Company formation in USA for non residents, and establishing a business offers numerous advantages for international entrepreneurs. The opportunities are expansive, from accessing a strong consumer market to leveraging a stable economic environment.

Why Form a Company in the USA?

- Market Access: The USA boasts one of the largest and most diverse consumer markets globally.

- Economic Stability: Benefit from a stable and predictable business environment.

- Legal Protections: Strong intellectual property laws and business-friendly regulations.

- Funding Opportunities: Access to venture capital, angel investors, and other funding sources.

Steps for Company Formation in USA for Non-Residents

Whether you are a startup with multiple shareholders seeking investment, an e-commerce business owner aiming to operate and sell seamlessly in the US market, or a freelancer/creator, it is crucial to make wise decisions. It’s essential to seek professional assistance.

1. Choose the Type of Business Entity

The first step in forming a company is to decide on the type of business entity. The most common options for non-residents are:

- Limited Liability Company (LLC): Offers flexibility and limited liability protection.

- Corporation (C-Corp or S-Corp): Suitable for businesses looking to raise capital through the sale of shares.

Which option is the best for you?

? Read: Business Structures: LLC and C-Corp

? Watch: LLC vs C-Corp: Understanding the Differences and Benefits

2. Select a State

Each state has its own regulations, tax structures, and fees. Popular choices for non-residents include:

- Delaware: Known for its business-friendly laws and favorable tax climate.

- Wyoming: Offers low fees and strong privacy protections.

Which option is the best for you?

? Read: Delaware vs Wyoming?

? Watch: Guide to USA Incorporation: Delaware vs Wyoming?

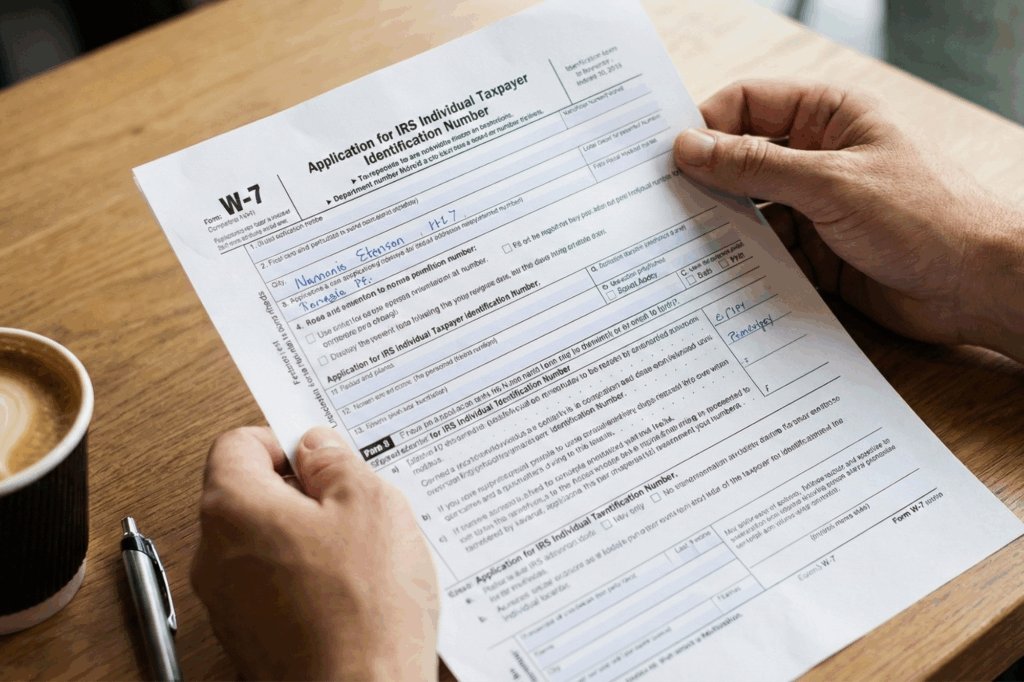

3. Tax ID Numbers: Obtain EIN and ITIN

Obtaining an EIN and an ITIN is crucial for your business.

An EIN is necessary for tax filing, opening a business bank account, hiring employees, establishing business credit, and complying with licenses and permits.

An ITIN is necessary for those not eligible for an SSN, enabling tax reporting, access to financial services, and compliance with U.S. tax laws.

Both identification numbers ensure legal recognition and financial separation between personal and business expenses and facilitate business growth and operations.

? Read: What Is EIN? How To Get It?

? Watch: Understanding SSN, EIN, and ITIN: Key Tax IDs Explained

4. Appoint a Registered Agent

A registered agent is required in the state of incorporation to receive legal documents on behalf of the company.

5. Open a US Business Bank Account

Opening a U.S. bank account can be a bit more complex for non-residents. Some banks require your physical presence, while others offer online options. Having a US business bank account is essential for managing your finances and conducting business operations. Requirements vary by bank, but generally, you will need:

- EIN

- Company formation documents

- Proof of identity and address

? Read: How to Open A Bank Account In the US?

? Watch: Opening a USA Bank Account as a Foreigner

Compliance and Ongoing Requirements

Annual Reports and Fees

Most states require annual reports and fees to keep the company in good standing. It’s important to stay compliant to avoid penalties and maintain the legal status of your business.

Tax Obligations

Non-residents must comply with US tax laws, which may include federal and state taxes. Consulting with a tax professional who understands international business taxation is advisable. To gain a better understanding of how taxes work, here is our usa tax guide.

? Read: Clemta Taxation Manual

? Watch: USA Business Taxes for Foreign Entrepreneurs: A Simplified Guide

How to Form and Manage Your Company in the USA

At Clemta, we specialize in assisting non-resident entrepreneurs with every step of the company formation process. Our services include:

- Company Registration: Simplify the LLC or C-Corp registration and meet all legal requirements.

- Registered Agent Service: Reliable and efficient service to ensure compliance.

- Tax ID Numbers: Get your an EIN and ITIN, essential for tax purposes.

- Business Bank Account: Open a US bank account for managing transactions and paying taxes.

- Bookkeeping: Maintain accurate and up-to-date financial records.

- Accounting: Navigate complex financial regulations and ensure your business remains compliant.

- Tax Filing: Ensure timely and accurate tax filings to avoid penalties.

- Ongoing Support: Easily manage your company with a custom dashboard tailored to your US business.

Let’s connect and explore how you can seamlessly manage your business in the USA.

Contact us: Feel free to ask your questions. ?