC into a new state while legally retaining its identity.

- Dissolution and Reformation: Alternatively, you can dissolve your old LLC in your current state and form a new one in your desired state.

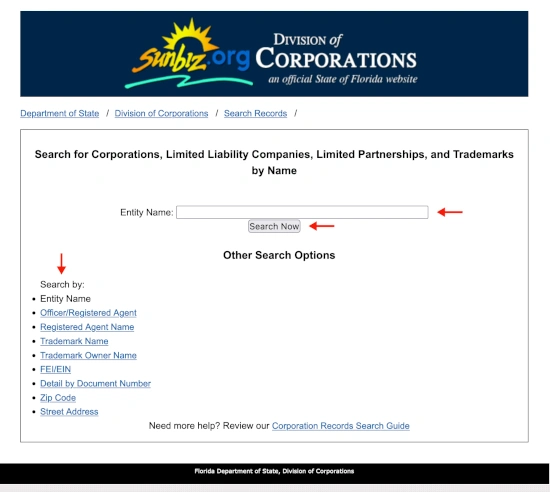

Domestication is often the preferred choice because it protects your LLC’s EIN, bank accounts, and contracts. However, you’ll need to register with the Secretary of State and adhere to any state-specific compliance rules. For example, check out the requirements for domestication at www.sos.state.fl.gov.

Moving an LLC from One State to Another

If you’re considering moving an LLC to a different state, ensure you review the business environment in the new location. Here’s a quick checklist:

- Obtain a Certificate of Good Standing from your current state.

- File a Foreign Qualification in the new state (if maintaining operations in the original location).

- Pay any state-mandated taxes during the transfer process.

Additionally, research the new state’s tax climate, business incentives, and regulations to ensure a smooth transition. For clarity, always double-check state filing requirements to avoid business disruption. For detailed information, refer to www.sos.state.ny.gov.

LLC Ownership Transfers: What to Expect

Changing LLC ownership, whether to another person or entity, requires precise documentation and legal oversight. Here’s how it works:

- Review your LLC’s Operating Agreement. This will outline the transfer procedures.

- Use the appropriate Transfer of Ownership Form.

- Notify the state where the LLC is registered to adjust ownership records.

Ownership transfers can range from simple internal agreements to complex arrangements, especially if external investors are involved. It’s essential to keep all parties informed and ensure compliance with state regulations. For more details, visit www.sos.state.ca.gov.

Should I Put LLC in My Business Name?

Many entrepreneurs wonder if adding “LLC” to their business name is essential. The short answer is yes—it’s legally required and signals your company’s limited liability status to customers and stakeholders. However, if you decide to change the business name alongside moving your LLC to another state, make sure to file the proper Amendment to Articles of Organization.

Additionally, having “LLC” in your business name can enhance credibility and transparency with clients and partners. Always verify naming requirements with your state’s business registry. For example, see the guidelines at www.sos.state.ga.gov.

FAQ: Transferring an LLC

Q1: How do I start transferring my LLC to another state?

A: Begin by checking if the new state allows domestication. If not, prepare for dissolution in your current state and formation of a new LLC in the target state.

Q2: Can you move an LLC to a different state quickly?

A: Some states expedite LLC domestication or formation, but the process usually takes several weeks due to filing and state approvals.

Q3: Do I need to inform the IRS when transferring an LLC to another state?

A: It depends. If you’re domesticating the LLC, you likely won’t need a new EIN. However, dissolution and reformation require notifying the IRS and obtaining a new EIN.

Q4: Is transferring LLC ownership internal only?

A: Typically yes, but external stakeholders such as investors or partners must be formally informed.

Q5: Can you operate in both states during an LLC move?

A: Yes, through Foreign Qualification, you can operate in both states during or after the move.

In conclusion, transferring an LLC—whether it’s ownership changes, state relocations, or operational adjustments—can be seamless with the right steps. For fast, reliable assistance, Clemta provides solutions ranging from Post-Incorporation Services to handling the legal paperwork for LLC transfers. Let us guide you in restructuring your business where it matters most.

Ready to transfer your LLC? Contact us today to simplify the process!