Understanding Form 1120: Corporate Income Tax Return for US C Corporations

Form 1120 is the official IRS tax return for US C Corporations. Whether you generated massive revenue or operated at a loss, understanding this form is your first step to corporate tax compliance. We break down the essentials.

How to Get a US Tax ID Number: EIN vs. ITIN Explained for Non-Residents

If you are a foreign founder, you likely need both an EIN and an ITIN eventually. However, getting them requires two completely different application processes. Here is your technical directive on which one to tackle first.

ITIN Application Guide: How to Apply for an Individual Taxpayer Identification Number

Applying for an ITIN is not a standalone process. You generally must file it alongside your annual tax return. Here is a helpful guide on how to get your number without getting rejected.

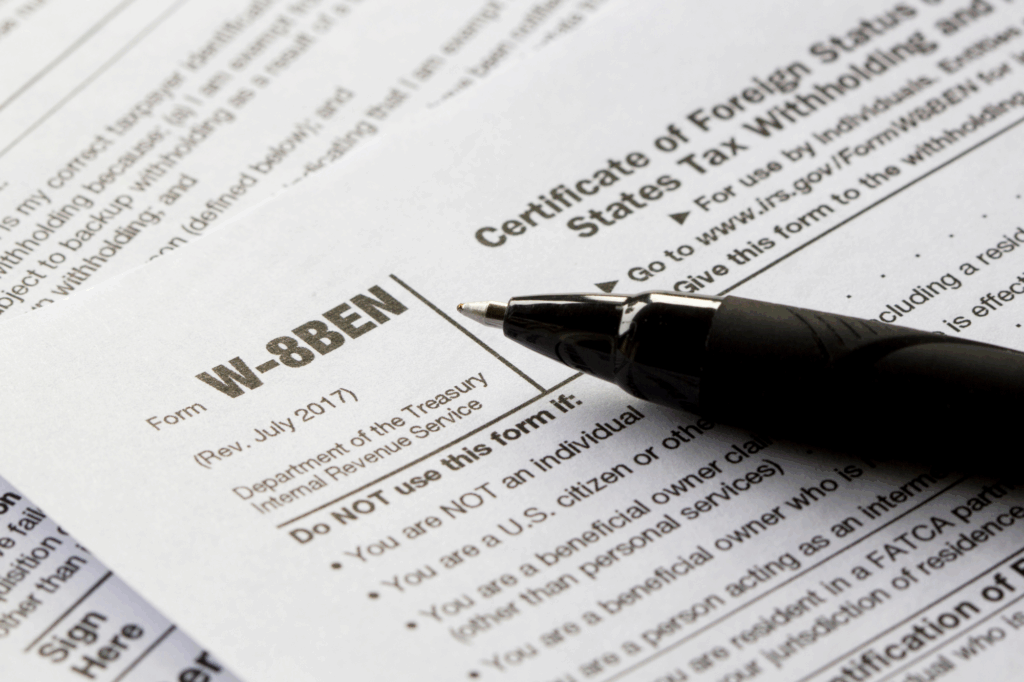

W-8 Form Explained: The Difference Between W-8BEN and W-8BEN-E

If you are a non-US freelancer or business receiving payments from the US, the W-8 form is not optional. It’s essential to avoid an automatic 30% tax withholding. This guide demystifies the complex IRS landscape and clarifies the critical differences between W-8BEN for individuals and W-8BEN-E for entities.

Guide to Form 1099-NEC: Who Files, Deadlines & The 1099-K Rule

The IRS has shifted how businesses report non-employee compensation. From the critical differences between the 1099-NEC and 1099-MISC to the “Double Reporting” dangers of the 1099-K, here is everything you need to know to navigate tax season without penalties.

How to File Your US Company Annual Report on Time: A Guide for International Founders

Filing your annual report is not just a bureaucratic formality—it’s a critical requirement for maintaining your business’s legal standing in the U.S. This document updates state authorities on essential details like your registered agent’s information, business address, and leadership structure. For international entrepreneurs, compliance demonstrates professionalism and commitment to U.S.

Do ITIN Holders Need to File Individual Tax Returns (1040)?

The Individual Taxpayer Identification Number (ITIN) is a tax-processing number issued by the IRS for individuals who are not eligible for a Social Security Number (SSN). Whether ITIN holders need to file taxes depends on factors such as US-sourced income, residency status, and eligibility for tax credits or deductions. Generally, ITIN holders with US income or those claiming tax benefits must file a tax return using either Form 1040 or 1040-NR, depending on their tax residency status. Understanding your obligations ensures compliance and helps avoid penalties.

Final Estimated Tax Payment Deadline 2025: Avoid Penalties with Clemta

The final estimated tax payment deadline for 2025 is crucial for non-resident entrepreneurs and US-based business owners to avoid penalties and stay IRS-compliant. Missing this January 15 deadline can result in underpayment penalties, accrued interest, and delayed refunds.

Use Tax vs. Sales Tax: Key Insights for Ecommerce Success in 2025

Sales tax is a consumption tax imposed by the government on the sale of goods and services. In the US, sales tax is typically levied at the state, county, and municipal levels, with rates and regulations varying widely across jurisdictions. The seller is responsible for collecting sales tax from customers at the point of sale, which is subsequently remitted to the government.

Maximizing Sales Tax Nexus Compliance for Your Online Store

Navigating the complexities of sales tax nexus laws is crucial for the success of your ecommerce business, especially if you’re a non-US resident entering the US market. This blog post delves into the importance of understanding sales tax nexus, the potential penalties for non-compliance, and strategies to ensure your business meets its obligations.