Why You Should Consider Moving Your LLC to Texas

Relocating a business is far more than just a logistical exercise involving movers and paperwork—it’s a pivotal business decision that can affect your company on multiple levels. From tax implications to legal compliance, your LLC’s move requires thoughtful planning and strategic execution. Relocation typically involves either expanding the business into a new state via foreign qualification or completely transferring the business’s underlying structure through a legal process known as domestication. A deeper understanding of these approaches ensures your move to Texas is both seamless and compliant. Learn more about business laws and practices through reliable government platforms like www.tdi.texas.gov.

Why Texas? Understanding the Appeal for LLCs

Texas has long been a magnet for entrepreneurs and expanding businesses—and for good reason. Its lack of state income tax, strong legal protections, and business-friendly environment make it an ideal destination for companies seeking a new home. For businesses looking to relocate, Texas supports domestication, allowing an LLC formed in another state to officially transfer its legal home to Texas without starting over. Alternatively, through foreign qualification, companies can operate in Texas while maintaining their original formation state. With a thriving, diverse economy and streamlined legal processes, Texas remains a strategic and popular choice for both U.S. and international business owners ready to grow and establish a stronger presence. Find more about state tax information at comptroller.texas.gov.

Whether your LLC plans to enter Texas through foreign qualification or fully settle down via domestication, the opportunities for success are endless. Let’s explore the distinct steps involved in these processes for your business transition to Texas.

What Is Foreign Qualification? Expanding Your Presence Legally

Foreign qualification is a legal mechanism allowing an out-of-state LLC to operate in Texas without transferring its home base. This process essentially registers your LLC with the Texas Secretary of State, ensuring compliance with local laws while maintaining its original identity. It’s ideal for businesses testing the Texas market or working on short-term projects.

To get started with foreign qualification, the following steps are essential:

- File a Certificate of Authority: This is your official notification to the Texas Secretary of State, expressing your intention to operate within Texas.

- Designate a Registered Agent in Texas: A Texas-based individual or organization must be appointed to receive legal documents and other correspondence for your business.

- Maintain Two Operational Bases: While your primary business operations may continue in your original state, a Texas presence ensures you meet the local requirements.

Foreign qualification allows your LLC to take calculated steps into Texas without overcommitting. It provides flexibility while keeping your company eligible to enjoy Texas’s business-friendly landscape. Visit www.sos.texas.gov for specific resources on registering your business in Texas.

Domestication: Making Texas Your LLC’s Forever Home

Domestication is the next step for LLCs looking to formally leave their original home state and establish Texas as their primary base of operations. This isn’t just a registration process—it’s a full legal repositioning, ensuring your LLC transitions into a Texas entity while bringing in its existing history, contracts, and goodwill.

Steps in the Domestication Process:

- File a Certificate of Domestication: Submit comprehensive documentation to reestablish your LLC under Texas law.

- Retain or Transfer Your Business Records: Domestication ensures your EIN, contracts, and operational frameworks remain unchanged.

- Enjoy Exclusive Benefits: Domestication offers a streamlined administrative process, making it easier to leverage Texas’s no-state-income-tax policy and reduced licensing burdens.

Domestication gives your LLC the room to immerse itself in Texas’s dynamic economy while simplifying regulatory requirements. Detailed forms and guidelines for this process can be found at official sites like www.sos.state.tx.us.

Comparing Foreign Qualification and Domestication

Both foreign qualification and domestication play vital roles in helping businesses transition to Texas. However, they cater to different needs.

- Foreign Qualification is for LLCs dipping their toes in the Texas waters. It’s a temporary solution for businesses that want to operate in Texas while maintaining a base in their original state.

- Domestication is for those ready to go all in, transitioning completely and establishing Texas as their LLC’s permanent home.

While companies often start with foreign qualification to explore new opportunities, many later transition to full domestication once Texas’s advantages prove irresistible. This step-by-step approach ensures compliance while planning for long-term growth.

