The US market presents a compelling opportunity for Fintech startups globally, offering access to substantial capital and a well-developed technology ecosystem. For e-commerce entrepreneurs and startup founders with innovative Fintech solutions, the prospect of securing investment and scaling their business in the US is incredibly attractive. However, achieving funding and sustainable growth requires navigating intricate regulations, complex tax laws, and discerning investor expectations. Attempting this journey alone can be fraught with challenges and potential setbacks. Therefore, expert professional support is not just advisable; it is essential for Fintechs aiming for success in the US investment landscape. A great resource for understanding government regulations related to finance can be found at the US Government Accountability Office: https://www.gao.gov/. This website offers in-depth reports and analysis on various financial and regulatory topics.

The US Fintech Funding Landscape: A Complex Maze

Imagine trying to find your way through a maze while blindfolded. That is what it can feel like when you try to navigate the US Fintech funding landscape without professional help. You will come across:

- Strict Regulatory Compliance: The US has a complicated structure of federal and state regulations that govern financial technology. This includes KYC/AML (Know Your Customer/Anti-Money Laundering) requirements, data privacy laws like the California Consumer Privacy Act (CCPA), and industry-specific regulations that vary by state and locality. Fintech businesses must invest the time and resources to meet these demands, or else they face potentially large fines and legal issues that could ruin their funding efforts. The complexities of these laws often require expert interpretation and implementation to avoid costly errors. For more information on federal financial regulations, you can visit the website of the Financial Crimes Enforcement Network (FinCEN) at https://www.fincen.gov/.

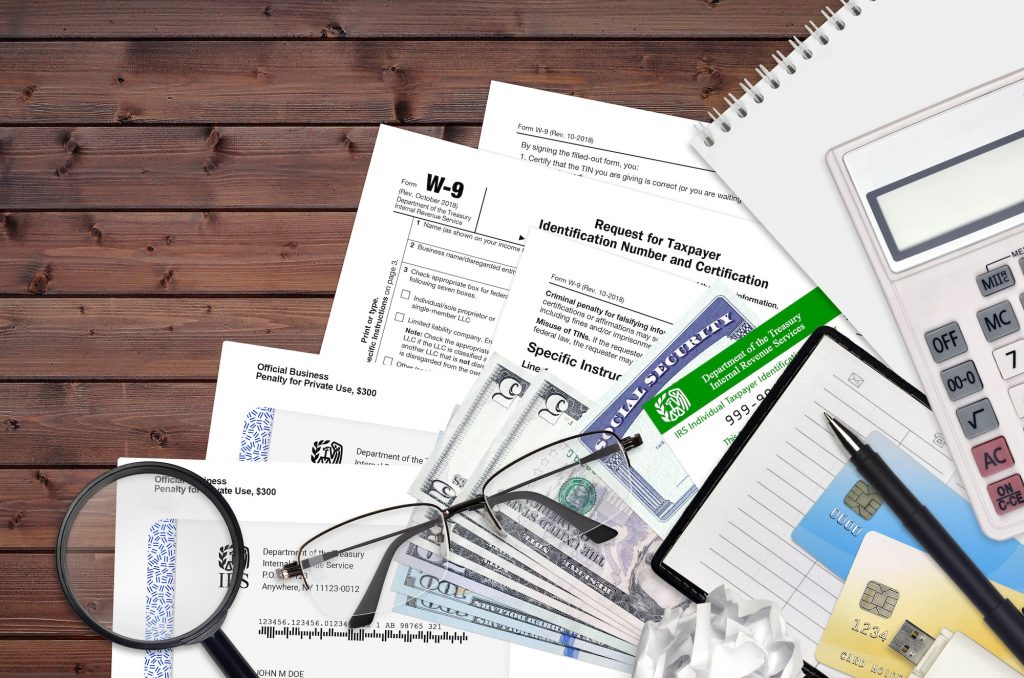

- Intricate Tax Laws: US taxation is well-known for being complicated, particularly for companies that have activities in different countries. Understanding federal income tax, state tax duties, sales tax nexus (check out clemta’s guide on Sales Tax Nexus Simplified: Your Essential Guide to Understanding Nexus Laws), and international tax treaties is incredibly important. Knowing the complexities and nuances of the US tax system will not only save you from fines and penalties, but it will also help you to build a sustainable, lucrative business in the US. The IRS website also has useful information that is crucial to understanding the US tax system: https://www.irs.gov/.

- Investor Due Diligence: US investors are sophisticated and do their research carefully. They will carefully evaluate your financial accounts, legal structure, and compliance procedures. A lack of planning or readiness can raise concerns and put your chances of getting funding in jeopardy. Investors need transparency and compliance, therefore Fintechs must guarantee they are organized and compliant at all times to ensure a successful funding campaign. Failing to meet investor expectations may result in a loss of investment and the company’s overall credibility.

How Clemta Can Help You Navigate the Fintech Funding Process

At Clemta, we specialize in providing comprehensive business services to international entrepreneurs and startups looking to thrive in the US market. We understand the unique challenges faced by Fintech companies seeking funding. Here’s how we can support you:

- Company Formation: We guide you in choosing the optimal legal structure (LLC, C-Corp, etc.) for your Fintech business, considering your specific needs and investment goals. See our guide Company Formation in USA for Non-Residents: A Quick Guide. We handle all the paperwork and ensure compliance with state regulations.

