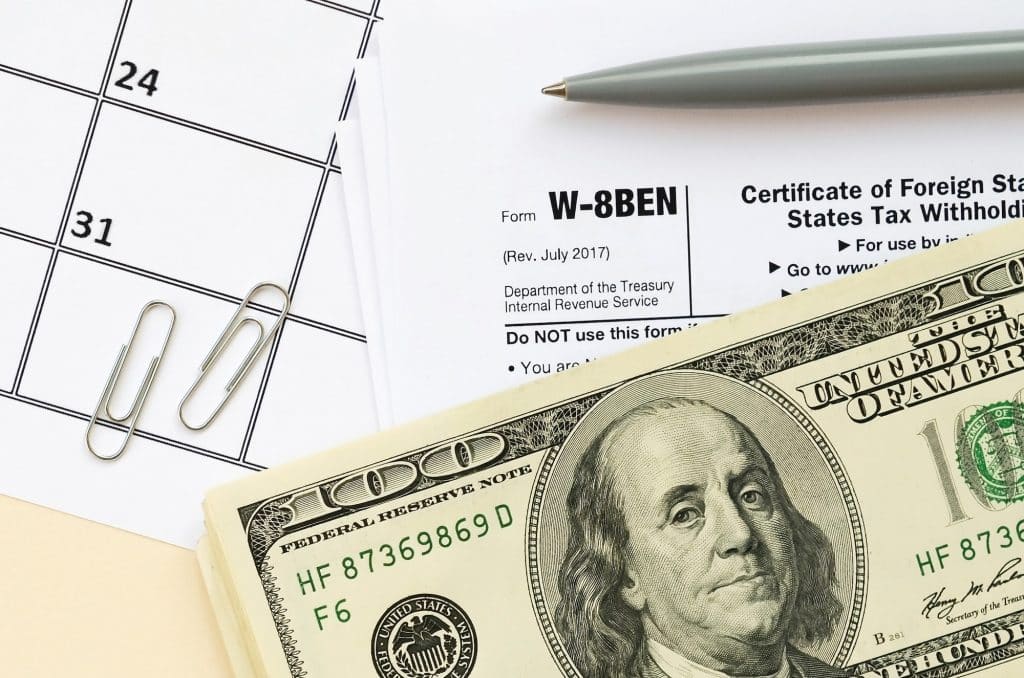

An Employer Identification Number (EIN) is a unique nine-digit identification number that the Internal Revenue Service (IRS) assigns to entities operating in the United States. This number is crucial for various business activities, including tax reporting and opening corporate bank accounts. When used for identification purposes other than employment tax reporting, people often refer to it as a Taxpayer Identification Number (TIN).

Why Is an EIN Important?

The EIN allows the IRS to identify taxpayers and keep track of your corporation’s tax reporting. Banks typically require an EIN to open corporate bank accounts. Furthermore, if you are not a U.S. citizen but conduct business in the U.S., such as running an e-commerce business, obtaining an EIN is essential.

How to Obtain an EIN

Methods of Application

If you’re planning to establish a business in the United States, obtaining an Employer Identification Number (EIN) is one of the most critical steps. This unique nine-digit number, assigned by the IRS, is essential for tax reporting, opening corporate bank accounts, and conducting business activities in the U.S. Whether you’re a non-resident entrepreneur or a U.S.-based startup founder, understanding the EIN process is vital for your business’s success.

What Is an EIN and Why Is It Important?

An Employer Identification Number (EIN) is a unique identifier issued by the IRS to businesses operating in the United States. It is often referred to as a Taxpayer Identification Number (TIN) when used for identification purposes other than employment tax reporting.

Here’s why an EIN is essential:

- Tax Reporting: The IRS uses the EIN to track your business’s tax obligations.

- Banking: Most banks require an EIN to open a corporate bank account in the U.S.

- E-commerce Requirements: If you’re a non-U.S. resident running an online business (e.g., Amazon, Shopify), an EIN is typically mandatory.

Without an EIN, your business operations in the U.S. could face significant limitations.

