We’re thrilled to share the latest enhancements and new features that we’ve been working on for the last couple of weeks. Your feedback and support have been invaluable in driving these improvements. Let’s dive in!

Summary of Updates

In this update, we’ll cover:

- Company formation is now available in all 50 states

- Enhanced integrations with financial institutions

- A new services module for more convenient purchasing and tracking

- New user roles and permissions

- Marking invoices as refunded

Start Your Business in Any State ??

With our latest update, entrepreneurs can now start their businesses in any state across the United States. Previously, our dashboard was exclusively crafted for the states of Delaware and Wyoming, but this expansion provides greater flexibility and convenience for our users, allowing them to choose the state best suited to their business needs. This aims to support our customers in their entrepreneurial journey by offering more options and services for business formation nationwide.

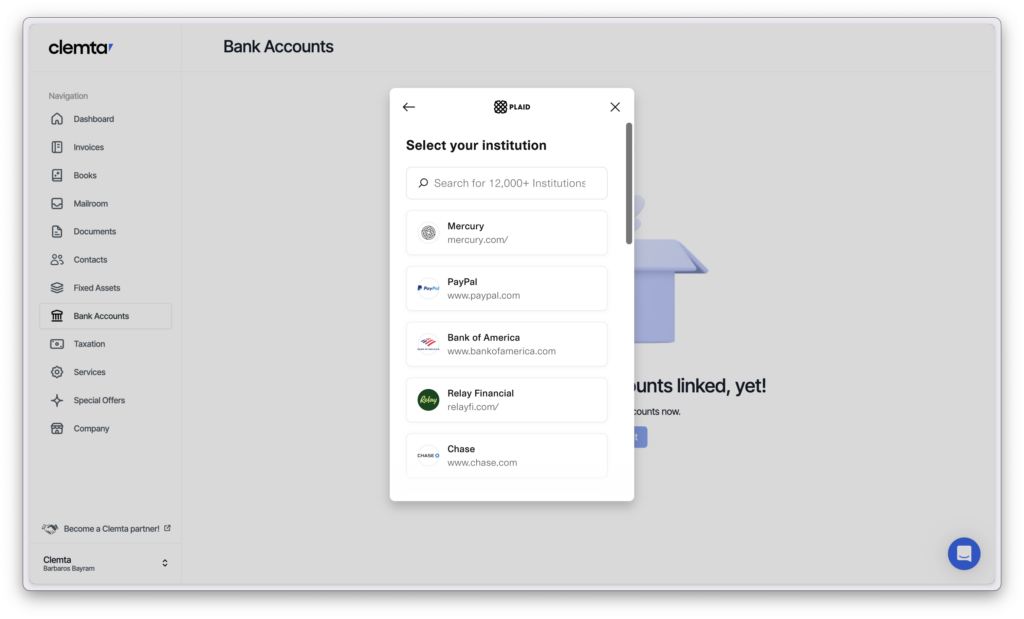

Enhanced Financial Institution Integrations ↔️

We’ve added new integrations with popular financial institutions, significantly expanding our capabilities. With Clemta Books, you can now connect with over 10,000 financial institutions, including our fintech partners Mercury and PayPal. This update simplifies your financial management by automating data synchronization between Clemta Books and these platforms, which allows for more efficient and comprehensive bookkeeping.

New Services Module ?

We’re excited to introduce our new Services module. This module allows users to purchase additional services directly from the dashboard, including the following ones:

- Certificate of Good Standing

- ITIN (Individual Taxpayer Identification Number)

- Reseller Certificate

- Dissolution services

- Bank Account Application

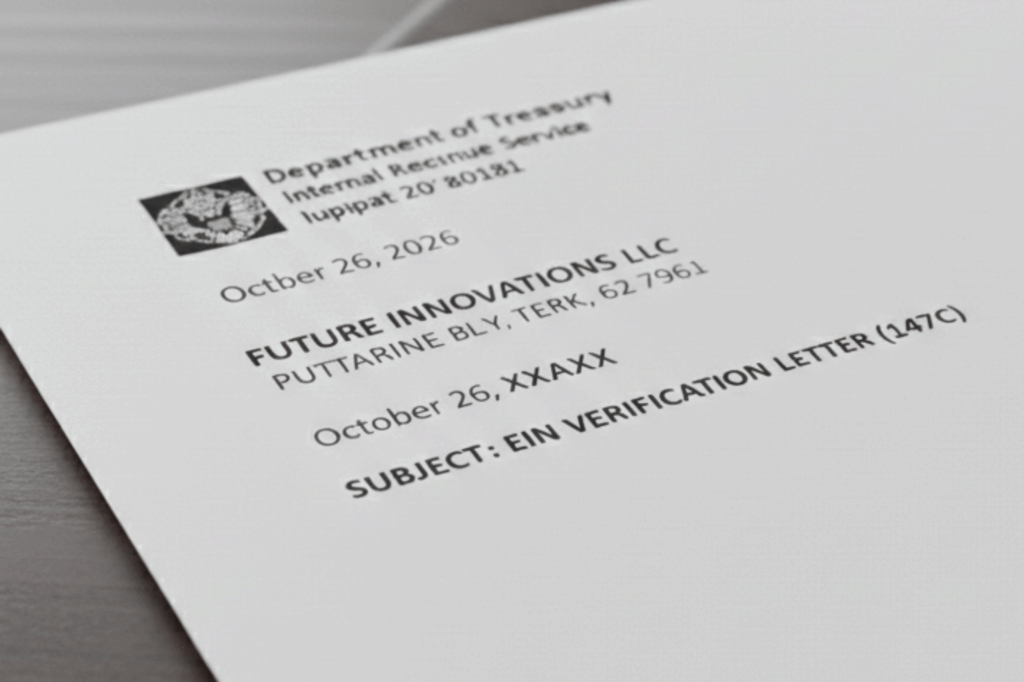

- EIN

- Federal Tax Filing

- State Tax Filing

- Post-Incorporation

- Trademark

- US Phone Number

- Address with Unique Suite Number

- Operating Agreement

- Beneficial Ownership Filing

- Amendment to Articles of Organization

This integration simplifies the management of various aspects of business operations through a single dashboard. Additionally, users can track the status of their orders directly from the dashboard and view the services included in their package, ensuring they have full visibility and control over their packages.

In the existing company flow, users can continue without purchasing a package subscription and can instead buy one-time services during the onboarding process. This flexibility ensures that customers only pay for what they need, when they need it.

New User Roles and Permissions ?✈️

This feature enables users to invite others with more customized roles and extended permissions. Now, users can add and edit roles with specific permissions directly from the dashboard. Built-in roles include Administrator, Compliance Tracker, and Financial Responsible, but users can also create custom roles to fit their needs. Additionally, account holders can transfer their permissions to another user with a sing click.

Mark Invoices as Refunded ?

By popular demand, we have introduced a new feature that allows invoices to be marked as refunded, either partial or full. Users can choose to mark it as a partial or full refund. After marking an invoice as refunded, their customers will receive an email notification along with a receipt for the refund.

Share Your Feedback with Us!

Your feedback is invaluable for us to improve our platform for your convenience. Please share your thoughts on these updates via [email protected].

Conclusion

Thank you for your continued support and engagement. As your trusted partner, we’re committed to continuously improving Clemta to serve you better.