Beneficial ownership information report (“BOIR”) filing has been a debated topic since the Corporate Transparency Act was passed by Congress in 2021. This law requires reporting beneficial ownership info to prevent bad actors from hiding their ill-gotten gains through shell companies or other unclear ownership structures.

However, the filing procedure and the timeline to file have recently been announced. The BOIR filing carries significant importance for both existing companies and companies to be formed following January 1, 2024.

What is Beneficial Ownership Information Report(BOIR) Filing

BOIR filing encompasses important details about individuals with direct or indirect ownership or control over a company. This requirement ensures that reporting companies file beneficial ownership information with the Financial Crimes Enforcement Network (“FinCEN”). This provides transparency by disclosing details about individuals with direct or indirect influence over the company’s ownership and control. This regulatory measure is designed to enhance accountability and promote a comprehensive understanding of the ownership landscape within businesses.

When to File?

The deadline to file the BOI report depends on when the reporting companies are incorporated or registered in the US:

a) If the company is filed or registered in the US before January 1, 2024, then it should file the BOI report by January 1, 2025;

b) If the company is formed or registered in the US on or after January 1, 2024, then it must submit the BOI report within 90 days of receiving the registration document; and

c) If the company is formed or registered in the US on or after January 1, 2025, then it must submit the BOI report within 30 days of receiving the registration document.

BOIR filing aims to provide transparent information regarding the company ownership and control structure. If the reporting companies miss the deadline, they may face hefty fines up to $10,000 or even jail time up to 24 months.

| As an example, – If you have a start-up established on February 2023, you must submit the initial BOI report until January 1, 2025; and– If you have a start-up established on February 1, 2024, then you must submit the initial BOI report until May 1, 2024. |

Reporting Companies

Not all companies are required to file the BOI report with the FinCEN. The companies subject to this obligation are called reporting companies, which are divided into two main categories:

a) Domestic Reporting Companies

Includes corporations, limited liability companies, and various entities created by filing documents with a secretary of state or a similar US office.

b) Foreign Reporting Companies

They are entities, like corporations and limited liability companies, formed under foreign country laws but have opted to register for business activities in the US by filing documents with a secretary of state or a similar office.

Certain companies enjoy exemptions from the BOI reporting requirements. There are 23 types of entities that are exempt from the reporting requirements, including governmental entities, some publicly traded companies, many nonprofits, and certain large operating companies (such as banks). Sole entrepreneurs are also out of the scope of this filing requirement unless they file a document with a secretary of state or similar office.

Beneficial Owner

In the context of reporting companies, a beneficial owner is an individual who either directly or indirectly holds significant influence over the company. An individual can be considered as a beneficial owner if;

a) the individual owns or controls a minimum of 25% of the reporting company’s ownership interests (equity, voting rights, options, convertible instruments, etc.) or

b) the individual exercises substantial control. The individual exercises substantial control in the given cases;

- (i) The individual is a senior officer (e.g., CEO, COO, President)

- (ii) The individual has the authority to appoint or remove certain officers or a majority of directors of the reporting company.

- (iii) The individual is an important decision-maker for the business, finance, or structure of the reporting company.

Which Information to Report with BOI?

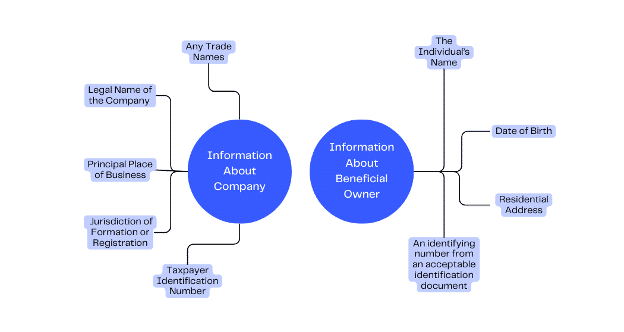

The BOIR must include information regarding both the reporting company and the beneficial owners. A reporting company is obligated to submit several key details like its legal name, any trade names it operates under (DBA), and the current street address of its principal place of business in the United States. For foreign reporting companies, this would be the address from which business is conducted in the United States. Additionally, the company must disclose its jurisdiction of formation or registration, along with its taxpayer identification number.

The BOIR should include information regarding beneficial owners and company applicants[1] (who file the BOI report) which are the individual’s name, date of birth, residential address, and an identifying number derived from an acceptable identification document[2] (the reporting company must provide an image of the identification document used to obtain the identifying number).

