Introduction

Forming a company in the United States presents a lucrative opportunity for entrepreneurs worldwide, especially for those seeking rapid growth and global market reach. However, navigating the complexities of company formation can be challenging, particularly for non-US residents. The United States boasts a sophisticated legal and business environment that requires strategic planning and careful execution. To help you succeed in this endeavor and avoid unnecessary pitfalls, here’s a guide to common mistakes to avoid when forming a company in the USA.

Choosing the Wrong Business Structure

One of the first and most critical decisions you’ll need to make when forming a company in the USA is selecting an appropriate business structure. Whether you’re considering a corporation, limited liability company (LLC), partnership, or sole proprietorship, each has distinct legal, tax, and operational implications. Many non-residents hastily choose the most popular option without considering factors such as liability protection, taxation, and administrative requirements. For instance, while an LLC might offer flexibility and limited liability, a corporation could provide better opportunities for raising capital. Each structure also has different implications for how profits are taxed and how much paperwork you’ll need to handle. It’s crucial to align your choice with your business goals, the level of control you wish to maintain, and future growth plans. Therefore, consulting a legal expert to determine the best structure for your business needs and long-term goals is advisable. This decision will lay the foundation for your business operations and can significantly impact your success.

Overlooking State-Specific Regulations

The USA is a federal republic, meaning each state has its own set of rules and regulations for company formation. Choosing a state with beneficial regulations for your business type can save you money and operational headaches. States like Delaware, Nevada, and Wyoming are often touted for their business-friendly environments, but they may not be the best fit for every business. For example, Delaware is popular for its flexible corporate laws and well-established court system for business disputes, but it might not offer tax advantages if your business operates primarily in another state. Understand the pros and cons of each state’s regulations, and consider factors such as tax rates, required documentation, and ongoing compliance needs. Researching state-specific incentives, such as tax credits or grants, can also provide financial benefits. Making an informed choice about where to incorporate can influence your business’s tax obligations, legal protections, and overall ease of operation.

Inadequate Name Search and Trademark Considerations

Choosing a unique and legally available name for your company is vital. Many business owners neglect the importance of conducting a thorough name search to ensure the name isn’t already in use or trademarked. Failing to do so can result in legal disputes or forced rebranding, which can be costly and damaging to your brand identity. Use the US Patent and Trademark Office’s database to conduct a comprehensive check and secure your business name legally through proper registration. Additionally, consider the potential for future expansion and ensure the name is adaptable to different markets or product lines. Protecting your brand through trademark registration not only safeguards your business identity but also enhances your credibility and value in the marketplace.

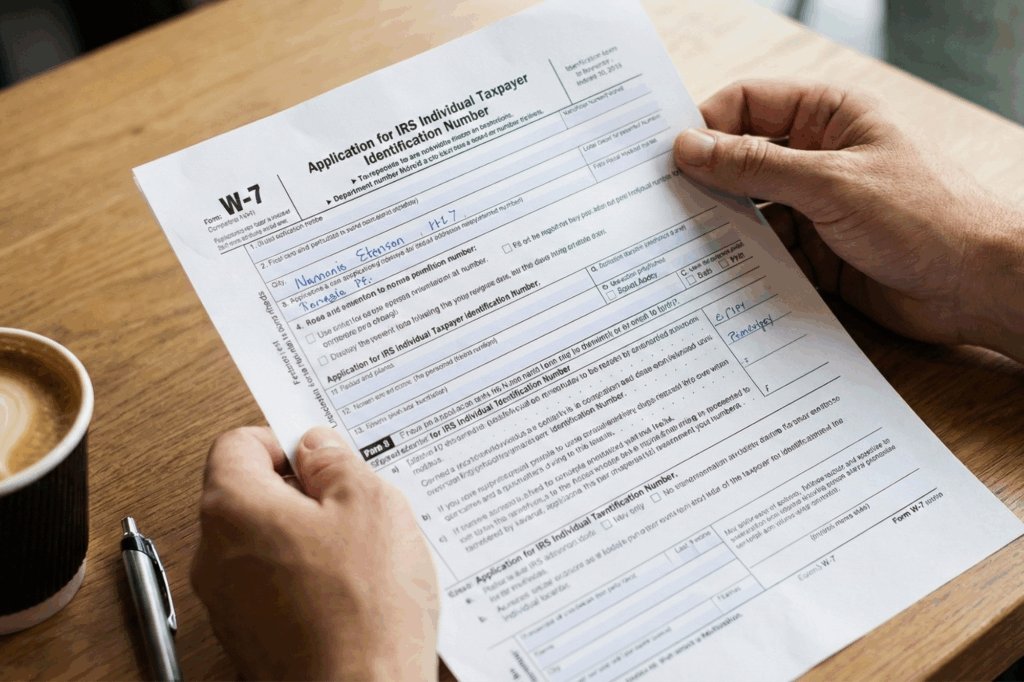

Neglecting Taxation Responsibilities

Understanding your tax obligations is crucial in the USA’s complex tax landscape. Common tax-related mistakes include overlooking nexus laws, misunderstanding sales or franchise tax requirements, and failing to obtain an Employer Identification Number (EIN) from the IRS. These oversights can lead to financial penalties and compliance issues, which can be detrimental to your business’s financial health and reputation. Consider consulting with a tax professional who is familiar with international business operations or utilizing a SaaS platform to manage bookkeeping, accounting, and tax filing responsibilities effectively. Staying informed about changes in tax legislation and maintaining accurate financial records can help you avoid unnecessary fines and focus on growing your business.

Failing to Open a US Bank Account

For non-residents, establishing a US bank account can be a daunting yet crucial step in forming a company. It’s essential for managing transactions, maintaining financial transparency, and enhancing credibility with US clients and vendors. Without a US bank account, you may face challenges with payment processing, currency conversion fees, and establishing trust with partners. Ensure you understand the requirements and navigate the relevant procedures, which may include a US address, EIN, and sometimes a personal visit to the bank. Some banks offer remote account opening services for international clients, which can simplify the process. Having a US bank account can streamline your financial operations and provide easier access to credit and capital.

Underestimating the Importance of an Operating Agreement

Even though many states do not require an operating agreement for LLCs, it is advisable for business owners to draft one. An operating agreement outlines the operational framework and ownership structure, helping to prevent potential conflicts among partners. It defines roles, responsibilities, and procedures for decision-making, which can reduce misunderstandings and disputes. An operating agreement also strengthens your business’s legal standing and is critical when pursuing investors or loans. It demonstrates professionalism and foresight, reassuring stakeholders of the stability and organization of your business. Even for single-member LLCs, having a written agreement can clarify personal and business finances, protecting your personal assets and interests.

Not Seeking Professional Guidance

Attempting a DIY approach can save upfront costs but may lead to costly mistakes in the long run. Partner with experienced professionals who specialize in US company formation, bookkeeping, tax filing, and legal compliance to ensure a smooth process and operational longevity. Services like Clemta provide valuable resources and support, aiding non-resident entrepreneurs in achieving a seamless transition to the US business environment.

Conclusion

Forming a company in the USA is an exciting venture that opens up vast opportunities for growth and expansion. By understanding and avoiding these common mistakes, you can establish a solid foundation for success in the highly competitive US market. Stay informed and explore reliable resources, such as Clemta, to guide you through each step of the process. With meticulous planning and a proactive approach, your dream of establishing an American business can become a thriving reality.