Florida is no longer just a tourism powerhouse; it is a premier global hub for e-commerce and international trade. For non-resident entrepreneurs, the “Sunshine State” offers a seamless gateway to the US market.

This guide breaks down the Florida LLC formation process for international founders, ensuring your entity is compliant, tax-efficient, and ready for global scale.

Why International Entrepreneurs are Choosing Florida in 2026

While Delaware and Wyoming are common choices, Florida offers unique strategic advantages for foreign-owned entities:

- Tax Efficiency: Florida has $0$ state personal income tax. As a pass-through entity, your LLC profits are only subject to US federal taxes, simplifying your global tax strategy.

- Logistical Superiority: With 15+ deepwater ports and major international airports, Florida is the primary “Gateway to the Americas.”

- Ease of Maintenance: Florida’s digital filing system (Sunbiz) is one of the most transparent and efficient in the United States.

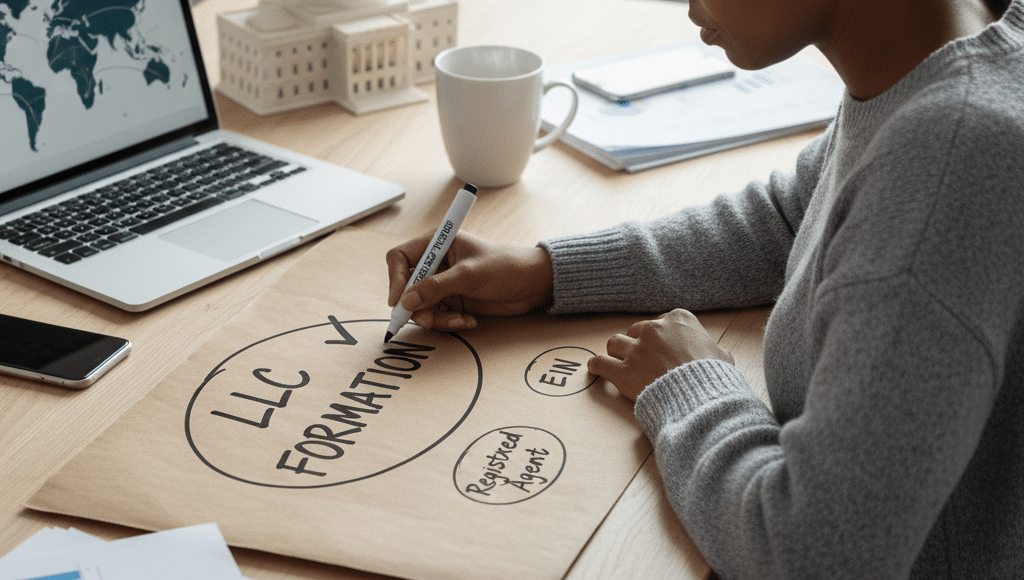

Checklist: 4 Steps to Incorporate Your Florida LLC

1. Conduct a Florida Entity Name Search

Your business name must be “distinguishable” from existing records in the Florida Department of State database.

- The Legal Designator: You must include “Limited Liability Company,” “L.L.C.,” or “LLC” in the title.

- Pro Tip: Beyond the state registry, check for URL availability and US Trademark conflicts to avoid rebranding costs later.

2. Appoint a Florida Registered Agent

Florida law requires a physical presence to receive “Service of Process.” Since you are operating from abroad, a professional Registered Agent service is mandatory.

- Privacy Protection: A professional agent allows you to use their address on public records, keeping your personal international address off the grid.

- Compliance: They ensure you never miss the May 1st annual report deadline, which carries a heavy $400$ USD late fee.

3. File the Articles of Organization

This is the formal document that creates your legal entity. You will file this with the Division of Corporations.

| Requirement | Description |

| Principal Address | Can be a physical business address or your Registered Agent’s address. |

| Management Structure | Decide if your LLC will be Member-Managed or Manager-Managed. |

| Processing Time | Usually 2–5 business days for online filings in 2026. |

4. Secure an EIN (Employer Identification Number)

An EIN is your business’s “Social Security Number.” You do not need a US SSN or ITIN to obtain an EIN.

- Banking: You cannot open a US business bank account (like Mercury or Relay) without an EIN.

- Federal Tax: It is required for IRS filings and hiring US-based contractors or employees.

Post-Incorporation Compliance for Foreign Owners

Operating a US business from abroad involves specific federal requirements that differ from local founders:

- Form 5472 & 1120: Foreign-owned US LLCs must disclose “reportable transactions” to the IRS annually.

- BOI Reporting: Under the Corporate Transparency Act, you must report “Beneficial Ownership Information” to FinCEN shortly after formation.

- Annual Reports: In Florida, these are due between January 1 and May 1 every year.

Ready to Scale Your Business in the US?

Navigating cross-border regulations shouldn’t slow you down. Clemta specializes in helping international founders launch Florida LLCs with ease. From Registered Agent services to EIN acquisition and lifetime compliance, we handle the paperwork so you can focus on the business.