Penalties

The reporting companies must file the BOI report until the deadline is provided. However, if the company corrects any mistakes or omissions within 90 days of the original report deadline, it may avoid penalties. Companies, senior officers, beneficial owners, or company applicants who deliberately provide false information, neglect to report, or cause the company not to file the BOI report by the deadline may incur civil penalties amounting to $500 per day until the violation is addressed. Additionally, they could face fines of up to 10,000 USD and/or imprisonment for a period of up to 2 years.

How Clemta Can Help

Seeking a customer centric and tech minded approach to managing the BOIR filing? Clemta’s assistance starts with assessing where to register, drafting the BOI report, and filing it with the FinCEN.

By choosing Clemta, you can be assured of accurate BOI report filing while avoiding the immense penalties. This will allow you to focus on what you do best: running your business.

FAQ (Frequently Asked Questions)

1. What is the BOIR filing requirement?

Beneficial ownership information requirement refers to the requirement of reporting companies to notify FinCEN regarding identifying information about the individuals who directly or indirectly own or control a company.

2. Is my company required to file BOIR?

YES, if the company is;

a) A domestic reporting company which is incorporated in the US; or

b) A foreign reporting company which is not incorporated in the US but is registered to do business in the United States

NO, if the company is an exempt entity, you may access the list here.

3. Who is the beneficial owner?

A beneficial owner is an individual who either directly or indirectly:

a) exercises substantial control over the reporting company, or

b) owns or controls at least 25% of the reporting company’s ownership interests.

4. What are important decisions?

Decisions regarding a reporting company’s business, financial matters, and organizational framework are crucial. Someone who guides, makes, or significantly impacts these pivotal decisions wields substantial control over the reporting company.

5. When should I file BOIR?

There are three possible scenarios. If the reporting company;

a) established before 2024, you have to file the initial BOIR until January 1, 2025;

b) established on or after January 1, 2024, you have to file the initial BOIR in 90 days; and

c) established on or after January 1, 2025, you have to file the initial BOIR in 30 days.

6. What happens if I do not file BOIR in time?

Please keep in mind there are severe penalties for failing to file the BOI report on time or providing inaccurate information;

a) Up to 2 years of jail time;

b) $500 per day until the violation is addressed; or

c) $10,000 fine.

7. What is a FinCEN identifier?

It’s a unique identifier issued by FinCEN for individuals and reporting companies to simplify future BOI reports. It’s not compulsory and can be issued for once.

8. What if the company or beneficial owner information changes?

You should update your BOI report within 30 days of any changes. Please note that you are not required to file an updated report for any changes to a company applicant.

If there is any change or inaccuracy in the information filed, individuals and reporting companies must report that no later than 30 days after the change occurred, or the individual/company became aware of such inaccuracy or had reason to know of it.

| As an example, you need to update the BOI report in case of:– Any changes made to the information reported for the company, including registering a new business address;– Any change in beneficial ownership occurs, like when a new CEO is appointed, or when a sale changes the ownership interest threshold of 25%; or– Any change to a beneficial owner’s name, address, or unique identifying number previously provided to FinCEN. |

9. What forms of identification are considered acceptable to fulfill the reporting requirement?

The only acceptable identification forms include the following:

· A non-expired US driver’s license (including those issued by a commonwealth, territory, or possession of the United States);

· A non-expired identification document issued by a US state or local government or Indian Tribe;

· A non-expired passport issued by the US government; or

· A non-expired passport issued by a foreign government (only applicable if the individual lacks one of the three aforementioned forms of identification).

10. Should the reporting company file the BOI report annually?

No, they are not required to! Reporting companies must file an initial BOI report and updated or corrected BOI reports, when needed.

11. Did I fulfill FinCEN’s BOI reporting obligation if I submitted beneficial ownership information to a state office, financial institution, or the IRS?

No, companies are required to report beneficial ownership information directly to FinCEN. While state or local governments, financial institutions, and other federal agencies, such as the IRS, may also require entities to report certain beneficial ownership information, those requirements do not replace the obligation to report to FinCEN.

12. Can a parent company file a single BOI report on behalf of its group of companies?

No, all reporting companies must file their own BOI report.

13. Should the initial BOI report include historical beneficial owners of a reporting company, or only the existing beneficial owners?

An initial BOI report must only include beneficial owners at the time of filing. Reporting companies must file updated reports with FinCEN to reflect changes to beneficial owners.

14. What evidence will a reporting company receive to confirm the successful filing of its BOI report?

The BOIR e-filing option will be available from January 1, 2024, and it will acknowledge submission’s success or failure. If you work with us, we will share the acknowledgment copy right after submitting the BOI report.

[1] It’s only required for companies created or registered on or after January 1, 2024.

[2] Acceptable identification document is only one of the non-expired US driver license, US identification document, or passport issued by the US or foreign government.