File Your Annual Reports & Pay State Taxes Easily

Why Choose Clemta for State Tax Filings?

Our team understands the complexities of all state-level regulations, ensuring compliance and taking advantage of local deductions and credits. With Clemta, you receive a tailored service committed to your business’ success and compliance with state laws.

Remote Filing

Filing your annual report is super easy with just a simple form.

Trusted Partner

Make an informed choice from a range of reputable tax professionals.

Tailored Support

Get personalized assistance for a successful state filing for non-US residents.

Ensuring Compliance

It is essential to file annual reports on time to maintain accurate financial records and avoid penalties.

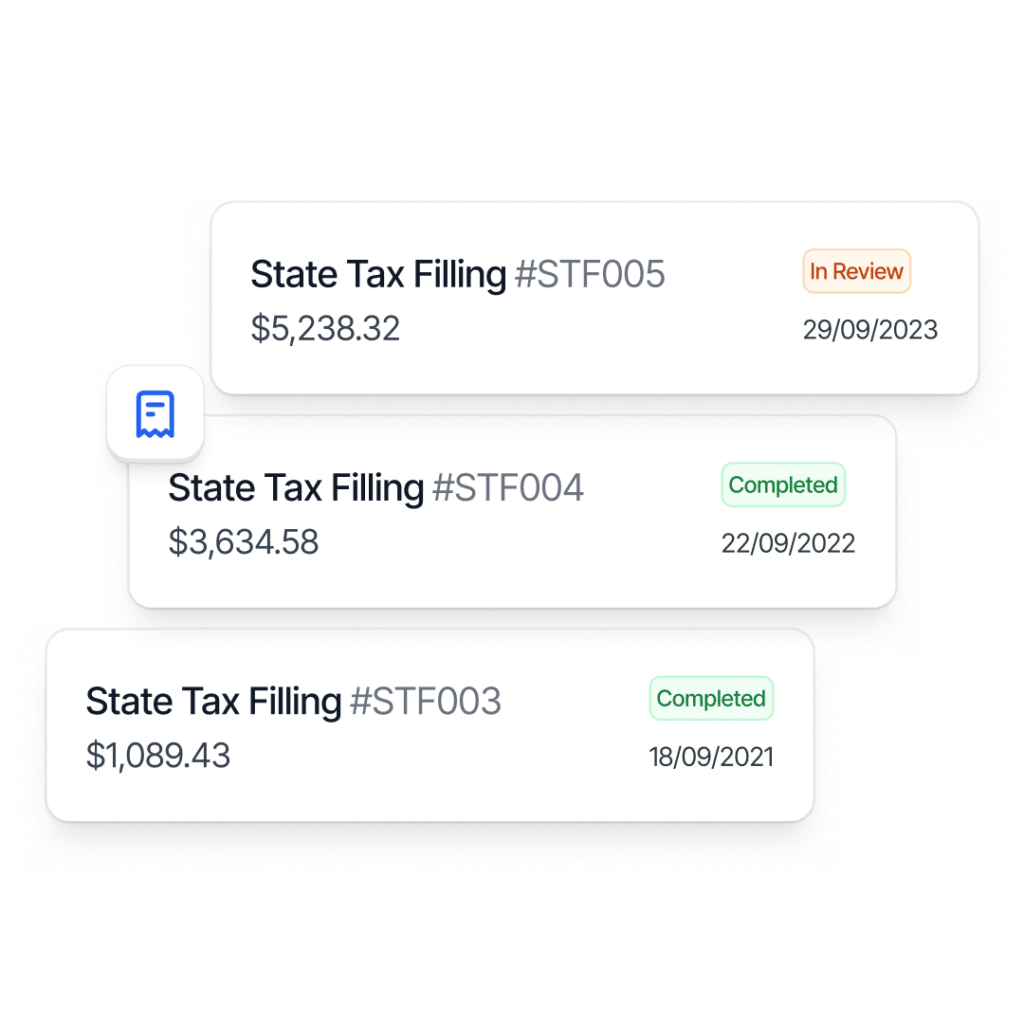

State Filings Made Easy for You

Our assistance extends throughout the year, not just during tax seasons. We provide ongoing support and are always available to answer your questions regarding annual reports and state taxes.

The Process Explained

With a team of committed experts, we ensure that tax filing will be a stress-free experience. We handle all the complicated paperwork, while you focus on your business.

Review your information

Fill the form

Submit the reports

Clemta assists you with filing annual reports with the state before the deadline.

Monitor progress

We’ll keep you informed of the filing status and share the confirmation letter when the process is completed.

Learn All the Essentials

We gathered all commonly asked questions regarding the annual report and state tax filing process below.

What is the annual report, and why is it important?

Annual reports are official filings submitted to the state agencies, detailing your company’s activities, financial status, and changes in the governance structure. They are essential for maintaining good standing with the state, ensuring legal compliance, and keeping your business information up to date.

I filed my federal tax return for the previous year. Do I still need to file a separate tax return with the state?

What is the deadline for filing annual reports?

The deadline for submitting reports and tax returns differs from state to state, and sometimes even by business type. For instance, the deadline to submit annual reports in Delaware is March 1 for C-Corps and June 1 for LLCs. On the other hand, Wyoming annual reports are due on the first day of the anniversary month of formation.

It’s important to check the specific deadlines for each state where your business operates to avoid any potential issues or sanctions.

What happens if I fail to file an annual report or state tax return on time?

States impose various penalties, fines, and interest charges in case of late or missed filings. In some cases, it may also lead to the loss of good standing with the state, and even administrative dissolution of your company. Therefore, filing annual reports on time is always important to keep your business operating and in good standing.