Introduction

Foreign qualification is a critical process for businesses expanding their operations beyond the state of their formation. This legal procedure allows companies to operate in other states, for compliance with local regulations. The term “foreign” in this context does not imply international activity but refers to interstate business activities within the United States. This blog post explores the concept of foreign qualification, the conditions necessitating it, the legal implications of non-compliance, and the steps involved in the qualification process.

What is Foreign Qualification?

Foreign qualification involves registering a business entity, such as a corporation or limited liability company (LLC), to operate legally in a state other than its state of incorporation. In its home state, a company is considered “domestic,” while in other states, it is regarded as “foreign”. This registration is mandatory for businesses that engage in regular and substantial activities within another state, allowing them to legally conduct business and protect their interests in legal proceedings.

Why is Foreign Qualification Necessary?

Legal Compliance: Foreign qualification ensures that businesses adhere to the legal requirements of the state in which they wish to operate. It allows the state to access essential information about the business, such as its legal name, business address, and the name of its registered agent. This transparency is crucial for protecting consumers and ensuring fair business practices.

Access to Legal System: Without foreign qualification, a business may be barred from initiating lawsuits or defending itself in the courts of the state where it operates. This can be particularly detrimental if a company needs to enforce contracts or seek damages.

Taxation and Regulation: Foreign qualification also subjects businesses to state taxes and regulations, preventing them from gaining an unfair advantage over local entities. States can levy taxes and require compliance with local labor and business regulations, ensuring a level playing field.

What Constitutes “Doing Business”?

The definition of “doing business” varies by state, but generally includes activities that are continuous and significant within a state. The following are typical indicators:

- Physical Presence: Owning or leasing real estate, maintaining an office, or operating facilities such as warehouses or retail stores.

- Employees: Employing individuals in the state, whether they work remotely or at a company facility.

- Sales and Services: Engaging in sales or service activities, including contract negotiations and order fulfillment within the state.

- Licensing: Applying for or holding state-specific professional or business licenses.

Exceptions to these requirements may include isolated transactions, maintaining bank accounts, and conducting internal corporate activities, which do not typically necessitate foreign qualification.

Consequences of Non-Compliance

Failure to obtain foreign qualification can lead to severe consequences, including:

- Inability to Sue: A company may be restricted from filing lawsuits in the state, limiting its ability to enforce contracts or seek damages.

- Fines and Penalties: States may impose fines, penalties, and back taxes on businesses operating without proper registration. In some cases, officers or agents of the company may also face penalties.

- Legal and Financial Risks: Non-compliant businesses may face challenges in securing financing, completing transactions, or being acquired, as potential legal liabilities can deter investors or buyers.

The Foreign Qualification Process

Step 1: Determine Name Availability: Before filing for foreign qualification, businesses must check the availability of their name in the new state. If the desired name is already in use or is too similar to an existing name, the company may need to adopt a fictitious or “doing business as” (DBA) name.

Step 2: Appoint a Registered Agent: A registered agent, located in the state of qualification, must be designated to receive legal documents and state communications on behalf of the business.

Step 3: Obtain a Certificate of Good Standing: Most states require a certificate of good standing from the business’s home state, confirming that the company is in compliance with all local laws and has paid any required fees or taxes.

Step 4: File Qualification Documents: The business must submit an application for a certificate of authority, including detailed information about the company’s structure, management, and intended business activities. The required documents and fees vary by state, and some states offer expedited processing for an additional charge.

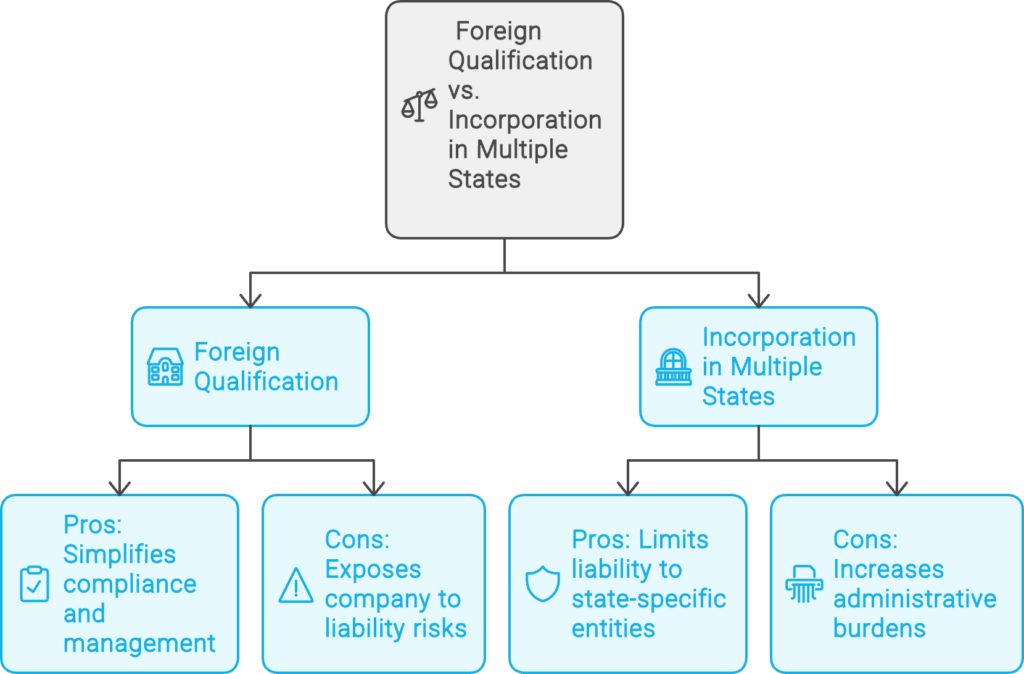

Foreign Qualification vs. Incorporation in Every State

- Foreign Qualification:

- Pros: Simplifies compliance and management by maintaining a single corporate structure; avoids the complexity of managing multiple legal entities.

- Cons: May expose the entire company to liability risks associated with operations in multiple states.

- Incorporation in Multiple States:

- Pros: Limits liability to assets within each state-specific entity; potentially more favorable local laws and tax regimes.

- Cons: Requires separate management, compliance, and reporting for each entity, increasing administrative burdens.

Conclusion

Foreign qualification is an essential process for businesses expanding across state lines in the United States. It ensures access to state courts, and adherence to local tax and regulatory requirements. By understanding the necessity of foreign qualification and navigating the process effectively, businesses can operate smoothly and avoid significant legal and financial risks. Companies should carefully assess their business activities and seek legal advice to determine their foreign qualification needs.

Contact us: Feel free to ask your questions ?

Need More Guidence?

?: Guide to USA Incorporation: Delaware vs Wyoming?

?: LLC vs C-Corp: Understanding the Differences and Benefits

?: USA Business Taxes for Foreign Entrepreneurs: A Simplified Guide