- EIN and ITIN Acquisition: We streamline the process of obtaining your Employer Identification Number (EIN) from the IRS. Need an ITIN (Individual Taxpayer Identification Number)? We can help with that too. (What is EIN? How To Get It?)[https://clemta.com/blog/what-is-ein-how-to-get-it]

- Banking Solutions: Opening a US business bank account is crucial. We can assist you in navigating the requirements and connecting with suitable banking partners.

- Bookkeeping and Accounting: Maintain accurate and up-to-date financial records is essential. Our expert bookkeeping and accounting services ensure you’re always prepared for investor scrutiny.

- Tax Planning and Compliance: We develop a tailored tax strategy that minimizes your tax liability while ensuring full compliance with US tax laws. This includes federal income tax, state tax, and international tax considerations.

- Trademark Protection: Protecting your brand is vital. We can assist you in registering your trademark in the US.

Building a Fundable Foundation: Key Steps for Fintechs

Before even approaching investors, take these crucial steps:

- Choose the Right Business Structure: Is an LLC or a C-Corp better for your needs? This decision has significant tax and legal implications. Learn more about Why You Should Form An LLC? and Why you should Incorporate in The US? Understanding the differences between business structures is crucial for optimizing tax efficiency and liability protection. Each structure has its own set of benefits and drawbacks that can greatly influence the company’s long-term financial health and operational flexibility. The Small Business Administration (SBA) offers resources to help you choose the best structure: https://www.sba.gov/.

- Comply with all Legal & Regulatory Requirements: Ensure you understand and adhere to all relevant US regulations. Navigating the complex web of US regulations requires staying updated with the latest changes and interpretations. Compliance not only protects your business from potential penalties but also builds trust with investors and customers. Regular audits and legal consultations are essential to maintain compliance.

- Establish a US Bank Account: This is essential for receiving funds and conducting business in the US. A US bank account facilitates smooth financial transactions and builds credibility with local partners and customers. Establishing a relationship with a reputable US bank provides access to financial services tailored to the needs of your business.

- Maintain Meticulous Financial Records: Accurate and readily available financial data is key to attracting investors. Detailed financial records provide a clear picture of your company’s financial health and performance. Investors rely on this data to assess the viability and potential of your business. Implementing robust accounting systems and processes ensures accuracy and transparency.

- Develop a Solid Business Plan: Outline your business model, target market, and growth strategy. A well-articulated business plan demonstrates your understanding of the market and your strategic vision for the future. It serves as a roadmap for your business and provides investors with a clear understanding of your goals and how you plan to achieve them.

Avoiding Costly Mistakes: The Price of DIY

Trying to handle everything yourself may seem cost-effective initially, but it can lead to:

- Compliance Violations: Fines, penalties, and legal issues that can cripple your business. Remember the Consequences of not paying Delaware Franchise Tax. Neglecting compliance can lead to severe financial consequences and damage your company’s reputation. Staying informed about the latest regulations and seeking expert advice can help you avoid costly mistakes.

- Lost Investment Opportunities: Investors may be hesitant to invest in a company with a questionable legal or financial foundation. Investors prioritize companies with strong governance and compliance frameworks. A lack of transparency and compliance raises red flags and can deter potential investors.

- Tax Inefficiencies: Overpaying taxes due to a lack of understanding of US tax laws. US tax laws are complex and constantly evolving. Without expert guidance, you may miss out on valuable deductions and credits, leading to unnecessary tax liabilities.

- Wasted Time and Resources: Focus on your core business and let professionals handle the complexities. Time is a precious resource for startups. By outsourcing complex tasks to professionals, you can focus on your core business activities and drive growth.

Partner with Clemta for Fintech Success in the US

Navigating the US Fintech funding landscape requires specialized knowledge and experience. Don’t risk your future by going it alone. Clemta provides the expert support you need to establish a solid foundation, comply with regulations, and attract investors.

FAQs About US Fintech Funding for International Startups

Q: What is the most common mistake Fintech startups make when entering the US market?

A: A common mistake is underestimating the complexity of US regulations and tax laws. Many startups attempt to navigate these challenges on their own, leading to compliance violations, tax inefficiencies, and lost investment opportunities. It is crucial to seek expert professional support to avoid these pitfalls.

Q: How can Clemta help with company formation in the US?

A: Clemta guides you in choosing the optimal legal structure for your Fintech business, whether it’s an LLC or a C-Corp, based on your specific needs and investment goals. We handle all the necessary paperwork and ensure compliance with state regulations, streamlining the formation process and saving you valuable time and resources.

Q: What is the importance of having a US bank account for a Fintech startup?

A: A US bank account is essential for receiving funds, conducting business transactions, and establishing credibility with local partners and customers. It simplifies financial operations and is a prerequisite for many business activities in the US. Clemta can assist you in navigating the requirements and connecting with suitable banking partners.

Ready to take the next step? Contact Clemta today for a free consultation and let us help you unlock the full potential of your Fintech business in the US! Visit app.clemta.com to learn more.