Methods for Obtaining an EIN

The IRS offers several ways to apply for an EIN, making the process accessible for both U.S. residents and non-residents. Below are the available methods:

1. Online Application

The online application is the fastest and most convenient method. However, it is only available to applicants with a U.S. Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

2. Mail Application

Non-residents can apply by mailing a completed Form SS-4 to the IRS. This method typically takes 4-6 weeks to process.

3. Fax Application

For faster processing, you can fax your completed Form SS-4 to the IRS. You may receive your EIN within 4-7 business days.

4. Phone Application for International Applicants

Non-residents without an SSN or ITIN can apply via phone by contacting the IRS directly. You will need to complete Form SS-4 beforehand and answer related questions during the call.

Each method requires you to accurately fill out Form SS-4, which collects details about your business, such as its structure, U.S. mailing address, and the reason for applying for an EIN.

Step-by-Step Guide to Completing Form SS-4

Form SS-4 is the key document in the EIN application process. Here’s a breakdown of the essential sections you’ll need to complete:

- Business Information: Provide your business name, type of entity (e.g., LLC, Corporation), and U.S. mailing address.

- Responsible Party: Identify the individual responsible for the business. If you’re a non-resident, this could be you or a third-party designee.

- Reason for Applying: Specify why you need an EIN, such as starting a new business or opening a bank account.

- Industry Details: Indicate the industry your business operates in (e.g., e-commerce, consulting).

Once completed, submit the form via your chosen application method.

Applying for an EIN via Phone

For international applicants, applying for an EIN by phone is a viable option. Here’s what you need to know:

- Authorization: Ensure you are authorized to apply for the EIN as the business owner or a Third-Party Designee.

- Preparation: Fill out Form SS-4 beforehand to answer questions efficiently during the call.

- Contact the IRS: Call the IRS at the designated number for international applicants.

At the end of the call, you’ll receive your EIN, which you can use immediately. A physical confirmation notice will also be mailed to your address within 4-5 weeks.

Simplify the EIN Process with Clemta

Navigating the EIN application process can be time-consuming, especially for non-residents unfamiliar with U.S. regulations. That’s where Clemta comes in.

At Clemta, we specialize in simplifying complex business processes, including obtaining an EIN. By partnering with us, you can:

- Avoid the hassle of completing Form SS-4 and dealing with IRS procedures.

- Receive expert guidance tailored to your business needs.

- Focus on growing your business while we handle the paperwork.

Final Thoughts

An EIN is more than just a number—it’s your gateway to operating a successful business in the U.S. From tax reporting to opening a corporate bank account, this identification number is indispensable.

Ready to streamline the EIN application process? Visit Clemta’s website today and let us take care of the details while you focus on scaling your business.

The IRS provides several methods for obtaining an EIN, even for non-residents. These methods include:

- Online Application: The most convenient method for obtaining an EIN.

- Mail Application: Sending a completed Form SS-4 to the IRS.

- Fax Application: Faxing the completed form for faster processing.

- Phone Application: Available for international applicants.

All these methods require the completion of Form SS-4, which gathers information about your business, including its U.S. mailing address, entity type, reason for applying for an EIN, and the industry in which you operate.

Completing Form SS-4

Regardless of the application method, you will receive a Form SS-4 Notice verifying that the IRS has assigned your business an EIN. Keep this notice for future reference.

Applying via Phone

If you choose to apply for an EIN via phone, consider the following important points:

- Ensure you are authorized to obtain the EIN, either as the business owner or as a Third-Party Designee.

- Complete the Third-Party Designee section of the form if you are authorizing someone else to receive the EIN.

- Be prepared to answer questions related to Form SS-4 during the call.

Having the form filled out beforehand will help you answer questions quickly, saving time. At the end of the call, you will receive your EIN, which you can use immediately. The IRS will also send a physical copy via mail, which takes approximately 4-5 weeks.

Simplifying the EIN Process with Clemta

Clemta is your reliable business partner in streamlining the EIN obtaining process. By partnering with Clemta, you can avoid dealing with the complexities and procedures involved in acquiring an EIN. Our expertise ensures a smooth and efficient process, allowing you to focus on growing your business.

For more information and assistance in obtaining your EIN, visit Clemta’s website today. Let us handle the paperwork while you concentrate on what truly matters—your business success.