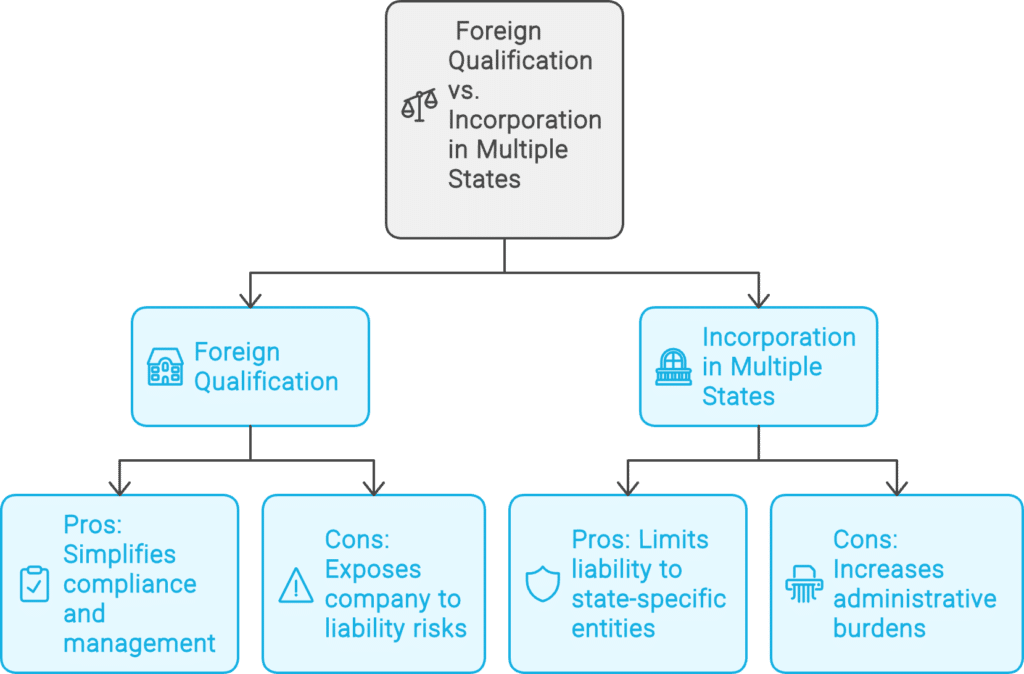

Foreign Qualification vs. Incorporation in Every State

Foreign Qualification:

Pros: Simplifies compliance and management by maintaining a single corporate structure; avoids the complexity of managing multiple legal entities.

Cons: May expose the entire company to liability risks associated with operations in multiple states.

Incorporation in Multiple States:

Pros: Limits liability to assets within each state-specific entity; potentially more favorable local laws and tax regimes.

Cons: Requires separate management, compliance, and reporting for each entity, increasing administrative burdens.

FAQs (Helping You Navigate the Transition)

How long does domestication take in Texas?

Domestication timelines vary depending on your original state’s processing speed and the Texas Secretary of State’s workload. However, Texas offers options to expedite filings, typically reducing the process to one to two weeks.

Can I run my business briefly in Texas without foreign qualification?

Occasional or sporadic transactions don’t usually necessitate foreign qualification. However, regular operations like hiring employees or maintaining assets in Texas will require formal registration.

Is transitioning from foreign qualification to domestication easy?

Yes! Transitioning from foreign qualification to full domestication is straightforward once your business commits to making Texas its operational home. Filing proper documents simplifies this action.

Will domestication change my EIN?

No. Your EIN remains constant post-domestication, provided your ownership structure and classification remain unchanged.

What taxes apply to Texas-based LLCs?

Texas doesn’t impose a state income tax on individuals, but LLCs may be subject to the state’s franchise tax, depending on revenue. Make sure to consult with a tax professional to ensure you’re prepared for any Texas-specific obligations.

Texas: Unlocking Limitless Growth Opportunities

Whether you start with foreign qualification or proceed directly to domestication, transitioning your LLC to Texas can unlock untapped growth opportunities in a vibrant economic landscape. From tax advantages to workforce availability, Texas offers everything a forward-thinking entrepreneur needs to succeed. By navigating these legal processes effectively, you can position your company to thrive in one of the nation’s most dynamic markets.

Need more help getting started or finalizing your move? Visit app.clemta.com for expert resources and simplified solutions tailored to your LLC’s transition!